News

Non- Compliance with Mr President’s Directive in Handover at BPP- Bad Precedence Persists As Transparency Group Kicks

… insists a pool officer from Ministry of Justice can’t manage procurement matters

…as a matter of urgency, AGF, SGF, HoCSF should Wade into this matter

By Kayode Sanni-Arewa

A transparency group, Transparency and Anti-Corruption Campaign in Africa (TRACA), has demanded that President Bola Tinubu must immediately correct an abnormality caused by the immediate past Director General, Bureau of Public Procurement (BPP) – Mamman Ahmadu.

Recall that President Tinubu had on June 14 fired the then DG and ordered that the most senior officer in BPP should immediately take over from him.

In a statement issued and signed by its Executive Director, Steve Orovwuje , the group kicked against a situation where the immediate past DG handed over to a junior officer beneath three (3) directors.

At this critical time of the economy of the Nation, the Public Procurement is germane and is a strategic tool to help generate fiscal savings and sustainable outcomes including promotion of local markets and jobs.

This will allow for impartial and open competition, thereby ensuring fair prices for goods, services and improved quality. Public Procurement can be a very effective way to achieve cost- effective outcomes through economies of scale and improved quality control which the Nation needs urgently to ensure Mr. President achieves his Renewed Hope Agenda expediently and effectively.

In view of the sensitivity of the BPP to achieve these and expectation of a highly professional and knowledgeable leadership we conducted an investigation regarding the recent handover and gathered that the current Ag. Director-General of the BPP is not the most senior officer as it is being claimed. There exist three (3) other Directors on level 17 who apparently are his senior based on steps in their grade level.

“As a transparency group we cannot allow this corrupt move and bad governance by the former DG to stand,” noting that: “Mamman Ahmadu, FNIQS, who handed over power to the Director of Legal Services, a pool officer from the Federal Ministry of Justice, posted to the Bureau barely a year ago.

President Tinubu should please make correction in the BPP as a junior officer cannot direct the affairs of the establishment over three (3) Senior Directors in an office where Due Process is expected to be highly upheld and enshrined.

This decision directly contradicts the circular issued by the Office of the Secretary to the Government of the Federation, referenced SGF/OP/I/S.3/T/39, dated 28th August 2019 as

“Paragraph 2(b) of the aforementioned circular states that “pending the appointment of a substantive Head of Extra-Ministerial Departments, Director General, Chief Executive Officers of parastatals, Agencies, Commissions, and Government-owned companies, outgoing CEO, without any form of discretion, must hand over to the next most senior officer of the establishment as long as the officer does not have any pending disciplinary matter.

We therefore appeal to Mr. President to direct the appropriate agencies and investagive bodies to look into these abnormalities in order to avoid the abuse of the Public Service, unnecessary rancour within the Bureau and to ensure it does not become a bad precedence in the Public Service.

“We know President Tinubu is an apostle of equity and fair play and we fervently hope that this wrong must be adequately corrected.

“The AGF, SGF, HoCSF should note this massive abnormality in BPP and act.

News

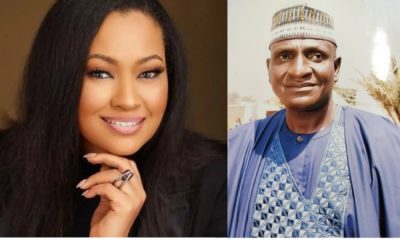

There’s valid evidence of Akpabio sexually harassing me; I’ll release it, Natasha Akpoti-Uduaghan declares

Kogi Senator Natasha Akpoti-Uduaghan has vowed to release evidence of Senator Godswill Akpabio sexually harassing her at the right time.

Mrs Akpoti-Uduaghan disclosed this in an interview with Channels TV on Thursday night when told that Mr Akpabio said she has no evidence to back up her sexual harassment allegation against him.

“At the right time and at the right space, I will present the evidence that I have,” Mrs Akpoti-Uduaghan said.

Aniete Ekong, spokesperson for Mr Akpabio, could not be reached for comment on Mrs Akpoti-Uduaghan’s statement. A WhatsApp message sent to him was not replied to.

Mrs Akpoti-Uduaghan’s statement comes after the Independent National Electoral Commission dismissed the recall petition filed against her on Thursday.

The Kogi Central lawmaker was suspended from the Senate on February 28 after she accused Mr Akpabio of sexual harassment and abuse of office.

The Senate suspended her for six months, withheld her salaries, and withdrew her security detail, citing unruly behavior during plenary.

News

Delta issues 21-day ultimatum to unapproved schools

The Delta State Government has vowed to shut down all unapproved nursery and primary schools across the state.

The measure is being taken “to sanitise the private sector participation in the primary education sector in the state.”

This was contained in a government special announcement signed by the Director of Public Communication/Functioning Permanent Secretary in the State Ministry of Information, Theresa Adiabua Oliko.

Copies were made available to journalists in Warri on Thursday.

The government, however, advised owners of all unapproved primary schools across the state to “upgrade” within the 21-day ultimatum or risk being shut down.

