News

SEE Dollar to Naira Exchange Rate at Black Market ( July 3, 2024: USD to NGN CBN Rate

What is the Dollar to Naira Exchange rate at the black market also known as the parallel market (Aboki fx) Today July 3, 2024?

Many Nigerians, especially those engaged in foreign trade, travel, and investment, have always been very interested in and concerned about the exchange rate between the US dollar and the Nigerian naira.

The parallel market, also known as the black market or Aboki FX, often offers a different rate from the official Central Bank of Nigeria (CBN) rates.

For many, this is a critical source of foreign exchange. See the black market Dollar to Naira exchange rate for July 3, 2024, below. At these rates, you can exchange your dollar for Naira.

How much is a dollar to naira today in the black market? Dollar to naira exchange rate at black market Yesterday (Aboki dollar rate): The exchange rate for a dollar to naira at Lagos Parallel Market (Black Market), yesterday, July 2, 2024, players buy a dollar for N1500 and sell at N1505 according to sources at Bureau De Change (BDC).

Please note that the Central Bank of Nigeria (CBN) does not recognize the parallel market (black market), as it has directed individuals who want to engage in Forex to approach their respective banks. Dollar to Naira Black Market Rate Today July 3, 2024 Dollar to Naira (USD to NGN) Black Market Exchange Rate Today Buying Rate N1510 Selling Rate N1515 Dollar to Naira CBN Exchange Rate The Central Bank of Nigeria sets the official exchange rates, providing stability through government regulation. As of now, the rates are: Dollar to Naira CBN Rate Today Dollar to Naira (USD to NGN) CBN Rate Today Buying Rate N1548 Selling Rate N1549

These rates reflect government policies aimed at stabilizing the naira and managing foreign exchange reserves. Businesses and individuals that prefer regulated transactions frequently rely on these rates. Please note that the rates you buy or sell forex may be different from what is captured in this article because prices vary. Dollar to Naira Exchange Rate at Black Market (Aboki FX) July 2, 2024: USD to NGN CBN Rate

Pounds and Euro to Naira Exchange Rates For those dealing with currencies other than the US dollar, here are the latest rates: Pounds to Naira (CBN Rates) Buying Rate: ₦1,963 Selling Rate: ₦1,963 Euro to Naira (Black Market Rates) Buying Rate: ₦1,662 Selling Rate: ₦1,665 These rates are also subject to market conditions and economic policies. Geegpay and Grey: online Exchange Platforms

Digital platforms like Geegpay and Grey offer convenient and secure options for currency exchange, providing competitive rates. Geegpay Dollar to Naira Rates EUR (€): Buying at ₦1,690.03, Selling at ₦1,695.55 GBP (£): Buying at ₦1,950, Selling at ₦1,965 USD ($): Buying at ₦1,480, Selling at ₦1,550 Grey Dollar to Naira Rates EUR (€): Buying at ₦1,640.03, Selling at ₦1,719 GBP (£): Buying at ₦1,902, Selling at ₦2,015 USD ($): Buying at ₦1,460, Selling at ₦1,500 These platforms have gained popularity due to their ease of use, transparency, and security, making them viable alternatives to traditional methods. Factors Influencing Black Market Rates Understanding the factors that influence the dollar to naira exchange rate in the black market can help anticipate changes and make better financial decisions.

Economic Policies Government policies significantly impact exchange rates. Decisions on interest rates, inflation control, and foreign exchange regulations by the Central Bank of Nigeria (CBN) directly affect the naira’s value. For instance, when the CBN adjusts policies to manage inflation or stabilize the naira, it impacts the exchange rate. Supply and Demand The availability of foreign currency versus the demand for it plays a crucial role. When foreign currency is scarce or demand is high, the naira depreciates, leading to higher exchange rates. Conversely, an abundant supply of dollars can lead to lower rates.

Political Stability Geopolitical events and internal political stability affect investor confidence. Political unrest or uncertainty can cause the naira to depreciate as investors move towards safer assets. Stability and positive political developments, on the other hand, can strengthen the naira. Global Economic Conditions Global market conditions, such as shifts in oil prices (a major export for Nigeria), international economic trends, and global inflation rates, influence the naira’s value. For example, a significant drop in oil prices can negatively impact Nigeria’s economy and the naira. Comparing Official and Black Market Rates There is a significant disparity between official and black market rates. The black market offers higher rates, but with substantial risks such as fraud and legal issues. The CBN advises using official channels to avoid these risks. Official rates are stable and reliable, making them suitable for the majority of transactions.

Why the Disparity Between Official and Black Market Rates? The disparity between the official CBN rates and the black market rates is influenced by several factors: Supply and Demand: The availability of foreign currency in the official market is often limited, leading individuals and businesses to seek forex in the black market where demand drives up prices.

