News

Petrol queues spread to Lagos

The scarcity of petrol that started in the Federal Capital Territory(FCT) six days ago has spread to Lagos.

Yesterday, motorists at Nigeria’s commercial hub, spent hours at the few filling stations selling the product.

An on-the-spot assessment by our reporters showed that many of the stations that dispensed the product were independent marketers.

Many major marketers did not sell petrol.

The situation presented an opportunity to the independent stations to raise pump prices. The cost of a litre ranged between N610 to N800 depending on the area of purchase.

Petrol attendants and black market hawkers also made quick money from desperate motorists.

One of our reporters who drove from Akoka to Oshodi observed that only one filling station (Mobil ) at Vono Bus Stop in Mushin was open for business.

There were also queues at filling stations operated by TotalEnergies and Tecno Oil in Festac Town. NNPC Limited’s petrol station on Ago Palace Way had long lines of motorists waiting to buy the product.

At NNPC Limited filling station on Awolowo Road, Ikoyi, a motorist, who identified himself simply as Richard, said he willingly offered N1,000 to an attendant to hire a keg and buy petrol for him.

‘’Apart from the N1,000, I gave him N500 for his effort. There was no way I could have joined the queue because I had an emergency to attend to,’’ he told The Nation.

In the FCT, the queues lengthened with a litre of petrol selling for between N720 and N820 at independent stations. At those run by major marketers, it N690.

The NNPC Limited retail outlets that operated still sold for N617 per litre but with very long vehicular queues.

On the other hand, black market operators sold the product for as much as N1,100 to N1,300 per litre.

But as motorists and commuters groaned, the NNPC Limited warned against hoarding of petrol. It assured of improved in supplies soon.

In a statement by its Chief Corporate Communications Officer, Mr. Olufemi Soneye, the NNPC Limited blamed the scarcity on a number of factors, including thunderstorms and floods.

The company explained that the unfavourable weather conditions did not only affect ship-to-ship (STS) transfer of petrol but ‘’truck load outs and transportation of the product to retail outlets.

It added that there was need for caution to be upheld during rainstorms and lightning because of the inflammability of petroleum products.

Soneye said in the statement that there was no cause for alarm as ‘’loading has commenced in areas where these challenges have subsided’’

The statement reads in part: “The NNPC Ltd wishes to state that the disruption of fuel queues seen in the FCT and some parts of the country, were as a result of disruption of ship-to-ship (STS) transfer of Premium Motor Spirit (PMS), also known as petrol, between Mother Vessels and Daughter Vessels resulting from recent thunderstorm.

“The adverse weather condition also affected berthing at jetties, truck load-outs and transportation of products to filling stations, causing a disruption in station supply logistics.”

He added that adherence to safety regulations as advised by the Nigerian Meteorological Agency (NIMET) is mandatory as ‘’any deviation could pose severe danger to the trucks, filling stations and human lives.’’

Soneye also said the scarcity was compounded by consequential flooding of truck routes especially at coastal corridors to the FCT.

Executive Secretary, Major Energies Marketers Association of Nigeria (MEMAN), Clement Isong is on the same page with the NNPC Limited on the cause of the scarcity.

Isong said: “The supply chain was disrupted. For a few days last week, there was heavy rain which disrupted operations at depots and loading bays. Petrol cannot be loaded during rainstorm and lightening.

‘’The roads were flooded and trucks could either not move or were moving slowly. So we lost two or three days of loading activities and it’s the backflow of this that has led to the queues. But the queues will disappear because petrol is very much available, so there’s nothing to worry about.”

News

Saudi Arabia donates 100 tonnes of dates to Nigeria as fasting approaches

By Kayode Sanni-Arewa

The Embassy of the Kingdom of Saudi Arabia in Abuja has held an official ceremony to distribute 100 tonnes (100,000kg) of dates to Nigeria as part of its annual humanitarian relief efforts.

The initiative, facilitated by the King Salman Humanitarian Aid and Relief Centre (KSrelief), aims to support vulnerable families across the country and strengthen the deep-rooted ties between the two nations.

