News

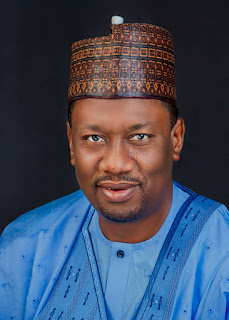

Afam Osigwe emerges NBA president

A Senior Advocate of Nigeria (SAN) and former General Secretary of the Nigerian Bar Association (NBA), Mazi Afam Osigwe, has emerged as the president-elect in the just-concluded 2024 NBA election.

He polled 20,435 votes to beat his closest contender, the Chairman of the NBA-Institute of Continuing Legal Education Governing Council, Tobenna Erojikwe, who scored 10,998 votes.

The online voting began at 12am yesterday and ended at 11.59pm with the live results for all positions also presented online.

As of 12am on Sunday, Osigwe secured 20,395 votes, defeating Erojikwe, who garnered 10,970 votes while former NBA Lagos Branch Chairman, Chukwuka Ikwuazom (SAN), got 9,007 votes.

Osigwe is set to succeed the outgoing President, Yakubu Maikyau (SAN).

The position of the Ist Vice-President went to Mr. Sabastine Anyia who polled 12, 114 votes to defeat his closest rival, Mr. Barthlomew Aguegbodo, who scored 6,864 votes, while four other contestants trailed behind.

For the position of the 2nd Vice-President, Mrs Bolatumi Olasunbo Animashun polled 26, 534 votes to defeat Mr. Pius Idemudia Oiwoh scored 11, 121 votes.

Similarly, Mrs. Zainab Aminu Garba defeated Mr. Michael Olarewaju Olorunmola to emerge as the 3rd Vice-President, having polled 23, 550 votes against Olorunmola’s 13, 897 votes.

The post of General Secretary went to Dr. Mobolaji Idris Ojibara, who scored 25, 713 votes to defeat Mr. Abdulwasiu Alpha, who scored 11, 730 votes.

The new NBA President-elect, Osigwe was born on October 25, 1972.

He graduated from the University of Nigeria Enugu Campus in 1997 and was called to the Bar in 1999. He started legal practice with Chike Chigbue and Co, Abuja Office in 1999 and left in 2002 to found his firm, the LAW FORTE (Legal Practitioners, Corporate Consultants and Notary Public).

In 2006 he became a Notary Public of the Supreme Court of Nigeria.

In 2010, he concluded a face-to-face tutorial at Keble College, Oxford, and obtained a Diploma in International Commercial Arbitration.

Osigwe became a Fellow of the Chartered Institute of Arbitrators (UK) in 2011.

In 2007 he obtained a Master’s of Laws Degree (LL.M) from the University of Jos.

He also holds another LL.M in (Transnational Commercial Practice) from the Centre for International Legal Studies, Austria (in collaboration with the Lazarsky University, Poland).

He has appeared as a counsel in many arbitral proceedings as well as sat as a sole arbitrator or member of arbitral tribunals in commercial disputes. He is an avid reader and researcher.

Osigwe was the last person to hold office as the Chairman of the Nigerian Bar Association, Abuja Branch (Unity Bar) for the whole Federal Capital Territory, Abuja. Bwari and Gwagwalada Branches were created during his tenure as Chairman of the Unity Bar.

By consent of the chairmen of Bwari and Gwagwalada Branches of the NBA, he became the first Chairman of Chairmen of NBA Branches in the FCT, in 2012.

He was sworn in as the General Secretary of the Nigerian Bar Association in August 2014 and held that position till the expiration of his tenure on August 26, 2016.

News

SAD! Former Speaker Dimeji Bankole, loses mother

By Kayode Sanni-Arewa

Alhaja Monsurat Atinuke Amoke Bankole, mother of former House of Representatives Speaker, Rt. Hon. Dimeji Bankole, has passed.

Alhaja Monsurat was a devout Muslim, philanthropist, and committed community leade during her life and times.

She founded Al Mönsur Islamic Society.