Regulatory Restrictions: The CBN imposes restrictions on the amount of forex available for personal and business use, making it difficult for many to meet their needs through official channels. Economic Instability: Fluctuations in oil prices, inflation, and economic policies can create uncertainty, prompting people to turn to the parallel market for more favorable rates. Impact of Black Market Rates on the Economy

The high exchange rates in the black market can have various implications for the Nigerian economy: Inflation: Higher costs for imported goods can drive up prices locally, contributing to inflation. Investment: Unfavorable exchange rates can deter foreign investment as investors seek more stable economic environments. Trade: Exporters may benefit from higher naira values per dollar, while importers face increased costs, potentially leading to trade imbalances. How to use the parallel market For those needing to engage in forex transactions through the black market, safety and caution are paramount. Here are some tips:

Verify Rates: Always check the latest rates from reliable sources like Aboki FX to ensure you get the best deal. Deal with Reputable Dealers: Engage with well-known and trusted Bureau De Change operators to avoid scams. Stay Informed: Keep abreast of economic news and CBN policies that could affect exchange rates. FAQs on dollar naira exchange rate black market How much is a dollar to naira today in the black market? The buying rate is N1495, and the selling rate is N1500 as of June 23rd, 2024. Why does the black market offer higher rates than the CBN? The black market rates are driven by supply and demand dynamics, regulatory restrictions, and economic instability. Is it legal to trade forex in the black market? While the CBN discourages it, many engage in the black market due to the unavailability of sufficient forex through official channels. What are the risks of trading in the black market? Risks include fluctuating rates, potential scams, and the legal gray area of such transactions. Can the CBN influence black market rates? The CBN can influence these rates through monetary policy, forex interventions, and regulatory measures, but direct control is limited. How often do black market rates change? Rates can change on a daily or even multiple times per day, depending on market conditions and economic news. Conclusion on the Dollar-Naira Exchange Rate Black Market

The dollar to naira exchange rate at the black market reflects a complex interplay of economic factors, regulatory frameworks, and market dynamics. While it offers a critical alternative for many Nigerians seeking forex, it also underscores the challenges and opportunities within Nigeria’s broader economic landscape. Staying informed and cautious can help navigate this often volatile market effectively. Non-Bank Transactions Surge Threatens West Africa’s Financial Stability – Cardoso Yemi Cardoso, Governor of the Central Bank of Nigeria, has raised alarms about the rising volume of transactions by non-bank and Other Financial Institutions (OFIs), warning that this trend threatens West Africa’s financial stability. Speaking at the 10th meeting of the College of Supervisors for Non-Bank Financial Institutions in Abuja, Cardoso emphasized the vital role of non-bank financial institutions in promoting financial growth and inclusion in the West African Monetary Zone (WAMZ). Non-bank financial institutions provide essential services to underserved populations, including SMEs, without accepting deposits like commercial banks. Cardoso praised the adoption of the Model Act for Non-Bank Financial Institutions, a legislative milestone aimed at harmonizing supervisory practices across the WAMZ. Highlighting fintech innovations, Cardoso noted the rise in fintech loans, crypto, and stablecoin assets. He stressed the importance of monitoring these trends, as their increasing volumes pose significant risks to financial stability. Cardoso urged supervisors to bolster cybersecurity frameworks and adopt risk-based supervisory approaches to mitigate these risks. Yaw Sapong, Chairman of the College, highlighted the role of non-bank financial institutions in fostering financial inclusion and economic growth, calling for coordinated policy responses to current challenges. Dr. Olorunsola Olowofeso, Director General of WAMI, emphasized the need for resilience in the financial sector against emerging risks such as cyber threats and climate-related issues

The CSNBFI meeting aims to review progress in the NBFI sector and strategize on addressing current challenges, focusing on regulatory harmonization, cybersecurity, and the impact of digital innovations on financial services.

News

NJC investigates 18 Imo judges over suspected age falsification

The National Judicial Council has launched a probe into 18 judges in the Imo State judiciary over allegations of age falsification, in a development raising fresh concerns about integrity and transparency within Nigeria’s judicial system.

The NJC, in a statement on Thursday by its Deputy Director of Information, Kemi Ogedengbe, confirmed that the allegations were being treated with utmost seriousness and were currently under review.

“Allegations of this nature require detailed investigation before any action can be taken,” Ogedengbe stated.

“The NJC is investigating the allegations and may take a decision by the end of the month. For now, we cannot act without completing our inquiries. The council will convene and make decisions on the matter.”

The investigation follows a petition submitted by a civil society group, Civil Society Engagement Platform, which described the matter as an “unprecedented breach of judicial integrity.”

The group alleged that the judges deliberately manipulated their birth records to either prolong their tenure or gain appointments within the judiciary.

