News

THE IMPERATIVE OF CBN’S AUTONOMY

BY :IBRAHIM MODIBBOMphil.Ph.D

Under globalization and multi-cultural settings such as ours, Nigerians are under no illusion to the enormity of the myriad of challenges confronting the President Bola Tinubu Administration. In my opinion, anxiety and trepidation seems to trial the move by the National Assembly, to amend the provisions of the CBN Act of 2007. Industry watchers and members of the banking community fear that the attempt to amend the Act will erode confidence in the apex bank, have a negative impact on the banking industry and ultimately, affect the nation’s economy.

In the dynamic landscape of global economics, the independence of central banks stands as a cornerstone for maintaining sound macroeconomic stability and fostering confidence in financial markets. Across all major world economies, from the United States of America, United Kingdom, the developed Asian economies to the European Union, this principle is upheld as a vital aspect of prudent economic management. However, recent proposed amendments to the Central Bank of Nigeria (CBN) Act by the Nigerian Senate threaten to erode this independence or autonomy, putting Nigeria at odds with global best practices and jeopardizing its economic stability going forward. In this piece, we shall examine the critical reasons why preserving the autonomy of the CBN is imperative for Nigeria’s economic future.

It is crucial that we fully understand and appreciate the significance of maintaining the Central Bank’s independence. An independent central bank is critical for ensuring that monetary policy is conducted without political interference. This autonomy allows central banks to implement policies that focus on long-term economic health, such as controlling inflation, stabilizing the currency, and promoting sustainable economic growth. In major economies, central bank independence has been instrumental in achieving these goals. The Federal Reserve in the United States, the European Central Bank, and the Bank of England all operate independently of their respective governments, ensuring that monetary policy decisions are based on available economic data and analysis rather than political whims.

While commendably the idea of the proposed amendments to the CBN Act aim to enhance compliance and strengthen corporate governance, some of the key aspects pose significant threats to the bank’s autonomy. One of such proposal is the creation of a Coordinating Committee for Monetary and Fiscal Policies. This committee, dominated by fiscal authorities including the Ministry of Finance, would have a considerable influence on monetary policy decisions. Such an arrangement risks subordinating monetary policy to fiscal objectives, undermining the CBN’s ability to achieve its primary mandate of price stability in the economy. Apparently, this is a step in the wrong direction in the management of the Nigerian economy.

Fiscal policy, which is the cardinal responsibility or primary function of the Ministry of Finance, encompasses a range of activities related to government spending and taxation. This policy area involves the allocation of government resources, management of public funds, and implementation of tax regulations, all aimed at influencing the country’s economic conditions positively. While the effective coordination between fiscal and monetary policy is desirable, giving fiscal authorities dominance over the CBN compromises the bank’s ability to act independently. This fiscal dominance could lead to short-term policy decisions that prioritize immediate fiscal needs over long-term economic stability. For instance, the government might pressure the CBN to keep interest rates artificially low to reduce borrowing costs, even if such a policy could lead to higher inflation and other economic vulnerabilities.

Another alarming aspect of the current amendment process at the hallowed precincts of the Nigerian Senate pertains to the insistence on subjecting the Central Bank of Nigeria’s yearly budget to approval by the National Assembly. This proposed measure raises significant apprehensions regarding the potential politicization and interference in the operations of the Central Bank of Nigeria. The approval process could result in undue delays of monetary policy decisions, hindering the CBN’s ability to respond swiftly and effectively to economic challenges. In an environment where rapid decision-making is often essential, this could prove detrimental to Nigeria’s economic health.

Global best practices emphasize the need for central bank independence to ensure economic stability and investor confidence. Across the world today, major and emerging economies adopt this framework to ensure a situation of a more stable and predictable economic environments. For Nigeria to diverge from this path would not only isolate it from the global business community but also undermine investor confidence, leading to potential capital flight, increased borrowing costs from multilateral institutions, and a general loss of economic credibility as well as downward grading by global rating organizations.

The proposed amendments, particularly the inclusion of the Coordinating Committee for Monetary and Fiscal Policies, represent a concerning shift towards fiscal dominance. This committee’s role in determining interest rates on the CBN’s temporary advances to the federal government is especially problematic. With the committee chaired by the Minister of Finance as proposed in the current amendment and ostensibly dominated by fiscal authorities, there is a clear conflict of interest. Such a structure inherently favors fiscal objectives over monetary prudence, jeopardizing the delicate balance and the thin line required for sound macroeconomic management. The CBN should rather be encouraged to foster effective prudential guidelines in management of its advances to the federal government as enshrined in the current Act.

