News

Redeemed Church Of God Explains Why The Senior Pastor Of City Of David Parish In Lagos Was Suspended

According to Punch, the Redeemed Christian Church of God (RCCG) has suspended Idowu Iluyomade, the Senior Pastor of the City of David Parish in Lagos State. This decision follows the lavish 60th birthday celebration of his wife, Siju.

According to a source who spoke with Church Times, Pastor Iluyomade received his suspension letter over the weekend. He has been replaced by Pastor Charles Kpandei of the church’s Resurrection Parish Region 11, effective immediately.

The source revealed that Iluyomade was suspended for three months by the church’s Governing Council. This decision came after a panel was constituted to investigate allegations against him and the parish. A top pastor within the church, who requested anonymity, disclosed to Church Times that the suspension was a response to public outcry against the extravagant birthday party, which took place shortly after the death of Access Bank’s Chief Executive Officer, Herbert Wigwe.

Fondly known as PID, Iluyomade has faced criticism for hosting the 60th birthday party for his wife, Siju, just a week after Wigwe’s death in a helicopter crash in the United States. Many perceived the celebration as insensitive, given Wigwe’s significant contributions to the church.

In addition to his role at City of David, Iluyomade serves as the Special Assistant to the RCCG General Overseer on Christian Social Responsibility through the His Love Foundation. It is not yet clear if he has been relieved of this responsibility as well.

Iluyomade’s suspension is linked to two key issues: the audit of the church and his alleged resistance to being transferred from the parish. An anonymous source detailed, “The church’s Governing Council met on two issues: the audit of the church, where questions were raised, and the issue of the pastor allegedly resisting transfer.”

The source continued, “The council then resolved to suspend Iluyomade for three months, during which time the pastor next to him will be in charge. When he resumes from suspension, the council also resolved that he should resume at the church’s headquarters, not the City of David.”

News

Senator Natasha on FB listed 3 politicians that should be arrested if anything happens to her

The Senator representing Kogi Central Senatorial district, Natasha Akpoti-Uduaghan has taken to her verified Facebook page to raise a serious alarm, alleging that her life is in danger following a reported attack on her family house in Kogi State.

In the strongly worded post, the Kogi-born lawmaker fingered some high-ranking political figures in Nigeria, declaring that should anything happen to her, the Nigerian Senate President, Godswill Akpabio, former Kogi Governor Yahaya Bello, and the current state Governor, Usman Ododo, should be held accountable.

“Nigeria Police, I reiterate, should any harm befall me, Nigerian Senate President Godswill Akpabio, Ex Gov. Yahaya Bello & Gov. Usman Ododo of Kogi state should be held responsible,” she posted.

Her statement comes, hours after her family home in Kogi was attacked, although details surrounding the incident remain sketchy as of the time of filing this report.

Recall that this is not the first time the Kogi senator is making such allegations against the trio. She made the same statement few weeks ago during her homecoming to Kogi State where she accused the senate president, Akpabio and Yahaya Bello for plotting evil against her.

Senator Natasha has been a vocal political figure and critic of the ruling establishment in Kogi, and this latest development adds to the growing tension in the state and national political landscape.

Authorities are yet to issue an official response to her recent allegations.

News

Emergency Rule: We should be thankful to President Tinubu -Wike

The Minister of the Federal Capital Territory (FCT), Nyesom Wike, has backed President Bola Tinubu’s declaration of a state of emergency in Rivers, saying he wanted the removal of Governor Siminalayi Fubara of the oil-rich state.

In a move that has continued to divide opinions, Tinubu suspended Fubara, his deputy, Ngozi Odu, and members of the House of Assembly following months of political crisis in Rivers State.

But Wike said the president’s move saved Rivers from implosion, arguing that the decision to appoint a sole administrator following Fubara’s suspension was a step in the right direction.

The former Rivers governor said this on Friday in Abuja during a media parley with select journalists.

“As a politician, I am not happy with the declaration of Emergency Rule in Rivers state. I wanted the outright removal of the governor. But for the interest of the state, the president did the right thing to prevent anarchy in the state.” Wike said.

However, people must tell the truth. The governor was gone. He was gone, yes… so when people say the president did this, I say they should be praising him.

“Every morning, they should go to the president and ask, ‘Can we wash your feet for saving us?’”

In February, the Supreme Court waded into the months-long political crisis in Rivers State, asking the Martin Amaewhule-led members of the state’s House of Assembly to resume sitting.

The apex court also barred the Central Bank of Nigeria (CBN) to stop releasing funds to the Rivers State government over what it labelled as disregard for court orders. It dismissed the cross-appeal filed by Fubara challenging the validity of the House of Assembly presided over by Amaewhule as the Speaker and asked the governor to re-present the budget to the lawmakers.

After weeks of back and forth between Amaewhule and the lawmakers over the budget re-presentation and moves to impeach Fubara, President Tinubu stepped in.

He suspended Fubara and his deputy and members of the Rivers State House of Assembly for six months, citing security reasons. Tinubu declared a state of emergency in the state and appointed Vice Admiral Ibok-Ete Ibas (retd) as the sole administrator, a step Wike said saved Rivers.

