News

Zamfara Gov, Dauda Lawal Loses Private Jet in Lagos Over Alleged Scam

By Kayode Sanni-Arewa

Zamfara State Governor Dauda Lawal was the victim of an elaborate scheme that saw him lose ownership of a private jet worth $6.3 million to a crafty pair of aviation business executives in Lagos.

Peoples Gazette learnt through documents and sources that Mr Lawal has been silent about the fraud because he feared raising it with Nigerian authorities would trigger suspicion about how he managed to heap over $6 million on a personal aircraft in the first place.

He was a banker at First Bank of Nigeria Plc when he bought the plane, which he secretly registered under the name of a couple running a jet-leasing venture at Murtala Muhammad International Airport, Lagos, The Gazette learnt.

The Gazette heard that the husband, Ovi Osazele, changed ownership of the jet to his own name after parting ways with his wife, Gloria Osazele, and fleeing to the United States, leaving Mr Lawal in limbo.

The governor did not return The Gazette’s requests for comment. His press secretary committed twice to get a response for this story but ultimately declined. A legal representative for Ms Osazele did not return a request seeking comments. Mr Osazele could not be reached for comments, and The Gazette heard he was at large.

Mr Lawal’s ordeal began in 2014 when he moved to buy the plane by paying Jet Leasing Support Services Ltd, a firm run by the now-estrange couple that purportedly handled fleet management and aircraft acquisition and services for high-net-worth individuals.

Our sources said that Mr Lawal, elected governor in 2023, concealed the purchase under the couple’s name because he knew his legitimate earnings as a First Bank official were significantly below the multimillion-dollar deal. He paid Jet Leasing a $250,000 broker fee to hold the title of the jet and manage its use for him.

“The governor refused to report the matter because it would raise questions about how he got the money,” a source close to Mr Lawal said.

The arrangement, however, turned sour after Ms Osazele discovered in 2015 that her husband had changed the jet’s ownership to his name. She claimed she made several attempts to recover the jet for Mr Lawal, but a source familiar with the matter said Mr Lawal believed she was in on the same. The couple had a nasty fallout that ended in divorce in 2020.

Ms Osazele fled Nigeria to Canada shortly after the divorce and told authorities there that her ex-husband was trying to kill her because of their disagreement over Mr Lawal’s private jet.

She accused her husband of sending Black Axe cult members to make an attempt on her life, leading her to seek asylum in Canada. However, Canadian asylum officers rejected her application for asylum because it was replete with inconsistent and outright false submissions.

Notwithstanding, a judicial review of her application overturned the decision to deny her asylum and remanded the matter to another asylum officer for a fresh evaluation. This decision, which came in May, would allow Ms Osazele to linger in Canada for a few more years while her case is reprocessed.

Even though Ms Osazele told Canadian authorities the jet was later returned to Mr Lawal, sources close to the governor said it was not returned, and the governor was still trying to get hold of the couple.

“They both disappeared and no one could tell us their whereabouts,” a source close to the governor said. “She lied that she returned the jet.”

Mr Lawal was identified as one of Diezani Allison-Madueke’s top allies, particularly in the former petroleum minister’s multibillion-dollar money-laundering scandal that made headlines in Nigeria, the United States and the UK. He tried to retrieve $40 million from over $153 million forfeited by Ms Allison-Madueke to the Economic and Financial Crimes Commission (EFCC) in 2017.

Mr Lawal’s name was repeatedly mentioned in several charges stacked against Ms Alison-Madueke and was invited on several occasions by the anti-graft commission to clarify his role, or lack thereof, in the alleged fraud.

He denied all allegations of helping Ms Allison-Madueke hide stolen public funds and insisted their relationship was purely “professional.”

According to a statement in 2016, Mr Lawal said all Nigerian banks were eager to establish a rapport with Ms Alison-Madueke, who was petroleum minister between 2010 and 2015, implicitly suggesting that First Bank was no exception among businesses that sought favours from the infamous ex-minister.

Mr Lawal resigned from First Bank to successfully seek elected office in Zamfara’s 2023 governorship election under the Peoples Democratic Party, facing and denying accusations by political opponents that he was a money-launderer.

