News

Money supply hits all time high at 56% to N101trn in June

By Kayode Sanni-Arewa

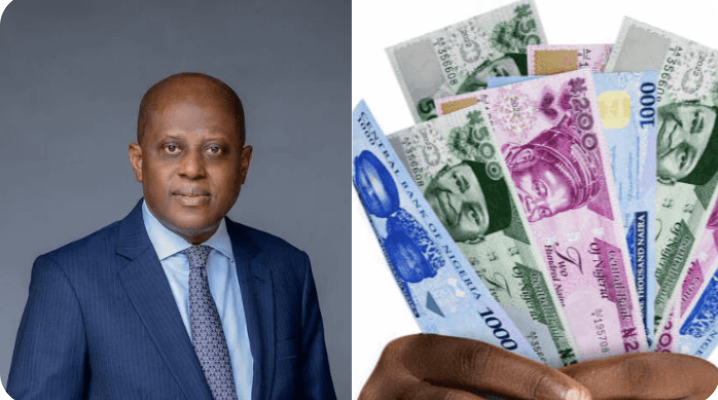

Money supply (M3), which is a broad measure of the total amount of money in an economy, has surpassed N100 trillion, reaching an all-time high for the country.

Data from the Central Bank of Nigeria (CBN) shows that M3 rose to a record N101.34 trillion in June 2024, represents a 56.15 percent increase to N64.90 trillion recorded in the corresponding period of June 2023.

When the money supply increases, it can lead to higher inflation. As more money chases the same amount of goods and services, prices tend to rise. This means that households might face higher living costs for everyday items, reducing their purchasing power, said a Lagos-based economist.

On a month-on-month basis, money supply increased by 2.11 percent from N99.23 trillion in May 2024. M3 is used by economists to estimate the total amount of money available in an economy, which can influence inflation, interest rates, and overall economic activity.

This is despite the monetary tightening of the CBN. The CBN has issued over N1.5 trillion in Open Market Operation (OMO) bills since Olayemi Cardoso took the helm as governor in a bid to stem inflation and prop up the naira, whose steep decline has unsettled the economy.

“The increased money supply is as a result of the expanded government revenue on the back of the persistent naira depreciation and improved performance of the oil sector,” said Ayokunle Olubunmi, head of financial institutions ratings at Agusto Consulting.

The Senate and the House of Representatives on Wednesday doubled government’s borrowing limit from the CBN, known as Ways and means, from five percent threshold to 10 percent amid excess liquidity concerns. Ways and Means is provided by the CBN to finance the Federal Government’s budget shortfalls. This facility allows the government to borrow from the CBN to secure short-term or emergency funding for critical projects.

The CBN’s data revealed that currency in circulation (CIC) rose to an all-time high of N4.05 trillion in June 2024. It jumped by 55.77 percent year-on-year from N2.60 trillion in June 2023. Money in circulation increased by 2.27 percent from N3.96 trillion in May 2024.

“While the increase in CIC may suggest improved economic activity in nominal terms and higher consumer spending, it also highlights the risk of inflation, particularly if money supply growth exceeds real output growth,” analysts at FBNQuest said.

According to a report by FBNQuest indicates continued expansion in liquidity despite the Monetary Policy Committee’s (MPC) hawkish measures to tighten liquidity and control inflation.

Latest data from the Nigerian Bureau of Statistics (NBS) shows an inflation rate of 34.2 percent in June 2024, up from 22.8 percent in June 2023.

According to the data, net credit to the government declined by 10.18 percent to N28.05 trillion in June 2024 from N31.23 trillion in June 2023. On a month on month basis, it dropped by 0.32 percent from N28.37 trillion recorded in May 2024.

Credit to the private sector decreased to N73.12 trillion in one month (June 2024), representing 1.60 percent over N74.31 trillion in May 2024. Against the corresponding period, it rose by 38.46 percent from N52.81 trillion in June 2023

News

Enugu Reps PDP Caucus Welcomes LP Members To Its Fold

Members of the Enugu State Caucus of Peoples Democratic Party, ( PDP) in the House of Representatives, Rt. Hon. Nnolim Nnaji , Rt. Hon. Martins Oke and Hon Anayo Onwuegbu have welcomed Rt. Hon. Dennis Agbo and Hon. Chidi Mark Obeta of Labour Party, (LP) to the PDP fold.

They observed that the visionary leadership of Dr Peter Ndubuisi Mba in Enugu State has ignited massive decamps and unprecedented upsurge of membership of the Peoples Democratic Party, (PDP) in the state.