“Mr president came in and saved the situation, saved Rivers people from that calamity and anarchy,” the FCT minister argued.

News

Court Orders Fast-Tracked Trial Of 15 Workers Held In Prison For 6 Yrs Over Patience Jonathan’s Missing Jewellery

The Bayelsa State High Court has ordered a fast-tracked trial for 15 domestic workers who have spent nearly six years in detention at the Okaka Correctional Centre, Yenagoa, without conviction, over missing jewellery belonging to former First Lady Patience Jonathan.

SaharaReporters gathered that the order came after the prosecution and defence teams reached a rare consensus during Thursday’s proceedings to fast-track the case, which has suffered deliberate and serial delays allegedly masterminded by Patience Jonathan’s private legal team.

“The court proceeded well today, and both parties have agreed to finish the case as soon as possible, with an accelerated hearing. So victory is coming,” a source close to the defence told SaharaReporters.

The 15 accused persons, most of whom were part of Mrs Jonathan’s domestic staff, were arrested in 2019 and have remained in detention without bail, with the case dragging on endlessly for years amid reports of consistent manipulation of court processes.

A previous report by SaharaReporters exposed a pattern of intentional court delays reportedly orchestrated by Mrs Jonathan’s private prosecutors, Ige Asemudara and Samuel Chinedu Maduba, both of whom have been consistently representing the former First Lady since 2019.

“The prosecutors are Ige Asemudara and Samuel Chinedu Maduba,” one of the sources confirmed.

“One of them comes from Lagos while the second travels in from Port Harcourt. They’ve been handling this case from day one, presenting witnesses who come to tell lies. One witness took almost two years,” a source earlier told SaharaReporters.

Sources alleged that Mrs Jonathan gave direct instructions to delay the proceedings.

“The aim is to frustrate the process and keep these innocent people in prison as long as possible. It’s an abuse of the legal system,” a source close to the courtroom told SaharaReporters.

The delay tactics reportedly included health excuses, unreachable witnesses, and repeated adjournments based on flimsy reasons. “Sometimes, Ige Asemudara would claim he is sick or his witness has work. Other times, he just asks for long adjournments,” said another insider.

Shockingly, the judiciary itself was not spared from complicity allegations. A source revealed that the presiding judge initially delayed hearing the bail applications, claiming she wanted to listen to some of the prosecution’s evidence first to determine the nature of the charges.

“When the case started in 2019, they all applied for bail,” the source said. “But the judge told their lawyers to wait so she could hear some evidence. After that, she shockingly denied bail, saying the offences were capital and therefore not bailable.”

Meanwhile, the Bayelsa State High Court has denied any involvement in the delays, recently restating its commitment to speedy justice and dismissing reports of suspects’ trials being delayed.

The court, in a reaction to reports that alleged that the trial of 15 domestic workers facing trial for burglary and theft of jewellery, was being delayed, said the claim was false.

It claimed that, according to available records, the matter had suffered delays due to multiple defence lawyers who must cross-examine witnesses, which had slowed down proceedings. It added that the case had also suffered several adjournments at the instance of counsel.

The delays have left the defence team and families of the detainees stunned, particularly since the prosecution reportedly failed to produce any convincing evidence to support the capital charges.

The affected persons are Williams Alami, Vincent Olabiyi, Ebuka Cosmos, John Dashe, Tamunokuro Abaku, Sahabi Lima, Emmanuel Aginwa, Erema Deborah, Precious Kingsley, Tamunosiki Achese, Salomi Wareboka, Sunday Reginald, Boma Oba, Vivian Golden and Emeka Benson.

They have remained behind bars without justice, caught in the web of power, influence, and a compromised legal process.

With the court finally conceding to an accelerated hearing, hope has once again sparked for the victims of this legal nightmare.

-

News19 hours ago

News19 hours agoAbuja light rail project must be commissioned on May 29-Wike vows

-

News10 hours ago

News10 hours agoTinubu Remains Engaged In Governance From Europe, Will Return After Easter – Presidency

-

News20 hours ago

News20 hours agoJust in: Alleged Herdsmen Armed With AK-47 Rifles Take Over Communities In Benue State

-

News23 hours ago

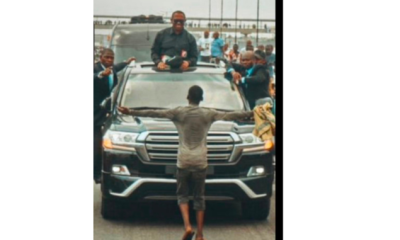

News23 hours agoFinally , Lagos Court frees Quadri, young Nigerian who stood before Obi’s convoy in viral photo

-

News20 hours ago

News20 hours agoSEYI Tinubu Speaks On Alleged Abduction, Brutalization Of NANS President Atiku Abubakar Isah

-

News10 hours ago

News10 hours agoFirst Lady Convoy Kills Seven-Year-Old Girl In Ondo State

-

Foreign10 hours ago

Foreign10 hours agoTrump To Close US Embassies In South Sudan, France, Others

-

News9 hours ago

News9 hours agoNJC investigates 18 Imo judges over suspected age falsification