The potential for political interference in the CBN’s operations extends beyond the management of the monetary policy. It threatens the very fabric of Nigeria’s economic governance. An autonomous central bank acts as a check on government excesses, ensuring that fiscal policy does not compromise long-term economic stability. By undermining the institutional and operational autonomy, the proposed amendments risk eroding this safeguard and shield, potentially leading to economic policies driven by political rather than economic considerations.

While the Nigerian Senate’s intentions to amend the CBN Act may stem from a desire to enhance governance and performance by the apex, the proposed measures threaten to undermine the very foundation of effective economic management. Eroding the CBN’s autonomy not only contradicts global best practices but also risks plunging Nigeria into a cycle of political interference and economic quagmire.

It is therefore imperative that the Senate reconsider some key aspects of these amendments as enunciated here, preserving the CBN’s independence as a cornerstone of Nigeria’s economic policy framework. Only by doing so can Nigeria ensure a stable, predictable, and resilient economic future, in line with global standards and best practices. The nation’s economic health and international standing depend on it.

While admitting that some of the proposed amendments to the CBN Act are commendable as they are designed to entrench the culture of compliance, strengthen corporate governance, and reposition the apex bank for improved performance in attaining its mandate, most analysts however, say some of the major proposed amendments to the CBN Act appear to erode the bank’s autonomy and weaken the independence of monetary policy, at variance with international best practices.

For example, the proposed coordinating committee for monetary and fiscal policies concerning monetary policy in their opinion will undermine the apex bank’s independence and capacity in achieving its price stability mandate, including fiscal and monetary policy coordination as well as undermining the CBN’s operational independence and weaken the apex bank’s flexibility in deploying appropriate policy frameworks in a dynamic economic environment to achieving its core mandate.

Similarly, the proposed amendment to the CBN Act by the lawmakers will promote undue political interference in purely economic matters, as the fiscal authority would dominate the proposed committee’s membership and chairmanship. Subjecting the CBN’s budget to National Assembly approval will also undermine its institutional autonomy and introduce the potential for political interference in monetary policy which could lead to significant delays in monetary policy implementation and hinder swift monetary policy responses with potential negative implications for macro-economic stability.

According to Dr. Williams Puye an economic and financial expert, some of the proposed amendments threaten the independence and operational autonomy of the CBN as the country’s monetary authority. He asserted that the inclusion of the coordinating committee for monetary and fiscal policies in determining the rates of interest on the apex bank’s temporary advances to the federal government will not only erode the bank’s operational autonomy, but also breed conflict of interest since the committee is chaired by the minister and dominated by fiscal actors.

The now controversial amendment bill to the CBN Act is sponsored by Senator Mukhail Adetokunbo Abiru and co-sponsored by all 41 senators of the Senate Committee on Banking, Insurance and other Financial Institutions and proposes the establishment of a 7-member coordinating committee for monetary and fiscal policies to be chaired by the minister of finance, to among other things set internally consistent targets of monetary and fiscal policies that are conducive to controlling inflation and promoting financial conditions for sustainable economic growth.

It sets the tenure of the CBN Governor and Deputy Governors at a single non-renewable term of six years, appointment of a minimum of one career staff of the bank in the committee of governors, the appointment of at least one female among the External Directors as a Board member, that the five external directors should hold office for a non-renewable term of five years (one year less than the six-year tenure of the governor and deputy governors.

The amendment further proposes the establishment of the position of chief compliance officer in the rank of a Deputy governor, who reports directly to the Board and may occasionally be summoned to appear before the relevant committee of the National Assembly, limit temporary advances to the federal government, including modalities for the issuance of new legal tender to replace existing ones, providing that the withdrawal of the old legal tender should be carried out in phases and in a manner that does not cause any distortion to economic activities, while the apex bank should be in possession of sufficient new currency, not less than 70 percent of the old stock of currency to be withdrawn before embarking on such a programme.

In the area of Board governance, based on the fact that the CBN governor also serves as the Board chairman, the bill proposes that the board committees should be headed by non-executive directors instead of the deputy governors. The bill further proposes to amend the paid-up capital of CBN to N1trillion and that this figure may be increased from time to time by such amount as the government may approve either by way of transfers from the general reserve fund or by such other means as the government, in consultation with the board may approve.

Another notable provision of the bill states that the CBN governor must appears on a semi-annual basis whilst the National Assembly in the exercise of its constitutional duties should reserve the power to invite the governor to make presentations from time to time as the need arises. It also proposes the publishing of a monetary policy report and an interim financial report every six months that should be submitted to the president and the National Assembly within one month of the reference period.

It adds that where the governor fails to make a report to the president and the National Assembly as required by law, he shall be served with a warning letter by the National Assembly and if the failure persists, by a recommendation from the National Assembly for the governor’s suspension from office by the president.

Most significantly, the bill proposes that the budget approved by the CBN board can only be implemented upon the consideration and approval of the relevant committees of the National Assembly.

