News

Reps Repeal, Enact 2024 Appropriation Act

News

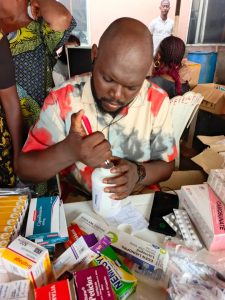

OBIO/AKPOR FEDERAL CONSTITUENCY FREE MEDICAL OUTREACH(PHOTOS)

The month of March was a busy one at the Obio/Akpor Federal Constituency with numerous Programmes and Trainings approved and sponsored by Rep. O. K. Chinda.

The month of April is already showing signs of being busier as we have commenced a Free 3-day Medical Outreach.

Today, which is day 1, featured Health Talks and Sensitization, with some participants going home with 10kg of rice after being attended to.

The programme continues tomorrow and will include the following: –

• Vital signs checking.

• Seeing of Doctor/optometrist.

• Laboratory/ diagnosis

• Pharmacy.

The medical outreach is anchored by Dailystar Pharmacy Nigeria Limited

“I WIN, U WIN”

From

The Media Team

Obio/Akpor Federal Constituency Office

News

Security Personnel Shoots Himself Trying To Nab Suspect In Abuja

By Kayode Sanni-Arewa

There was tension on Wednesday As vigilante operating at Dei-Dei community in Bwari Area Council of the Federal Capital Territory (FCT), Mujahid Ibrahim (32), has reportedly shot himself while trailing a suspect in the area. Abuja Metro learnt that the bullets from his rifle injured him around his feet, with at least seven cartridges extracted from his body

He was said to be awaiting x-ray results for the possibility of more cartridges in his body.

The incident took place around 12 am in the early hours of Wednesday when the victim and his colleague intercepted a resident in the neighbourhood, they were guarding for working at late hours.

Speaking yesterday at the Kubwa General Hospital, where he was rushed to, Ibrahim said the suspect came around 12 am against the 11 pm, which was agreed upon by the members of the community.

“My colleague, who attended to him, tried in vain to make him understand the rule, but instead for him to cooperate, he resorted to violence and in an effort to scare him, I cooked my rifle pointing toward the sky. I later withdrew the rifle back to my shoulder, but forgot to pull it back and in the process of running toward him as the man was having a scuffle with my colleague, the gun fired out some bullets that hit me around my feet,’’ he said

Also speaking, his colleague, who accompanied him to the hospital, Ben Isaac, said following the incident, the resident in question disappeared but his elder brother has taken all the responsibilities including the treatment charges.

He added that a 24- hour warning was issued to him to appear or get arrested.

News

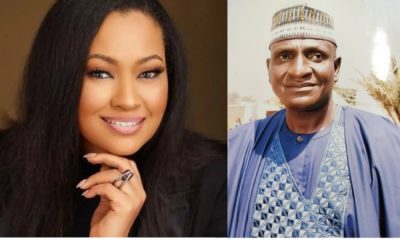

Just in: INEC dumps recall petition against Sen Natasha

The Independent National Electoral Commission,( INEC) has rejected the petition to recall the Senator representing Kogi Central, Natasha Akpoti-Uduaghan, inadequate.

The electoral umpire via its 𝕏 handle on Thursday, April 3, 2025, made this known in a terse statement where it disclosed that the group, who initiated the process did not meet the requirements of the constitution.

INEC in a tweet on its ‘X’ handle said; “The petition for the recall of the Senator representing the Kogi Central Senatorial District has not met the requirement of Section 69(a) of the Constitution of the Federal Republic of Nigeria 1999 (as amended)”.

-

News11 hours ago

News11 hours agoRivers APC demands Fubara’s probe over ex-HoS allegations

-

Economy3 hours ago

Economy3 hours agoSEE Black Market Dollar To Naira Exchange Rate Today 3rd April 2025

-

News24 hours ago

News24 hours agoS/African Court Acquits Nigerian Pastor Of Rape, 31 Other Charges

-

News4 hours ago

News4 hours agoNatasha: Kogi PDP hammers Ododo, reiterates unfeigned support for her

-

Economy12 hours ago

Economy12 hours agoNaira rebounces against the dollar in parallel market

-

News2 hours ago

News2 hours agoJust in: INEC dumps recall petition against Sen Natasha

-

News11 hours ago

News11 hours agoAir Algerie Inaugural Flight to Abuja Will Strengthen Nigeria-Algeria Ties – FG

-

News7 hours ago

News7 hours agoJust in: Finally, Trump imposes 14% tarriff on Nigeria oil, others