News

State assemblies filled with governors loyalists, minister laments

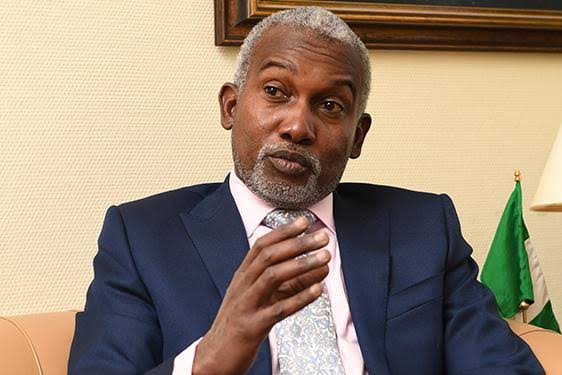

The Minister of Foreign Affairs, Yusuf Tuggar, has expressed concerns about the composition of state Houses of Assembly across the federation.

According to him, the state Houses of Assembly are filled with passive loyalists who neglect their duty of providing checks and balances on the executive arm of government.

Tuggar’s comment comes as many in the country are celebrating the Supreme Court’s judgment granting autonomy to local governments.

Delivering a paper titled “Pathways to Peace, Security and Stability in the Sahel: What Role for Nigeria?” at the Nigeria Intelligence Agency Headquarters in Abuja on Tuesday, Tuggar stated that a system had been put in place to promote loyal local government chairmen to the state House of Assembly, ensuring they wouldn’t challenge the governor’s actions.

He said, “Many states don’t even bother with elections. The governors simply appoint loyalists as LG sole administrators. A system has been perfected through which a loyal LGA Chairman is promoted to the state House of Assembly, where he would not dare challenge the perspective of the governor.

“In reality, state Houses of Assemblies are packed with passive loyalists that fail in their duty of providing checks and balances on the executive arm. They also fail in looking out for the interest of their local government areas.”

Tuggar noted that after the autonomy granted to the LGs, routine elections must be conducted.

He added that this would prevent anyone selected by the governors from controlling the LG funds.

Tuggar said, “The other half is to find a way to establish routine elections at the LGA level, so that LG funds are administered by elected officials- Chairman and Ward Councillors, instead of those handpicked by governors.

“The governor’s party sweeps all the LG elections except in a few symbolic instances, leaving little room for inter-party competition for developmental projects that ultimately benefit the people. Competition makes everyone sit up for fear of underperforming and losing the next election.”

Addressing the lecture’s topic, Tuggar noted that there is often an over-simplification that the Sahel is primarily inhabited by nomadic groups like the Tuaregs, Bororo, and Zaghawa, many of whom are incorrectly assumed to lean towards terrorism and criminal activities.

He said, “There is often an over-simplification that goes thus: the Sahel is sparsely populated by nomadic groups (Tuaregs, Bororo, Zaghawa, etc.) and many of them tend towards terrorism and criminal activities. A certain degree of laziness in information collection processes and the wholesale adoption of western taxonomy and labelling has often led to wrong decision-making.”

He called on NIA to take the lead in adequate information collection processes to solve the challenges of insecurity in the Sahel region

Tuggar said, “Nigeria must therefore, as the hegemon in the region lead the way in providing more accurate and factual analyses and interpretation of events in the Sahel. It is incumbent on the NIA to pave the way through its information collection process.

“This would begin with more accurate taxonomy and labelling of groups. Not every act of crime- kidnapping for ransom, attack on a community, smuggling of weapons must necessarily be ascribed to a stand-alone jihadi or tribal group. Quite often, such acts are driven by economic interests and not ideological or tribal association.

News

Residents express concern over return of Turji, as DHQ officials keep mum

The Defence Headquarters has remained silent following the return of terrorist kingpin, Bello Turji, which has sparked panic among residents of Sokoto State.

In separate operations conducted in January 2025, the military announced the killing of Aminu Kanawa, the second-in-command to Turji, along with 31 other fighters and Turji’s son.

The DHQ also reported that troops inflicted serious injuries on some of Turji’s close allies, including his younger brother.

The military stated that Turji fled during one of the operations, calling him a coward for abandoning his son and fighters during the gun battle.

However, a member of the Sokoto State House of Assembly representing Sabon Birni Local Government, Aminu Boza, told journalists last week that Turji had resurfaced in Sokoto State and imposed a N25m levy on villages.

He also revealed that Turji had set up camp in a forest in the Isa Local Government Area.

“Bello Turji is currently in the Isa and Sabon Birni axis of Sokoto. He has even imposed a N25m levy per village in some communities,” Boza said, adding that Turji had been collecting taxes from the local population.

Turji’s re-emergence has heightened fears among residents who have long suffered from the activities of bandits in Sokoto and neighboring areas.

Efforts to reach the Director of Media Operations, Maj. Gen. Markus Kangye, for comments on what the military is doing to allay residents’ fears proved abortive.

Calls and messages to his line from last Thursday through Sunday had yet to be answered at the time of filing this report.

