News

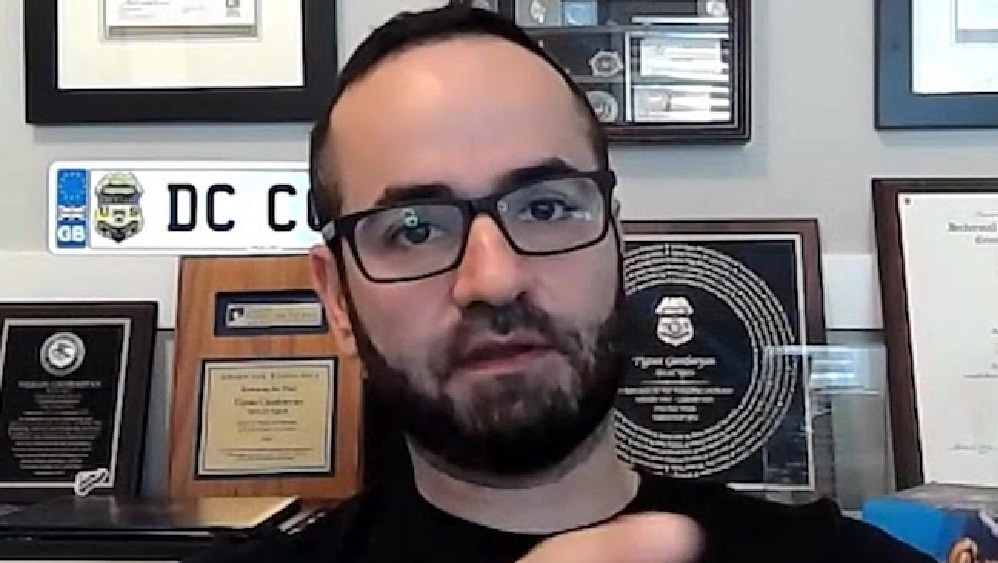

Binance executive, Gambaryan may die of malaria in Kuje Correctional Centre – Lawyer

Aluko & Oyebode, the law firm handling the case of Binance Holdings Limited, says Mr Tigran Gambaryan, the cryptocurrency firm’s executive, standing trial alongside the company in Nigeria, may die in Kuje Correctional Centre.

The law firm stated this in a letter addressed to the Deputy Chief Registrar of Federal High Court (FHC) and signed by a Partner, C.J. Caleb.

The News Agency of Nigeria (NAN) reports that the letter, dated and filed on May 23, which was sighted on Sunday, was titled: “Re: Charge No: FHC/ABJ/CR/128/2024 – Application for the Provision of Medical Treatment to Mr. Tigran Gambrayan at Nizamiye Hospital.”

Caleb said: “We continue to act as counsel to Mr. Tigran Gambaryan, the 2nd defendant in the captioned suit pending before the Honourable Justice E. Nwite sitting at Court 9 of the Federal High Court, Abuja.”

He said Gambaryan, the Head of Financial Crimes Compliance of the cryptocurrency platform, broke down on Wednesday (May 22) in prison and was administered with “Intravenous (IV) treatment for malaria” by the medical personnel.

“Please be informed that the 2nd defendant, who is an American citizen and remanded at the Kuje Medium Correctional Facility is very ill and requires comprehensive medical attention at the best available hospital within the jurisdiction of this honourable court.

“The applicant broke down yesterday and the medical facility gave him Intravenous (IV) treatment for malaria,” he said

The lawyer, therefore, raised the alarm over Gambaryan’s continuous remand in the correctional facility, expressing fear for his life amid his alleged deteriorating health.

“The Consul Officer at the United States Consul Office in Abuja, emphasised the need for the applicant to receive comprehensive treatment because malaria is a severe disease for American citizens which can result in death because they do not have the immunity that ordinary Nigerians have against the disease,” he said in the letter.

Caleb, who said the defendant equally suffered from throat infection, added that “the Kuje Medium Correctional Facility is currently undergoing renovation works.”

According to him, given the above, we humbly apply that the applicant be transferred to Nizayime Hospital, Abuja, to receive comprehensive diagnoses and treatment for the preservation of his Iife.

NAN observes that the letter came six days after Justice Emeka Nwite of a Federal High Court declined to grant Gambaryan’s bail application moved by a lawyer in the defence team, Mark Mordi, SAN.

Justice Nwite had held that based on the affidavit evidence before him, Gambaryan would jump bail if the application was granted.

The judge held that the Economic and Financial Crimes Commission (EFCC) had overwhelming evidence against the applicant that he was a flight risk.

Justice Nwite ordered him to remain in remand throughout the hearing and determination of the alleged money laundering and terrorist financing charges.

NAN reports that on Thursday when the matter came up, the ailing Gambaryan collapsed in the open court over alleged ill-health.

The development occurred shortly after the matter was called for trial continuation before Justice Nwite.

His lawyer, Mr Mordi, explained to the court why his client could not stand as soon as the matter was called.

News

Army acquires 43 drones, wings 46 Turkey-trained personnel

The Federal Government has bolstered the Nigerian Army’s operational capacity with the acquisition of 43 Bayraktar TB2 drones, primarily for deployment in the North-West theatre of operations.

The Commander of the Nigerian Army Space Command, Brig. Gen. U.G. Ogeleka, disclosed this on Tuesday during the winging ceremony of 46 personnel trained in the operation and maintenance of the drones.

The initiative, codenamed Project Guardian, aims to strengthen military operations against insurgency and other security challenges in the region.

“Between May and September 2022, a team of 35 officers and 11 soldiers from the Nigerian Army’s routinely piloted aircraft system regiments underwent specialised training in Turkey on the operation and maintenance of the Bayraktar TB2 drones,” Ogeleka said. “The training crew included multi-piloted aircraft pilots, mission operators, avionics, and mechanical engineers and technicians.”