It goes without saying that safeguarding the independence of the Central Bank of Nigeria is crucial for maintaining the country’s overall economic stability and fostering investor confidence with a good mix of monetary policy tools. The proposed amendments to the CBN Act, particularly those that threaten the bank’s autonomy, must be reconsidered to ensure Nigeria’s economic future remains secure and safe. The Nigerian Senate must be careful not to exacerbate the current economic woes in the country. Hence, by upholding the principle of central bank independence, Nigeria can align itself with global best practices and ensure a stable and prosperous economic environment for its citizens now and in the future.

Dr. Modibbo is an Abuja based Journalist & Social Commentator on National Issues.

News

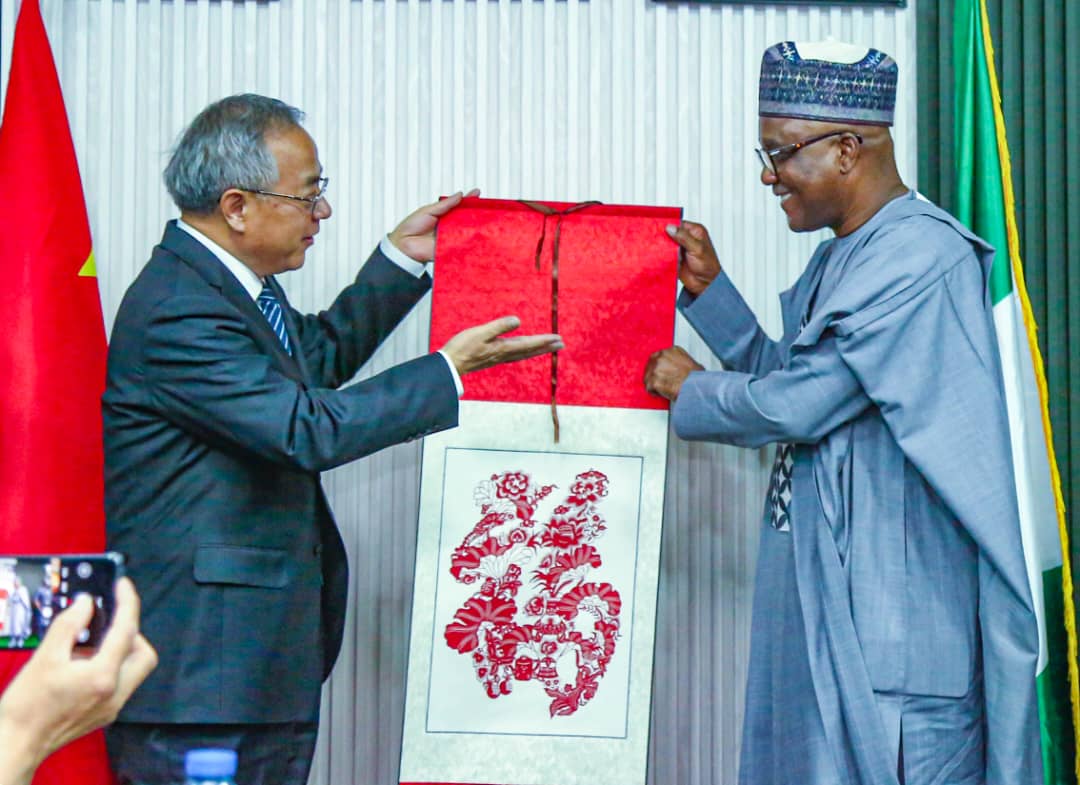

US Tariffs: Speaker Abbas Looks to China, Calls for Closer Ties

News

FCT minister, Wike gives land allotees 21 days to pay or lose offer

The Federal Capital Territory Administration (FCTA) has given land allottees 21 days to pay all statutory Right of Occupancy (R of O) bills and charges or lose the offer.

Mr Lere Olayinka, Senior Special Assistant on Public Communications and Social Media to the FCT Minister, disclosed this at a news conference in Abuja on Friday.

Olayinka explained that the measure was part of the broad and comprehensive reforms on land administration in the FCT, approved by the FCT Minister, Mr Nyesom Wike.

He said that the reforms, which would become operational from April 21, covers specific areas like conditions of grant of statutory R of O, and contents of the statutory R of O bill.

Others, he said, would include contents of Letter of Acceptance/Refusal of offer of grant of R o O, titling of mass housing and sectional interests, as well as regularisation of area council land documents.

He explained that the crux of the sweeping reforms in the FCT land administration would ensure the regularisation of land allocations in area councils and title of mass housing properties in favour of buyers.

He added that the land allottees were also expected to develop allocated lands within two years.

Olayinka noted that before now, deadline for payment of bills, rents, fees and charges were not specified in the statutory R of O bill, with no penalty for failure to make payment promptly.