Meanwhile, Sokoto State Governor, Dr. Ahmed Aliyu, has reiterated his administration’s unwavering commitment to tackling insecurity in the state.

Speaking on Saturday at a security summit organised by the Movement for Social Justice in collaboration with the Sokoto State Government, Aliyu emphasised the need for accountability and transparency in security management.

He acknowledged the widespread security challenges facing Nigeria, which have significantly hindered the country’s economic, political, and social development.

According to him, every region in the country faces distinct security threats, with Sokoto and other North-West states grappling with banditry, kidnapping, and cattle rustling—especially in the eastern part of the state.

Governor Aliyu stated that upon assuming office, his administration swiftly implemented decisive measures to improve security through collaboration with conventional security agencies.

“Before we came into office, several communities were under the control of bandits, who dictated the terms of daily life to residents,” he said.

To address the situation, the governor outlined several proactive steps taken by his administration, which includes, “restoring security allowances previously owed to security personnel and procuring and distributing over 140 Buffalo and Hilux vans to security agencies for enhanced surveillance.”

“Providing motorcycles to the Department of State Services to improve intelligence gathering, sharing, and surveillance as well as upgrading DSS tracking equipment from 2G and 3G to 5G technology.”

Furthermore, Governor Aliyu highlighted the establishment of the Sokoto State Security Guard Corps to complement conventional security forces.

The corps, he said, had been equipped with Hilux vans, 700 motorcycles, and fully operational offices in the 13 local governments most affected by insecurity.

Additionally, the government has facilitated the full operationalisation of the Sokoto State Air Force Base by providing essential facilities, including hangars and other logistical support, to strengthen aerial surveillance and neutralise bandit hideouts.

Governor Aliyu reaffirmed his administration’s commitment to promptly addressing the needs of security agencies, emphasising that these efforts had led to a noticeable reduction in banditry.

He noted that security forces have successfully repelled several attacks, demonstrating the effectiveness of the measures put in place.

“Our administration is fully committed to ensuring the safety of Sokoto State. We are prepared to spend every last kobo in the state’s account to protect our people,” he declared.

Credit: PUNCH

News

We are achieving success as insecurity in the Northwest is diminishing – Defence Minister

Alhaji Muhammed Badaru Abubakar, Nigeria’s Minister of Defense, has reported a considerable improvement in the security situation in the Northwest and north-central regions of the country.

He ascribed this positive development to persistent and coordinated military actions against banditry, particularly in the states of Zamfara, Sokoto, Niger, Katsina, and Kaduna, where security challenges have been notably severe.

Speaking to journalists in Birnin Kudu, the headquarters of Birnin Kudu Local Government Area in Jigawa State, the minister reaffirmed the federal government’s commitment to completely eradicating insurgency before the year ends.

According to him, various stakeholders—including opinion leaders, civil society organizations (CSOs), and local residents—have acknowledged a noticeable reduction in terrorist and bandit activities.

“From the feedback we are receiving, people across the affected areas are confirming that the security situation has improved significantly. However, despite these positive developments, we remain committed to building on these achievements,” he said.

He further emphasized that the government is prioritizing adequate logistical support for the armed forces to ensure they have all necessary resources to maintain and enhance security efforts throughout the year.

News

FLASH BACK: Orderly Shares authentic story of General Murtala’s escape from Dimka’s initial gunfire

…says he would have survived the coup

Had the coup plotters led by Lt. Col. Buka Suka Dimka not noticed the door of General Murtala Muhammed’s Mercedes Benz car opened minutes after it was sprayed with bullets from AK-47 assault rifles, triggering another round of firing, perhaps the late Head of State would have survived the brutal attack.

The lone survivor and Orderly to the late Head of State, Staff Sergeant Michael Otuwu, broke his silence in a highly emotional interview with The AUTHORITY Daily, nearly 40 years after the tragic incident.

According to the Orderly, on their way to work on the morning of Friday, February 13, 1976, the Head of State left his personal house in Ikoyi and was headed to work in Dodan Barracks, the seat of government, which he said was being renovated at the time.

Otuwu disclosed that beside the Head of State was his ADC, Lt. Akintunde Akinterinwa, himself (Otuwu) directly seated in the front passenger’s seat, with Sergeant Adamu Michika behind the wheels.

According to the Orderly, as the unsuspecting car of the Head of State stopped before a row of cars at a junction, he noticed a man in a traditional attire, babanriga (he later identified him as Dimka) who approached the car, removed the flowing robe and pulled out an AK-47 rifle, shooting the driver in the head point blank.

According to the Orderly, having disabled the car by killing the driver, other soldiers clad in robes, ran towards Murtala’s car and opened fire.

“The Head of State, his ADC and I all ducked while the shooting lasted,” narrated the Orderly, sobbing uncontrollably as he recalled the traumatic incident. After the shooting, Otuwu continued, he heard the gunmen running towards the Radio House.

A few minutes later, he continued, he noticed that the injured ADC opened his door, apparently to come to the aid of the equally injured Commander-in-Chief.