In a letter addressed to the NJC Chairman and Chief Justice of Nigeria, Justice Kudirat Kekere-Ekun, the platform cited discrepancies in the judges’ official documents, including Law School registration forms, Department of State Services reports, and Nominal Rolls.

The petition, signed by CSEP’s Director of Investigation, Comrade Ndubuisi Onyemaechi, included what it described as compelling documentary evidence marked as Exhibits 001 to 018.

Among those named in the petition is Justice I. O. Agugua, who reportedly has two different birth dates—May 10, 1959, and May 10, 1960—and is also facing separate allegations of misconduct.

Justice C. A. Ononeze-Madu is alleged to have birth records stating both July 7, 1963, and July 7, 1965, while Justice M. E. Nwagbaoso is accused of presenting conflicting dates of birth—August 20, 1952, and August 20, 1962.

The remaining 15 judges also reportedly have varying inconsistencies in their personal data, a revelation that has intensified public scrutiny of the judiciary’s accountability mechanisms.

The NJC, which is constitutionally empowered to discipline judicial officers, is expected to reconvene soon to deliberate on the findings of its inquiry and take appropriate disciplinary actions where necessary.

The unfolding development comes amid mounting calls for institutional reforms to restore public trust in the judiciary and reinforce ethical standards across all arms of government.

News

Delta committed to safeguard its cultural heritage – Oborevwori

Delta State Governor, Sheriff Oborevwori, has reaffirmed his administration’s commitment to the preservation and promotion of the state’s rich and diverse cultural heritage, describing cultural festivals as vital tools for sustaining indigenous identity.

Oborevwori made this known on Thursday while receiving the President and leadership of the Organisation for the Advancement of Anioma Culture, who paid him a courtesy visit at Government House, Asaba.

Speaking during the meeting, the governor commended OFAAC for its over two decades of dedication to the promotion of Anioma cultural heritage, describing the body as a “vehicle of unity” in Delta State.

He pledged his administration’s full support for OFAAC and similar cultural organisations that contribute to peace, unity, and development.

“I commend OFAAC’s tirelessness and dedication to preserving Anioma culture, heritage, and identity,” Oborevwori said. “Your efforts are crucial in promoting our rich traditions and values.

As a government, we reaffirm our commitment to preserving cultural heritage across the state and supporting initiatives that promote festivals and language, which are essential in shaping our identity.”

Oborevwori also expressed gratitude to the people of Delta North for their overwhelming support during the last governorship election, noting that he secured victory in all nine local government areas within the Anioma region.

“Under our M.O.R.E. Agenda, we have implemented key projects across the Anioma nation and throughout the state. I am particularly grateful to the Anioma people for their strong support and love,” he said.

He further lauded the inclusiveness of OFAAC’s activities, noting its practice of inviting other ethnic groups to its events, which he said fosters unity and cultural harmony across the state.

Earlier, OFAAC President, Arc. Kester Ifeadi, said the purpose of the visit was to formally inform the governor about the group’s forthcoming cultural fiesta, scheduled for Easter Monday.

He described Oborevwori as a “detribalised leader” and commended his administration’s developmental strides across all three senatorial districts in the state.

Ifeadi reaffirmed the support of the Anioma people for the governor’s M.O.R.E. Agenda, emphasising that OFAAC would continue to be a platform for promoting unity among Delta’s various ethnic nationalities.

News

Scores killed as NAF fighter jet bombs insurgents’ stronghold in Sambisa forest

The Nigerian Air Force on Thursday announced that two coordinated airstrikes had successfully neutralised several terrorists and destroyed their hideouts in Borno State.

The precision strikes, carried out under the Air Component of Operation Hadin Kai, targeted known insurgent enclaves in Kollaram and Arra—two areas identified as long-standing terrorist strongholds within the Sambisa general area and the Southern Tumbuns.

According to a statement released by the Director of Public Relations and Information at NAF Headquarters, Air Commodore Edward Gabkwet, the first operation was conducted at approximately 5:30 a.m. in Kollaram, following credible intelligence and surveillance footage that confirmed the presence of high-value terrorist commanders and operational facilities.

“In a bold display of force and precision, the Nigerian Air Force, under Operation Hadin Kai, executed two highly successful air interdiction missions on April 15, 2025, targeting terrorist strongholds in Borno State’s Sambisa general area and the Southern Tumbuns,” the statement read.

“The first strike occurred at approximately 5:30 a.m. in Kollaram, a known insurgent hub. Intelligence reports, corroborated by surveillance footage, confirmed the presence of high-value terrorist commanders and several operational structures, including those equipped with solar panels. NAF assets executed a precision strike, eliminating numerous fighters and disabling key infrastructure.”

Later in the day, at about 3:55 p.m., another strike was carried out in Arra, also within the Sambisa axis.