During the ceremony, the Ambassador of the Custodian of the Two Holy Mosques to Nigeria, Faisal bin Ibrahim, conveyed the Kingdom’s dedication to humanitarian causes.

He expressed his profound gratitude to King Salman bin Abdulaziz and Crown Prince Mohammed bin Salman for their unwavering support in providing aid to Muslims and underserved communities worldwide.

He emphasised that Saudi Arabia remains steadfast in its commitment to fostering Islamic solidarity and providing relief to those in need.

Mr Al-Ghamdi explained that this year’s distribution includes 50 tonnes of dates for Abuja and another 50 tonnes for Kano, continuing Saudi Arabia’s tradition of assisting Nigeria through humanitarian donations.

He noted that the initiative represents the Kingdom’s broader mission to uplift Muslim communities, alleviate suffering, and promote unity, particularly during significant religious periods such as Ramadan.

The embassy, in collaboration with local authorities and humanitarian organisations, will ensure the proper distribution of the dates so that they reach the most vulnerable families in various regions of Nigeria

Saudi Arabia has been a longstanding partner in providing humanitarian aid to nations across the globe, including Nigeria. The Kingdom’s continued efforts in supporting food security and welfare initiatives exemplify its role as a global leader in charitable and humanitarian endeavours.

Through Vision 2030, Saudi Arabia seeks to expand its contributions to international humanitarian causes, reinforcing its dedication to fostering peace, stability, and prosperity worldwide. The ongoing provision of aid to Nigeria is a testament to these commitments and highlights the decades-long partnership between the two brotherly nations.

News

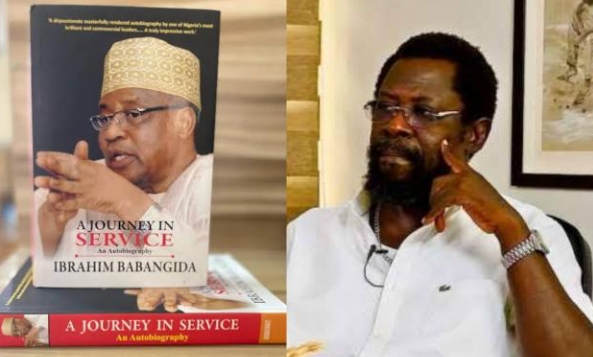

Babangida’s Book is filled with distorted facts, collection of lies, says Dele Farotimi

By Kayode Sanni-Arewa

Dele Farotimi, a human rights lawyer, has launched a heavy attack on former dictator Gen. Ibrahim Babangida (retd.), describing his reign as “ruinous”.

Farotimi, who lived through Babangida’s rule, recounted his experiences as a participant in the fight against the former leader’s “evil actions and inactions

Farotimi’s comments come after Babangida’s recent admission that Chief M.K.O. Abiola won the 1993 presidential election, which Babangida annulled.

The human rights lawyer expressed his disappointment, but not surprise, at the “mixed bag of lies, half-truths, urban legends, and obfuscations” in Babangida’s recent statements.

Farotimi’s criticism is not isolated, as many Nigerians have questioned Babangida’s legacy and the lack of consequences for his actions. The annulment of the 1993 election led to widespread protests and a prolonged struggle for democracy in Nigeria.

In a statement, Farotimi concluded, “No hagiographic allocutus can redeem the Evil Genius of Minna”.

The statement was shared on X while he was reacting to a comment made by Adnan Abdullahi Adam, which stated that “it’s better to read every side of exposition before forming your own judgement”.

With the cover picture of the IBB’s memoir “A Journey In Service” @realadnantweet wrote:

“I think IBB’s memoir: “A Journey in Service” exposes a fresh perspective on everything.

“It’s better to read every side of exposition before forming your own judgement.

“Everyone should try reading the book as jury to the plea of the accused.”

Responding Farotimi wrote: “I lived through his ruinous reign. I wasn’t a passive victim of his evil actions and inactions, I was a participant in the fight to be freed of him.