The caucus in a statement issued after the two members of the House of Representatives, Rt. Hon Dennis Agbo of Igboeze North/ Udenu and Chidi Mark Obeta who represents Nsukka/Igboeze South formally announced their transfer of membership to PDP at the resumption of House plenary on Tuesday said it was gladdening to receive them into the PDP fold.

They stressed that PDP in Enugu State was witnessing a great rebirth as a result of the transformative development agenda being unleashed in various sectors of the economy of the state by Governor Mba which has received global commendations.

The Enugu State caucus Leader, Rt. Hon. Nnolim Nnaji on behalf of the members further noted that Governor Mba’s investments in infrastructure, agro economy, and security among others have made Enugu State a tourist’s haven adding that with the good governance structure he has put in place, his second tenure would be a walkover.

News

2025 budget: Tinubu Seeks NASS Approval For N1.784trn FCT Statutory Budget

News

Finally , DTHA becomes one party assembly as Speaker, 21 other PDP members defect to APC

Speaker of the Delta State House of Assembly, Rt. Hon. Emomotimi Guwor, along with twenty-one other former members of the Peoples Democratic Party (PDP), elected into the Assembly has officially defected to the All Progressives Congress (APC), following a major realignment of political stakeholders across the state.

The defection of the twenty-two lawmakers has effectively transformed the Delta State House of Assembly into a one-party legislature, as the remaining seven members were originally elected on the ticket of the APC.

Announcing the development on Tuesday during the resumption of plenary after the Easter break, the Speaker stated that the decision was the result of extensive consultations with their constituents and political leaders throughout the state.

He emphasized that the move aligned with Section 109 of the 1999 Constitution, as amended.

While expressing appreciation to members for their contributions so far, Guwor urged the House to ensure the completion of all pending bills as the second legislative session nears its end.

He noted that the political shift towards the APC was in response to the realignment of stakeholders and the desire to align with the Federal Government under President Bola Tinubu’s leadership.

“The mass defection of members of the Peoples Democratic Party, led by Governor Sheriff Oborevwori, to the All Progressives Congress was made in the overall interest of Deltans and the state,” the Speaker said.

He explained that the decision followed extensive consultations held on April 23 and which cumulated on the official reception on April 28, 2025, at the Government House and the Cenotaph, respectively.

He said: “We are fully committed to partnering with the Federal Government to deliver greater development to Deltans.

“On behalf of the House, I commend the courage and visionary leadership of our Governor, Rt. Hon. Sheriff Oborevwori, in making this strategic and timely decision.

“As a legislative body, we stand with His Excellency in this endeavour. This renewed partnership between the state and Federal Government must be supported and allowed to flourish, so that we can begin to enjoy its benefits in the shortest possible time.”

He informed the House that he had received twenty-two letters (including his own) notifying of the change of party affiliation from the PDP to the APC.

The defection, he said, was driven by instability within the PDP’s national leadership and factional divisions within the South-South Zonal Executive Committee, leading to internal conflicts and disunity within the party.

Citing Section 109(1)(g) of the Constitution of the Federal Republic of Nigeria, 1999 (as amended), the Speaker affirmed the constitutional basis for the defection.

“With this action, the Delta State House of Assembly is now composed entirely of members from the All Progressives Congress. We thank our constituents for endorsing this progressive course of action”.

A motion to adopt the letters of party change was moved by the Majority Leader, Hon. Emeka Nwaobi, and seconded by Hon. Ferguson Onwo, who represents Isoko South II.

Speaking to journalists after the plenary, the Majority Leader, Hon Emeka Nwaobi reiterated that the defection was prompted by the crisis within the PDP.

“Our decision was based on the instability at the national level and the factionalization at the South-South level. Consequently, we chose to move to the ruling All Progressives Congress, in accordance with Section 109 of the 1999 Constitution, as amended,” he said.

-

Opinion12 hours ago

Opinion12 hours agoRIVERS, WIKE, FUBARA, AND THE WAY FORWARD

-

Politics11 hours ago

Politics11 hours agoJust in: Delta PDP Reps members defect to APC

-

News22 hours ago

News22 hours agoFULL STEPS: How to check 2025 JAMB results

-

News22 hours ago

News22 hours agoMinistry denies awarding N13bn contracts without due process

-

News16 hours ago

News16 hours agoVDM may be released on Tuesday

-

News13 hours ago

News13 hours agoNANS Barricades Lagos-Ibadan Expressway Over Alleged NELFUND Mismanagement

-

News13 hours ago

News13 hours agoCourt bans Nnamdi Kanu’s in-law from 3 proceedings over live streaming

-

News9 hours ago

News9 hours agoTension As Lawmakers Warns of Public Revolt Over Insecurity