Source: The Gazette

News

Saudi Arabia donates 100 tonnes of dates to Nigeria as fasting approaches

By Kayode Sanni-Arewa

The Embassy of the Kingdom of Saudi Arabia in Abuja has held an official ceremony to distribute 100 tonnes (100,000kg) of dates to Nigeria as part of its annual humanitarian relief efforts.

The initiative, facilitated by the King Salman Humanitarian Aid and Relief Centre (KSrelief), aims to support vulnerable families across the country and strengthen the deep-rooted ties between the two nations.

During the ceremony, the Ambassador of the Custodian of the Two Holy Mosques to Nigeria, Faisal bin Ibrahim, conveyed the Kingdom’s dedication to humanitarian causes.

He expressed his profound gratitude to King Salman bin Abdulaziz and Crown Prince Mohammed bin Salman for their unwavering support in providing aid to Muslims and underserved communities worldwide.

He emphasised that Saudi Arabia remains steadfast in its commitment to fostering Islamic solidarity and providing relief to those in need.

Mr Al-Ghamdi explained that this year’s distribution includes 50 tonnes of dates for Abuja and another 50 tonnes for Kano, continuing Saudi Arabia’s tradition of assisting Nigeria through humanitarian donations.

He noted that the initiative represents the Kingdom’s broader mission to uplift Muslim communities, alleviate suffering, and promote unity, particularly during significant religious periods such as Ramadan.

The embassy, in collaboration with local authorities and humanitarian organisations, will ensure the proper distribution of the dates so that they reach the most vulnerable families in various regions of Nigeria

Saudi Arabia has been a longstanding partner in providing humanitarian aid to nations across the globe, including Nigeria. The Kingdom’s continued efforts in supporting food security and welfare initiatives exemplify its role as a global leader in charitable and humanitarian endeavours.

Through Vision 2030, Saudi Arabia seeks to expand its contributions to international humanitarian causes, reinforcing its dedication to fostering peace, stability, and prosperity worldwide. The ongoing provision of aid to Nigeria is a testament to these commitments and highlights the decades-long partnership between the two brotherly nations.

News

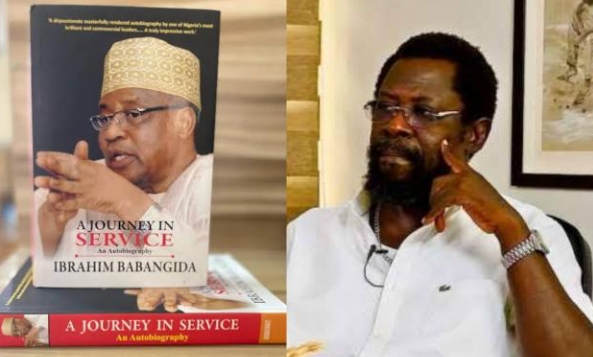

Babangida’s Book is filled with distorted facts, collection of lies, says Dele Farotimi

By Kayode Sanni-Arewa

Dele Farotimi, a human rights lawyer, has launched a heavy attack on former dictator Gen. Ibrahim Babangida (retd.), describing his reign as “ruinous”.

Farotimi, who lived through Babangida’s rule, recounted his experiences as a participant in the fight against the former leader’s “evil actions and inactions

Farotimi’s comments come after Babangida’s recent admission that Chief M.K.O. Abiola won the 1993 presidential election, which Babangida annulled.

The human rights lawyer expressed his disappointment, but not surprise, at the “mixed bag of lies, half-truths, urban legends, and obfuscations” in Babangida’s recent statements.

Farotimi’s criticism is not isolated, as many Nigerians have questioned Babangida’s legacy and the lack of consequences for his actions. The annulment of the 1993 election led to widespread protests and a prolonged struggle for democracy in Nigeria.

In a statement, Farotimi concluded, “No hagiographic allocutus can redeem the Evil Genius of Minna”.

The statement was shared on X while he was reacting to a comment made by Adnan Abdullahi Adam, which stated that “it’s better to read every side of exposition before forming your own judgement”.

With the cover picture of the IBB’s memoir “A Journey In Service” @realadnantweet wrote:

“I think IBB’s memoir: “A Journey in Service” exposes a fresh perspective on everything.

“It’s better to read every side of exposition before forming your own judgement.

“Everyone should try reading the book as jury to the plea of the accused.”