She also held prominent Islamic titles, including Iya Adinni of Egbaland and Iya Sunnah of Alasalatu Society of Nigeria and West Africa.

Burial, according to the family, would take place today, Friday, January 10, 2025, in Abeokuta by 4pm.

She is survived by her husband, Chief Suarau Olayiwola Alani Bankole, a Nigerian Egba businessman and chieftain from Ogun State, who holds the Yoruba chieftaincy titles of the Oluwo of Iporo Ake and the Apena of Egbaland,, children, grandchildren, and several blood relations.

News

Photos: Senator Manu lights up Kurmi LGA in Taraba Central, installs 50 solar powered streetlights

Still disturbed over power outage in his district, Senator Manu Haruna of Taraba Central Senatorial District again lights up Kurmi LGA in Taraba Central.

This laudable development is coming barely two weeks after the tireless Senator connected Gunduma Ward to the National Grid that attracted dignitaries from the district during its inauguration ceremony.

Senator Manu install 50 solar powered streetlights in Kurmi LGA, Taraba Central

Manu has continued to demonstrate his dedication to improving the lives of his constituents through infrastructure and development projects.

Senator Manu install 50 solar powered streetlights in Kurmi LGA, Taraba Central

On Thursday, 50 solar streetlights were installed in Kurmi Local Government Area, received by the Executive Chairman of Kurmi LGA, Hon. Moses Maihankali, alongside Senator Haruna Manu’s campaign organization.

The solar streetlights have significantly enhanced the look of Baissa, the headquarters of Kurmi LGA, eliminating darkness in key areas and improving safety and visibility. the project ensures that critical areas within the community benefit from the enhanced lighting.

Senator Manu install 50 solar powered streetlights in Kurmi LGA, Taraba Central

Hon. Moses Maihankali lauded Senator Manu’s commitment, not only to Kurmi but across Taraba Central Senatorial District. He commended the Senator’s dedication to infrastructure, healthcare, and humanitarian services, noting that his actions have earned him political trust, respect, and goodwill within the state.

Recall that, Senator Manu’s earlier efforts to connect Kurmi LGA to the national grid, further reinforcing his commitment to providing reliable power to the Senatorial District.

By installing the solar streetlights, Senator Manu ensures an immediate solution to power issues while contributing to the economic growth of Kurmi.

Senator Manu install 50 solar powered streetlights in Kurmi LGA, Taraba Central

Senator Haruna Manu’s focus on sustainable projects continues to position him as a transformative leader in Taraba State.

His investments in infrastructure and human capital development underscore his resolve to address key challenges facing his constituents, paving the way for long-term progress and prosperity.

News

WATCH Your Family Lawyer Podcast on YouTube tomorrow

The second edition of Your Family Lawyer will hit the airwaves tomorrow (Saturday) precisely by 9.am.

Join Barrister Chinye Chuma, a veteran lawyer marshall out issues laced with court verdicts and how victims can resolve such knotty legal matters.

Watch introductory clip below;

-

News22 hours ago

News22 hours agoUsman to Morka: “Peter Obi’s life now in your hands, nothing must happen to him

-

News17 hours ago

News17 hours agoBudget Defense: Reps Decry Poor Funding for Environment Ministry

-

Politics18 hours ago

Politics18 hours agoMASSIVE WASTE! Rivers LG chairman appoints 130 SAs

-

Economy22 hours ago

Economy22 hours agoSEE Black Market Dollar To Naira Exchange Rate in Lagos and FCT today, 9th January 2025

-

News17 hours ago

News17 hours agoVIDEO; Nigeria’s foreign relations: So far, Tinubu has showcased good salesmanship-Dr Nwambu

-

Metro8 hours ago

Metro8 hours agoInsecurity: security operatives waste notorious bandit leader

-

News7 hours ago

News7 hours agoCourt freezes Nduka Obaigbena’s assets in commercial banks

-

News18 hours ago

News18 hours agoJust in: Sack newly appointed Super Eagles coach now, NANS tell NFF