According to the Orderly, the opened door alerted the assailants that the occupants of the vehicle were not dead – and this prompted the coup plotters to return a second time to, again, open fire on the car in order to finish them off. He passed out.

According to Otuwu, Generals TY Danjuma and Olusegun Obasanjo were lucky because they were also targets but escaped because they did not leave for their offices as early as Murtala did and they heard the radio announcement which may have fatefully altered their movement plans.

According to Otuwu, who enlisted in the Nigeria Army in 11 September, 1967, he had moved early that morning with the late Head of State from his Ikoyi residence to Dodan Barracks because the overthrown General Yakubu Gowon had not evacuated the official residence and it was not yet renovated.

His words:

“I was his Orderly throughout to his last day during the Dimka coup. I was inside the car with him when he was killed.

“On the morning of that February 13, we were going to the office. Sergeant Adamu Michika was the driver; Sergeant Akintunde Akinterinwa, his ADC, sat behind the driver. As an Orderly, I was in front with the driver.

“While the Head of State sat behind me – I was the one who opens the door for him. That fateful day I came up in the morning to carry him to the office in Dodan Barracks. We got to the former Secretariat, now at Ikoyi, which was under construction.

Before the place they call Alagbon junction, near the labour office. The official car was a Mercedes Benz 600. It is still at the National Museum. There were about four or five vehicles in front of us. You know at that junction there was traffic. We didn’t go with sirens. During his time we didn’t go with escorts with the accompanying out-riders, road-closed signs and all that.

So when we got to the Alagbon junction, the traffic warden stopped the vehicle and we were in the queue. We were the fifth or sixth vehicle behind the forward vehicles that were stopped. That secretariat was under construction.

They put zincs around the compound behind that secretariat. Then some soldiers came in Agbada carrying AK-47 rifles. “They wore uniforms but covered them with Agbada. They had their Kalashnikovs with Agbada cover-up in form of camouflage. We never knew they were even waiting for us. Then one soldier from Golf Road shot and got our driver, Sergeant Michika. Our motor was neutralized.

“Between me and the driver was an arm-rest. On that arm-rest was Oga’s brief case. In this brief case he puts civil dress he could use as needed. When he wants to go to Mosque, he does not like going back to Ikoyi to change.

“Then some other soldiers converged on us. I can’t recall their number. They began to spray us from the back. All of us took cover. I fell on top of the driver; the blood of the driver covered my head. They thought the bullet got my head.

“After the first shooting and without return of fire they must have assumed that we were all dead. The shooting was actually in two phases. They ran to the NBC to announce the assassination. They shared themselves into three.

“There was a group waiting for Obasanjo when he was about to go to the office. Also another group was waiting for TY Danjuma at Bourdillon – our own was at Ikoyi Road. It happened we were the first target that moved early from the house to the office.

“Before Obasanjo and TY Danjuma moved to their offices they have already heard the radio announcement. By the time of the first shooting, we being the target and their running to NBC to go and announce that they have already finished their assignment, the ADC who was still alive, thinking they were gone, opened the door of the Benz.

“In the first spraying of the car, except the driver who was killed, the three of us were injured but not dead. On observing the car door opening, one of the attackers, still within range, a Major, called to the others: “he never die, he never die.” He was calling his group to return.

“This time around when they came back they finished their entire magazines. That was what happened. They carried everybody to the mortuary at Igbosere Hospital, not far from Kam Salem Police Headquarters. Because of the extreme cold of the mortuary, my left hand started shaking and one of the attendants saw it and called the nurses or doctors and said somebody was still alive.

“From there they checked and confirmed I was still breathing. So they had to look for a vehicle to carry me to Dodan Barracks. From Dodan Barracks they looked for an ambulance and carried me to a hospital, Awolowo Road hospital, a military hospital.”

Otuwu, who hails from Kogi State, spent six months in the hospital after his miraculous survival. He has not been recognized by the army or the state.

Presently, he does a few jobs for late General Murtala’s son, in Abuja.

Credit: The Archives.

-

News12 hours ago

News12 hours agoEx-UFC Champion, Adesanya replies critics

-

News12 hours ago

News12 hours agoBabangida’s Book is filled with distorted facts, collection of lies, says Dele Farotimi

-

News18 hours ago

News18 hours agoREVEALED! Gov Fubara Accused of Paying N4.8Bn Monthly to Ikenga Ugochinyere

-

News18 hours ago

News18 hours agoHow CBN Spent $8bn On Naira Defence Against Dollar At FX Market

-

News18 hours ago

News18 hours agoWhy Buhari govt was shoved aside – IBB

-

News20 hours ago

News20 hours agoThai lady arrested at Lagos airport with boxes of illicit drug consignments

-

News12 hours ago

News12 hours agoNDPC Finally Secures NJI’s Support for Data Privacy Right in Nigeria

-

News12 hours ago

News12 hours agoSaudi Arabia donates 100 tonnes of dates to Nigeria as fasting approaches