According to Ejodame, real-time visuals obtained from Intelligence, Surveillance, and Reconnaissance missions revealed clusters of armed militants actively operating in the area.

“Precision-guided munitions were employed during the mission, resulting in the effective destruction of identified targets and significant disruption of the group’s operational capabilities,” he added.

Ejodame emphasised that the airstrikes form part of an ongoing and intensified aerial campaign aimed at degrading terrorist capabilities, dismantling leadership structures, and eliminating insurgent sanctuaries across the region.

Meanwhile, the Defence Headquarters said on Thursday that troops neutralised a notorious terrorist kingpin, Bello Kaura, in a precision airstrike conducted by troops of Operation Fasan Yamma.

Kaura was among the scores of terrorists neutralised by troops between April 10 and 16, 2025, according to the DHQ.

A statement by the Director, Defence Media Operations, Maj. Gen. Markus Kangye, said troops, in collaboration with other security agencies and hybrid forces, carried out a series of coordinated operations in Zamfara, Sokoto, Kaduna, Niger, Kwara States, and the FCT among others.

These operations, he said, were marked by fierce engagements with terrorists, leading to the killing of several insurgents, arrests of suspects, and recovery of a cache of arms and ammunition.

“Between 10 and 16 April 2025, troops conducted fighting patrols and made contact with terrorists in Anka, Tsafe, Talata Mafara, Kaura Namoda and Maru LGAs of Zamfara State as well as Gudu, Isa and Tangaza LGAs of Sokoto State. They conducted operations in Giwa, Chikun and Birnin Gwari LGAs of Kaduna State as well as Bida LGA of Niger State.

“During the encounters, many terrorists were neutralised, including an identified terrorist kingpin, Bello Kaura, in an air interdiction, arrested some of them, while 17 kidnapped victims were rescued,” he said.

He also said troops thwarted oil theft worth over ₦262.7m and arrested suspects.

“During the week under review, Operation DELTA SAFE foiled oil theft worth over N262,702,150.00 only.

“The breakdown indicates: 117,395 litres of stolen crude oil, 22,050 litres of illegally refined AGO, 6,000 litres of DPK and 8,060 litres of PMS. Additionally, they discovered and destroyed 102 crude oil cooking ovens, 94 dugout pits, 18 boats, four speedboats, 56 storage tanks, 164 drums and 42 illegal refining sites. Other items recovered include pumping machines, drilling machines, galvanised pipes, tricycles, motorcycles, mobile phones and nine vehicles,” he said.

Kangye assured the citizens of the Armed Forces’ commitment to protecting national sovereignty and ensuring the safety of all law-abiding citizens.

He said to deny the criminals freedom, the military would take the battle to them.

“We are taking the battle to the enemy to deny them freedom of action, making them thirst for surrender.

“I wish to reiterate the untiring commitment of the Armed Forces of Nigeria to dominate and act in defence of our nation’s sovereignty while guaranteeing the protection of all law-abiding citizens to promote the betterment of our society.

“Our operations across all theatres remain focused, intelligence-driven, and in line with the highest standards of professionalism and respect for human rights,” Kangye added.

He called on the civil populace to continue supporting military operations.

Kangye said, “We once again appeal that the civil populace trust us and see us as friends and partners working for the general good and well-being of the nation. We recognise the sacrifices made daily by our gallant troops, and we salute their courage and dedication.”

-

News19 hours ago

News19 hours agoBREAKING: Unknown gunmen reportedly storm Senator Natasha’s family residence

-

News22 hours ago

News22 hours agoSnub story on removal of Rivers Sole Administrator, it’s FAKE-Chief Registrar

-

News21 hours ago

News21 hours agoSAD! Again, Alleged Herdsmen Attack Three Benue Communities

-

News14 hours ago

News14 hours agoAbuja light rail project must be commissioned on May 29-Wike vows

-

News19 hours ago

News19 hours agoLawmaker Slams NBA Over Rivers Crisis, Demands Return of N300m

-

Politics21 hours ago

Politics21 hours agoPDP govs are jokers, can’t stop coalition train, Atiku boasts

-

News14 hours ago

News14 hours agoJust in: Alleged Herdsmen Armed With AK-47 Rifles Take Over Communities In Benue State

-

News18 hours ago

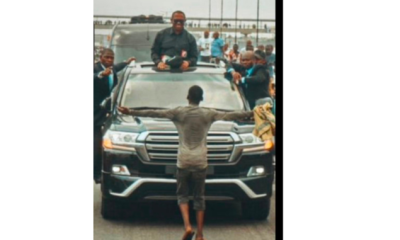

News18 hours agoFinally , Lagos Court frees Quadri, young Nigerian who stood before Obi’s convoy in viral photo