“I am painfully aware of the extent of his evil capabilities, and I have not been disappointed by the mixed bag of lies, half truths, urban legends, and obfuscations contained in the excerpts already in the public domain. No hagiographic allocutus can redeem the Evil Genius of Minna.”

On Thursday, February 20, 2025, former Nigerian military ruler General Ibrahim Badamasi Babangida (IBB) released his long-anticipated autobiography, “A Journey in Service.”

The memoir has ignited a firestorm of controversy, with critics accusing Babangida of distorting historical events and maligning deceased individuals who cannot defend themselves.

This development has reopened debates about his tenure and its lasting impact on Nigeria’s political and economic landscape.

Babangida’s tenure from 1985 to 1993 was marked by the implementation of the Structural Adjustment Programme (SAP), among others. In “A Journey in Service,” he provides an insider’s perspective on the adoption of SAP, aiming to offer context for the controversial policy that aimed to liberalize Nigeria’s economy.

While intended to address economic challenges, SAP led to widespread protests and debates due to its harsh austerity measures and the social hardships it imposed.

Critics, however, contend that Babangida’s memoir serves as a self-exoneration tool, selectively presenting events to absolve himself of blame.

Human rights lawyer and former Chairman of the Nigerian Human Rights Commission, Prof. Chidi Odinkalu, described the book as a “pack of lies,” accusing Babangida of making allegations against deceased individuals who cannot contest his claims.

Odinkalu further criticized Babangida for portraying himself as a victim of circumstances orchestrated by those who are no longer alive to defend themselves.

The memoir has also rekindled discussions about Babangida’s annulment of the June 12, 1993, presidential election, widely regarded as one of Nigeria’s freest and fairest elections. In the book, Babangida attempts to justify the annulment, a move that plunged the nation into political turmoil and prolonged military rule. Many Nigerians view this action as a significant setback to the country’s democratic progress.

News

Saudi Arabia plans to invest $600bn in new US trade over 4 years

By Kayode Sanni-Arewa

Saudi Arabian Crown Prince Mohammed bin Salman told President Donald Trump that the kingdom wants to put $600 billion into expanded investment and trade with the United States over the next four years, the Saudi State news agency said early on Thursday.

In a phone call between the two leaders, the crown prince said the Trump administration’s expected reforms could create “unprecedented economic prosperity”, the state news agency reported.

The report said Saudi Arabia wants its investments to capitalize on these conditions. It did not detail the source of the $600 billion, whether it would be public or private spending nor how the money would be deployed.

The investment “could increase further if additional opportunities arise”, the agency quoted Bin Salman as telling Trump.

Trump fostered close ties with Gulf states including Saudi Arabia during his first term. The country invested $2 billion in a firm formed by Jared Kushner, Trump’s son-in-law and former aide, after Trump left office.

Trump said following his inauguration on Monday that he would consider making Saudi Arabia his first destination for a foreign visit if Riyadh agreed to buy $500 billion worth of American products, similar to what he did in his first term.

“I did it with Saudi Arabia last time because they agreed to buy $450 billion worth of our product. I said I’ll do it but you have to buy American product, and they agreed to do that,” Trump said, referring to his 2017 visit to the Gulf kingdom.

The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here.

Reporting by Hatem Maher; Editing by Leslie Adler and Cynthia Osterman

-

News22 hours ago

News22 hours agoJust in : Senator Gumau is dead

-

News23 hours ago

News23 hours ago10th NASS Committed to Constitutional Reforms – Kalu

-

Metro15 hours ago

Metro15 hours agoInsecurity! Gunmen invade church, slash pastor’s 2 fingers

-

News23 hours ago

News23 hours agoRep Salam Congratulates Governor Adeleke On Successful Conduct Of LG Elections

-

Metro15 hours ago

Metro15 hours agoFire engulfs MTN office in Oyo

-

News22 hours ago

News22 hours agoPolice seal OSSIEC office, officials nabbed, says chairman

-

News22 hours ago

News22 hours agoI have never insulted President Tinubu in my entire life”-Gov Adeleke

-

Foreign15 hours ago

Foreign15 hours agoPentagon set to sack 5400 staff as attack hits Trump’s downsizing plan