According to him, the non-collection of R of O and non-payment of bills has caused delay in revenue generation due to the FCTA.

“It has also caused slower pace of infrastructural development and promote sustained land speculation and racketeering.

“Also, huge expenses have been incurred by the FCT Administration through repeated advertisements and publications notifying the public on the need for collection of R of O and timely payment of bills and charges.

“Consequently, as against the unspecified period within which to collect the R of O and make full payment of the bills and charges, land allottees now have 21 days from the date of offer to make full payment of all bills, fees, rents and charges prescribed on offers, and submit a duly completed letter of acceptance alongside evidence of payments or lose the offer.”

The spokesman added that FCTA had equally given land allottees two years from the date of the commencement of the R of O to erect and complete development on any land granted in the FCT.

This, according to him, is against the lengthy or unspecified period within which to develop allocated lands.

“Therefore, any R of O bills and other payments made outside the stipulated 21 days shall be considered invalid while any land granted should be developed within two years,” he said.

Also, the Director of Land Administration, FCTA, Chijioke Nwankwoeze, said this was the first time the Administration had reviewed its land administration to improve efficiency.

Nwankwoeze said that with this development, allottees would no longer hold their R of O in their house and assumed they owned a land in FCT.

He said that beginning from April 21, any offer of R of O must be paid for within 21 days of offer to validate acceptance.

“So, acceptance of the offer of statutory R of O in the FCT is now tied to payments of the accompanied bills,” he said.

The director of land also said that for lands allocated in the area councils, the allottees would be expected to make all payments within 60 days.

News

OERAF Holds Memorial Lecture on the Benefits of Debate Competitions for Students in Ughelli

The Executive Director of Olotu and Ekuogbe Rowland Akpodiete Foundation (OERAF), Dr. Olotu Otemu Akpodiete, held a memorial lecture on the benefits of debate competitions for students in Ughelli, Ughelli North Local Government Area of Delta State.

The event took place, April 10, 2025, in honor of the remembrance of the passing of his grandfather, the late Chief Ekuogbe Rowland Akpodiete, Ph.D.

In his opening remarks, Dr. Olotu Akpodiete encouraged the students to take their academic activities very seriously, assuring them that his foundation would continue to provide support for quality education in Nigeria.

Olorogun Dr. Chris Oharisi, Chairman of the Board of Governing Council at Delta State College of Health Science and Technology, Ofuoma-Ughelli, who chaired the occasion, advised the students to be optimistic.

He emphasized the importance of debate to students, stressing that it helps them excel in public speaking.

On his part, Mr. Samson Obor, Principal of Government College Ughelli, thanked the organizers (OERAF) for their good work and encouraged the students to take their studies seriously.

He added that the importance of debate can never be overemphasized.

Presenting the lecture, Olorogun (Mrs.) Grace Akpodiete highlighted several benefits of debate for students.

She mentioned four major benefits: academic benefits, personal benefits, career benefits, and life skills benefits.

She concluded that by participating in debate competitions, students can develop a wide range of skills that benefit them academically, personally, and professionally.

During her speech about the life of the late Chief Ekuogbe Rowland Akpodiete, Barrister (Mrs.) Agboka Akpodiete-Omale highlighted his integrity and commitment to philanthropy.

She praised him as a great disciplinarian, dedicated community leader, lawyer, and known for his generosity.

Chief Dr. Linda Ikpuri, in her closing remarks, expressed satisfaction with the great job that Olotu and Ekuogbe Rowland Akpodiete Foundation is doing, assuring that she would collaborate with OERAF to build a better society.

Other highlights of the event included the presentation of cash prizes to various schools in attendance.

The schools included Lulu Schools, Government College Ughelli, Otovwodo Grammar School, Oharisi Secondary School, Transcorp Secondary School, Ekakpamre, Girls Model Secondary School, Evwreni, Divine Fire School, and Ekiugbo Grammar School.

-

News20 hours ago

News20 hours agoAmbassadorial list ready for NASS review after DSS clearance – FG

-

News8 hours ago

News8 hours agoConstituents Drag Akpabio, Senate to Court Over Suspension of Natasha

-

News16 hours ago

News16 hours agoSecurity operatives halt attempt to break into VP Shettima’s residence, nab suspect

-

News16 hours ago

News16 hours agoSuit Seeking To Sack Ibas As Administrator Suffers Heavy Setback

-

News13 hours ago

News13 hours agoIbas pouring petrol on fire in Rivers, Briggs laments

-

News21 hours ago

News21 hours agoPopular actress passes away + Photo

-

News21 hours ago

News21 hours agoFG Issues Flood Warning for 30 States and FCT in 2025: Communities Urged to Prepare (Full List)

-

News15 hours ago

News15 hours agoPAINFUL! Six Persons Perish In Helicopter Crash