News

India’s Company, Bajaj Launches First CNG-powered Motorcycle

Bajaj, one of the biggest players in India’s motorcycle market, perhaps the largest motorcycle market in the world has launched a CNG-powered motorcycle considered to be the first in the world.

Bajaj new invention is a new compressed natural gas (CNG) model, the Freedom. This bike looks set to ease one of the biggest pain points for most motorcyclists in India.

Around 100,000 motorcycles are sold in India each month, and of these, around 70% are commuters, meaning the fuel price is extremely important to most riders in India. So much so that a spike in fuel prices in 1997 is attributed to the rise in popularity of 4-stroke motorcycles versus the more popular 2-strokes of the time.

The new bike is coming at a time when fuel prices are volatile. Bajaj has made the bold move to design the world’s first production motorcycle that runs on CNG.

With Freedom, Bajaj claims that riders can reduce their operation costs by 50%. The bike has a starting price of just $1,317, and when running on CNG, the 9.3 horsepower 125cc engine will propel the Freedom to a top speed of 56 mph. It’ll also have a 124-mile range thanks to the 2-kg/12.5-litre CNG tank that sits under the seat.

Some people will have problems with CNG’s availability and the wait times to fill the tank. To combat this, Bajaj has fitted the Freedom with a 2-liter auxiliary gasoline tank so riders can switch on the go. When running on gasoline, the engine has a slightly higher top speed of 58 mph, but its range drops to around 80 miles.

The rest of the bike is relatively basic but comes with a fully digital speedometer with Bluetooth connectivity. Customers can’t really ask for much more from a bike that costs less than $1,350.

CNG-powered motorcycles may find their way to the US and other parts of the world as fuel prices rise along with inflation. A cheap, super-economic commuter is just what people need. However, it is not certain if Freedom has started selling in other parts of the world.

News

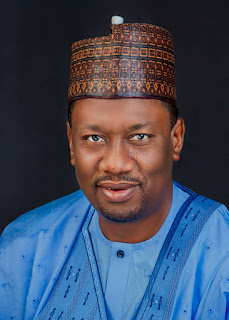

SAD! Former Speaker Dimeji Bankole, loses mother

By Kayode Sanni-Arewa

Alhaja Monsurat Atinuke Amoke Bankole, mother of former House of Representatives Speaker, Rt. Hon. Dimeji Bankole, has passed.

Alhaja Monsurat was a devout Muslim, philanthropist, and committed community leade during her life and times.

She founded Al Mönsur Islamic Society.

She also held prominent Islamic titles, including Iya Adinni of Egbaland and Iya Sunnah of Alasalatu Society of Nigeria and West Africa.

Burial, according to the family, would take place today, Friday, January 10, 2025, in Abeokuta by 4pm.

She is survived by her husband, Chief Suarau Olayiwola Alani Bankole, a Nigerian Egba businessman and chieftain from Ogun State, who holds the Yoruba chieftaincy titles of the Oluwo of Iporo Ake and the Apena of Egbaland,, children, grandchildren, and several blood relations.

News

Photos: Senator Manu lights up Kurmi LGA in Taraba Central, installs 50 solar powered streetlights

Still disturbed over power outage in his district, Senator Manu Haruna of Taraba Central Senatorial District again lights up Kurmi LGA in Taraba Central.

This laudable development is coming barely two weeks after the tireless Senator connected Gunduma Ward to the National Grid that attracted dignitaries from the district during its inauguration ceremony.

Senator Manu install 50 solar powered streetlights in Kurmi LGA, Taraba Central

Manu has continued to demonstrate his dedication to improving the lives of his constituents through infrastructure and development projects.

Senator Manu install 50 solar powered streetlights in Kurmi LGA, Taraba Central

On Thursday, 50 solar streetlights were installed in Kurmi Local Government Area, received by the Executive Chairman of Kurmi LGA, Hon. Moses Maihankali, alongside Senator Haruna Manu’s campaign organization.

The solar streetlights have significantly enhanced the look of Baissa, the headquarters of Kurmi LGA, eliminating darkness in key areas and improving safety and visibility. the project ensures that critical areas within the community benefit from the enhanced lighting.

Senator Manu install 50 solar powered streetlights in Kurmi LGA, Taraba Central

Hon. Moses Maihankali lauded Senator Manu’s commitment, not only to Kurmi but across Taraba Central Senatorial District. He commended the Senator’s dedication to infrastructure, healthcare, and humanitarian services, noting that his actions have earned him political trust, respect, and goodwill within the state.

Recall that, Senator Manu’s earlier efforts to connect Kurmi LGA to the national grid, further reinforcing his commitment to providing reliable power to the Senatorial District.

By installing the solar streetlights, Senator Manu ensures an immediate solution to power issues while contributing to the economic growth of Kurmi.

Senator Manu install 50 solar powered streetlights in Kurmi LGA, Taraba Central

Senator Haruna Manu’s focus on sustainable projects continues to position him as a transformative leader in Taraba State.

His investments in infrastructure and human capital development underscore his resolve to address key challenges facing his constituents, paving the way for long-term progress and prosperity.

News

WATCH Your Family Lawyer Podcast on YouTube tomorrow

The second edition of Your Family Lawyer will hit the airwaves tomorrow (Saturday) precisely by 9.am.

Join Barrister Chinye Chuma, a veteran lawyer marshall out issues laced with court verdicts and how victims can resolve such knotty legal matters.

Watch introductory clip below;

-

News22 hours ago

News22 hours agoUsman to Morka: “Peter Obi’s life now in your hands, nothing must happen to him

-

News17 hours ago

News17 hours agoBudget Defense: Reps Decry Poor Funding for Environment Ministry

-

Politics18 hours ago

Politics18 hours agoMASSIVE WASTE! Rivers LG chairman appoints 130 SAs

-

Economy22 hours ago

Economy22 hours agoSEE Black Market Dollar To Naira Exchange Rate in Lagos and FCT today, 9th January 2025

-

News17 hours ago

News17 hours agoVIDEO; Nigeria’s foreign relations: So far, Tinubu has showcased good salesmanship-Dr Nwambu

-

Metro8 hours ago

Metro8 hours agoInsecurity: security operatives waste notorious bandit leader

-

News7 hours ago

News7 hours agoCourt freezes Nduka Obaigbena’s assets in commercial banks

-

News18 hours ago

News18 hours agoJust in: Sack newly appointed Super Eagles coach now, NANS tell NFF