The public announcement partly reads, “It is hereby announced for the information of the public, particularly owners of private nursery and primary schools in Delta State, that the government, pursuance to its responsibility to sanitise the private sector participation in the primary education sector in the state, that all unapproved primary schools in the state are hereby given a 21-day ultimatum to upgrade their infrastructure and formalise their status with the ministry of primary education with immediate effect.

“Failure to comply with this directive will attract severe sanctions, including outright closure of all such schools.

“The 21-day ultimatum has become imperative as a result of the proliferation of unapproved private schools whose poor infrastructural facilities, unqualified teachers and unhealthy operational environment have become worrisome to the state government.”

News

I’m not behind Elisha Abbo’s sacking from Senate – Akpabio

The Senate President, Senator Godswill Akpabio on Thursday, berated former lawmaker representing Adamawa North Senatorial District, Elisha Abbo, saying he has no hand in his removal from the National Assembly.

The clarification was made in a statement issued in Abuja by Akpabio’s media aide, Eseme Eyiboh.

Abbo was sacked by the Court of Appeal sitting in Abuja on October 16, 2023.

The judgment delivered by a three-member panel presided over by Justice C.E. Nwosu-Iheme ordered the Independent National Electoral Commission to issue a Certificate of Return to Amos Yohanna of the Peoples Democratic Party as the duly elected lawmaker representing the area at the Senate.

The appellate court vacated the tribunal judgment which had earlier affirmed Abbo of the All Progressives Congress as the winner of the senatorial election.

But speaking on a live programme on Arise Television on Wednesday, Abbo blamed Akpabio for his predicament.

The Adamawa politician also accused the Senate President of running the Red Chamber like an emperor.

This was even as he condemned the suspension of the senator representing Kogi Central, Natasha Akpoti-Uduaghan, who is presently battling to retain her mandate.

Reacting, Akpabio said he was shocked to hear Abbo blame him again for his ouster from the Senate barely two years after apologising to him.

He said, “It is sad and regrettable that despite publicly retracting a similar allegation in 2023—after admitting that his earlier accusation was premature and based on the available information at our disposal—Mr. Abbo has once again embarked on a campaign of misinformation and blame transfer.

“Following a discussion with the Senate President last year, Mr. Abbo himself acknowledged that Senator Akpabio had ‘no involvement’ in the judicial process that led to his removal. It is puzzling that he would now return to the same baseless allegations he once renounced.”

Continuing, Akpabio emphasised that it was the court and not him that determined his fate before he was consequently removed.

The former governor asserted that he, therefore, found it illogical and irresponsible that Abbo could turn around and allege that he influenced the judgment that he accepted at the time.

“It is there in the papers (see PUNCH Newspaper of 18th October 2023). Mr Abbo has also sought to create the impression that he was unjustly denied official benefits following his ouster. He claims entitlement to salaries, allowances, and even an official vehicle, despite the court’s declaration that his tenure was null and void ab initio.

“If any of Abbo’s claims for payment did not reach the desk of the Senate President, it is because they failed to meet these lawful standards—not because of any personal or political vendetta. It is unfortunate that instead of accepting the consequences of his legal and political failings, Abbo continues to resort to media theatrics and reckless finger-pointing.

“Akpabio remains focused on the noble task of nation-building, providing purposeful leadership in the Senate, and strengthening democratic institutions—especially the independence of the judiciary. He will not be distracted by the antics of individuals who seek to rewrite history to mask personal failures.

“We urge Mr Abbo to reflect deeply, respect the rule of law, and focus on rebuilding the confidence of his constituents if he hopes to return to public life. Nigeria’s democracy can only thrive when its actors show maturity, responsibility, and an abiding respect for the truth,” the statement added.

-

News21 hours ago

News21 hours agoNatasha: Kogi PDP hammers Ododo, reiterates unfeigned support for her

-

Economy20 hours ago

Economy20 hours agoSEE Black Market Dollar To Naira Exchange Rate Today 3rd April 2025

-

News16 hours ago

News16 hours agoJust in: “Ignore rumour mongers, there was no time I collapsed “-Wike asserts

-

News16 hours ago

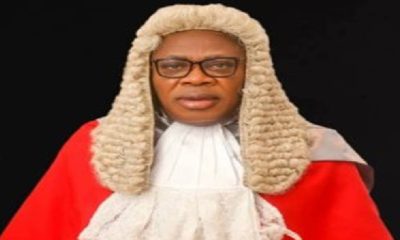

News16 hours agoCJ transfers Natasha’s case to Justice Nyako

-

News19 hours ago

News19 hours agoJust in: INEC dumps recall petition against Sen Natasha

-

News5 hours ago

News5 hours agoHow I Got Helicopter Idea To Visit Kogi State – Senator Natasha

-

News5 hours ago

News5 hours agoRivers CJ directs High Court judges to proceed on break

-

News13 hours ago

News13 hours agoWe’re putting together new 2025 Budget for Rivers-Ibas