Out of the 46 trained personnel, 14 are multi-piloted aircraft pilots, seven are mission operators, and 23 are engineers and technicians.

Ogeleka presented 22 of the trained personnel for the winging ceremony, noting that the others are actively engaged in operational duties.

The Chief of Army Staff, Lt. Gen. Olufemi Oluyede, praised the acquisition of the drones and the training of personnel as significant steps toward enhancing the army’s professionalism and combat readiness.

“The winging of these 22 officers and soldiers as pilots and certified maintenance engineers is a morale booster for others in service,” Oluyede said. “It confirms their readiness to operate and maintain the Turkish Bayraktar TB2 drones in our inventory.”

Oluyede further revealed plans to procure additional unmanned aerial systems in the coming year to strengthen military operations across all theatres in the country.

The drones will play a critical role in addressing security challenges in the North-West, a region plagued by banditry and insurgency.

Their advanced surveillance and strike capabilities are expected to significantly enhance the Nigerian Army’s operational effectiveness.

This development underscores the government’s commitment to leveraging technology to improve national security and highlights the Nigerian Army’s drive to modernize its arsenal and build capacity within its ranks.

With more unmanned aerial systems set for acquisition, the military’s ability to conduct precise, real-time surveillance and combat operations is poised for substantial improvement.

News

Ondo Assembly mulls 10-year jail term for land grabbers

The Ondo State House of Assembly is considering a bill that proposes harsh penalties for land grabbers, including up to 10 years imprisonment for forceful entry or illegal takeover of properties.

Governor Lucky Aiyedatiwa has further reinforced the fight against land grabbing by signing an Executive Order to prohibit such activities.

The order aims to end forceful entry, illegal occupation of landed properties, and fraudulent or violent conduct related to land in the state.

To strengthen enforcement, the governor has established a Task Force to protect property rights, uphold the rule of law, and ensure a secure environment for property owners and residents.

The proposed bill also includes severe penalties of up to 21 years imprisonment for selling family land without the consent of the family head or secretary.

Hon Moyinolorun Ogunwumiju, the lawmaker representing Ondo West Constituency 1, who sponsored the bill, spoke during a public hearing on the bill

Hon Ogunwumiju assured stakeholders that the bill would improve land administration, protect landowners, attract investors, and foster peace and development in the state.

He explained that the bill sought to regulate land dealings, protect landowners and buyers, penalise encroachers, and criminalise unregistered agents.

Ogunwumiju said the bill proposed penalties of up to 10 years’ imprisonment for forceful entry or takeover of properties and up to 21 years for selling family land without the consent of the family head or secretary.

Speaker of the Assembly, Hon Olamide Oladiji, urged committee members and stakeholders to ensure the bill served the interests of the people.

He said the bill would maintain order in the state and impose necessary sanctions on offenders.

“Land grabbers pose a significant threat to property acquisition. Their activities ranging from trespassing, forceful occupation, and illegal sales of properties to multiple buyers must be confronted decisively.”

Majority Leader and Chairman of the House Committee on Rules and Business, Oluwole Ogunmolasuyi, said the bill, would benefit the society at large

Ondo Commissioner for Justice and Attorney General, Kayode Ajulo said the bill would enhance land administration and complement the executive order signed by Governor Aiyedatiwa.

Stakeholders including traditional rulers called for full implementation of the bill when signed into law.

News

FG earmarks N250bn for Lagos-Abuja rail project in 2025 budget

The federal government has made an allocation of N250 billion in the 2025 budget for the Lagos–Abuja mass transit rail project.

This budgetary investment is part of a broader plan to revitalize Nigeria’s infrastructure and stimulate economic growth.

The government’s focus on infrastructure development is rooted in the belief that it is a cornerstone of long-term economic planning.

By investing in critical infrastructure such as roads, railways, energy, healthcare, and education, the administration aims to create a conducive environment for both domestic and foreign investment.

The Lagos-Abuja rail project, in particular, is expected to have a transformative impact on the Nigerian economy.

By improving transportation connectivity between two major economic hubs, the project will facilitate the movement of goods and people, reduce logistics costs, and stimulate economic activity.

Additionally, the project is expected to create numerous jobs, both directly and indirectly, contributing to the country’s overall employment rate.

The government’s infrastructure investments are also aimed at addressing regional disparities.

By connecting different parts of the country through improved transportation networks, the administration hopes to stimulate economic growth in underserved regions, reduce poverty, and promote equitable development.

The 2025 budget signals the government’s commitment to transforming Nigeria’s infrastructure landscape.

By investing in critical projects like the Lagos-Abuja rail line, the administration aims to lay the foundation for a more prosperous and connected Nigeria.

However, the success of these initiatives will depend on effective planning, efficient implementation, and transparent governance.

-

News21 hours ago

News21 hours agoGov Adeleke Speaks On Death Sentence For Chicken Thief

-

News16 hours ago

News16 hours agoNetizens Slam Lawmakers As They Sing Tinubu’s Anthem At Budget Presentation

-

News13 hours ago

News13 hours agoFinally, PDP Flushes Out Suspended National Vice Chairman, Ali Odefa

-

News21 hours ago

News21 hours agoDelta Assembly pardons two suspended members

-

News10 hours ago

News10 hours agoReps Call for Revival of NAPAC to Boost Transparency, Accountability

-

News21 hours ago

News21 hours agoJust in: CBN Imposes N100k Bar on PoS, Issues Warning to Operators

-

News21 hours ago

News21 hours agoHeavy Security Presence at National Assembly as President Tinubu Presents 2025 Budget

-

News10 hours ago

News10 hours agoReps Recommends Delisting NECO, UI, Labour Ministry, 21 Others From 2025 Budget