Responding Farotimi wrote: “I lived through his ruinous reign. I wasn’t a passive victim of his evil actions and inactions, I was a participant in the fight to be freed of him.

“I am painfully aware of the extent of his evil capabilities, and I have not been disappointed by the mixed bag of lies, half truths, urban legends, and obfuscations contained in the excerpts already in the public domain. No hagiographic allocutus can redeem the Evil Genius of Minna.”

On Thursday, February 20, 2025, former Nigerian military ruler General Ibrahim Badamasi Babangida (IBB) released his long-anticipated autobiography, “A Journey in Service.”

The memoir has ignited a firestorm of controversy, with critics accusing Babangida of distorting historical events and maligning deceased individuals who cannot defend themselves.

This development has reopened debates about his tenure and its lasting impact on Nigeria’s political and economic landscape.

Babangida’s tenure from 1985 to 1993 was marked by the implementation of the Structural Adjustment Programme (SAP), among others. In “A Journey in Service,” he provides an insider’s perspective on the adoption of SAP, aiming to offer context for the controversial policy that aimed to liberalize Nigeria’s economy.

While intended to address economic challenges, SAP led to widespread protests and debates due to its harsh austerity measures and the social hardships it imposed.

Critics, however, contend that Babangida’s memoir serves as a self-exoneration tool, selectively presenting events to absolve himself of blame.

Human rights lawyer and former Chairman of the Nigerian Human Rights Commission, Prof. Chidi Odinkalu, described the book as a “pack of lies,” accusing Babangida of making allegations against deceased individuals who cannot contest his claims.

Odinkalu further criticized Babangida for portraying himself as a victim of circumstances orchestrated by those who are no longer alive to defend themselves.

The memoir has also rekindled discussions about Babangida’s annulment of the June 12, 1993, presidential election, widely regarded as one of Nigeria’s freest and fairest elections. In the book, Babangida attempts to justify the annulment, a move that plunged the nation into political turmoil and prolonged military rule. Many Nigerians view this action as a significant setback to the country’s democratic progress.

News

Saudi Arabia plans to invest $600bn in new US trade over 4 years

By Kayode Sanni-Arewa

Saudi Arabian Crown Prince Mohammed bin Salman told President Donald Trump that the kingdom wants to put $600 billion into expanded investment and trade with the United States over the next four years, the Saudi State news agency said early on Thursday.

In a phone call between the two leaders, the crown prince said the Trump administration’s expected reforms could create “unprecedented economic prosperity”, the state news agency reported.

The report said Saudi Arabia wants its investments to capitalize on these conditions. It did not detail the source of the $600 billion, whether it would be public or private spending nor how the money would be deployed.

The investment “could increase further if additional opportunities arise”, the agency quoted Bin Salman as telling Trump.

Trump fostered close ties with Gulf states including Saudi Arabia during his first term. The country invested $2 billion in a firm formed by Jared Kushner, Trump’s son-in-law and former aide, after Trump left office.

Trump said following his inauguration on Monday that he would consider making Saudi Arabia his first destination for a foreign visit if Riyadh agreed to buy $500 billion worth of American products, similar to what he did in his first term.

“I did it with Saudi Arabia last time because they agreed to buy $450 billion worth of our product. I said I’ll do it but you have to buy American product, and they agreed to do that,” Trump said, referring to his 2017 visit to the Gulf kingdom.

The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here.

Reporting by Hatem Maher; Editing by Leslie Adler and Cynthia Osterman

-

News22 hours ago

News22 hours agoJust in : Senator Gumau is dead

-

News23 hours ago

News23 hours ago10th NASS Committed to Constitutional Reforms – Kalu

-

Metro15 hours ago

Metro15 hours agoInsecurity! Gunmen invade church, slash pastor’s 2 fingers

-

News23 hours ago

News23 hours agoRep Salam Congratulates Governor Adeleke On Successful Conduct Of LG Elections

-

Metro15 hours ago

Metro15 hours agoFire engulfs MTN office in Oyo

-

News22 hours ago

News22 hours agoPolice seal OSSIEC office, officials nabbed, says chairman

-

News22 hours ago

News22 hours agoI have never insulted President Tinubu in my entire life”-Gov Adeleke

-

Foreign15 hours ago

Foreign15 hours agoPentagon set to sack 5400 staff as attack hits Trump’s downsizing plan