Opinion

Before load shedding by telecoms operators begins

By Sonny Aragba-Akpore

Nigerians are commonly used to electricity power load shedding which strategically reduces or cuts off electricity supply to different consumers or areas in a controlled manner. “This process helps balance demand with available resources.”

It is often planned and negotiated with local building owners. Utility providers monitor electricity demand and identify when it exceeds supply or nears capacity limits. They then create a load shedding plan that entails rotating power outages, temporary current disconnections and incentives to building owners for complying. Once demand decreases or additional power resources become available, the utility provider restores power to the affected areas.

Load shedding can also happen without prior planning. Power customers might experience involuntary load shedding when a utility electrical provider lowers or stops electricity distribution across a coverage area for a short period of time.

This type of load shedding is commonly referred to as a rolling blackout. Brownouts, another type of involuntary load shedding, are caused by a power supplier lowering voltage distribution during peak usage times to balance supply and demand.

Load shedding is about survival when telecom operators might start turning off some of their cell sites during less busy times to save on energy and costs.

This could help them minimize resources better and keep services running, even when it’s not a perfect solution. If telecom operators implement load-shedding, the quality of service could decline sharply. Load-shedding would likely result in reduced network coverage, slower internet speeds, and an increase in dropped calls according to an analyst.

According to the Nigerian Communications Commission (NCC), Nigeria had over 164 million million active internet subscriptions as of March 2024,with mobile data accounting for the majority. A reduction in service quality could severely impact these users, leading to widespread frustration,this analyst added.

An alalyst describes load shedding as a deliberate shutdown of telecom services in a part or parts, generally to prevent the failure of the entire system when the demand strains the capacity of available infrastructure.

Plagued by incessant rising cost of operations, including the increased prices of diesel, infrastructure maintenance, and a depreciating naira, “have called on the NCC to approve a tariff increase to help mitigate their financial burdens.”

MTN, for instance,with a subscriber base of 81.7million as of March 2024,reported a first loss after tax of N137 billion since its 2019 listing on the Nigerian Stock Exchange in 2023. The telco incurred FX losses of N740 billion ($815.79 million at N907.1/$).

> “Airtel Africa, which had 63.3 million subscribers in Nigeria as of March 2024, reported a loss after tax of $89 million for its full year ended March 2024, primarily due to FX headwinds in Nigeria and Malawi. It lost $1.26 billion to derivative and FX exposures, with $770 million attributed to the naira’s devaluation.”

This has led to dwindled investment in the telecoms sector, Carl Cruz, chief executive officer of Airtel Nigeria, stated, adding that, “The devaluation of the Naira moving from N420/dollar to N760/dollar in a month’s time, to about N1500/dollar today, had indeed affected telecoms industry who rely heavily on importation of infrastructure to grow the sector.’

In the same vein, Karl Toriola, CEO, MTN Nigeria, said operators are reluctant to invest, simply because of the high operating cost and the devaluation of naira, among other issues that have marred the growth of the sector.

According to him, the telecoms sector in Nigeria is now in an intensive care unit (ICU) gasping for breath, while calling on the government to intervene.

The sector is facing a lot of challenges of which if urgent action is not taken, it will dry up. The truth is that investors are not going to come to invest in the sector if the fundamental issues are not addressed. To rescue the sector from collapsing, there is a need to increase prices of telecom services.”

Despite repeated pleas, the regulatory body has remained silent on the issue, causing frustration and uncertainty among industry players.

ALTON had earlier sent a working paper (memo) to the telecom regulator (NCC) saying that “the telecommunications industry has been significantly impacted by a myriad of macroeconomic challenges experienced in recent years due to the resulting exponential increase in broad business costs.”

“Of particular importance are:

*the upward trajectory in the inflation rate from 11.98% in 2019 to 21.34% in 2022 and currently 27.33% as at October 2023;

•rapid devaluation of the Naira evidenced by the recent upward movement at a rate of 68.5% from N461/$1 in December 2022 to N777/US$ as at the end of September 2023;and now over 1,590/a dollar.

•Sustained rise in energy prices with diesel currently retailing at an average price of N1,400/litre from N250/litre in January 2022.

With energy costs representing >40% of Mobile Network Operators’ operating expenses, tighter external financing conditions, higher debt service payments, and increased pressure on the Nigerian FOREX market, there has been a significant increase in the cost of production which has jeopardized MNOs’ capacity to maintain healthy margins in such a capital-intensive and FOREX- dependent industry as ours.

Despite these adverse economic headwinds, the telecommunications industry remains the only industry that has yet to effect any general tariff increase for its services in the last five years due to regulatory and political restrictions limiting the MNOs’ ability to react to the increased cost of doing business with our applications for these general increases still pending with the Commission one year after submission. The same cannot be said for our counterparts in other critical industries who have adjusted the retail prices of their goods and services with the support of their industry regulators to be reflective of their true business costs of production as a means of cushioning the net effect of the sky rocketing costs of doing business. We have attached, for the EVC’s consideration, a detailed overview of examples of such price increases in other sectors.

The operators also lament regulatory overlaps where unbudgetted expenditures are spent to defray unexpected expenses.

In their own position,ALTON also advocates for the co-creation of policies for the ICT sector,

better collaboration between ICT and non-ICT regulators with oversight over the sector (environment and consumer and corporate

governance) given the cross-cutting nature of digital services, which span multiple subject areas and regulatory frameworks.

“The Federal Government should also give the telecoms sector a special status like

> Agriculture and Manufacturing and introduce fiscal incentives for the sector, for example, the reduction of spectrum and numbering fees,replicate Road Infrastructure Tax Credit scheme for digital infrastructure projects.”

“ There is also a need to encourage market consolidation/collaboration arrangements to build stronger market players in the industry.”

“Implementation of the Open Data policy to make data accessible such that companies can collaborate with third-party developers, startups,

>> and other industries to develop applications, analytics tools, and

>> personalized services which will unlock new data-driven revenue

>> streams not only for telecoms but also for other industries such as banking, agriculture, manufacturing, “

“ We also require capable regulatory agencies overseeing and regulating these innovations. As such, the staff of relevant agencies will need to upskill and broaden their knowledge base while revising their frameworks to enhance technical and analytical capabilities.”

> ALTON laments that amid the formidable challenges facing the industry, “MNOs have also had to contend with a protracted history of non-payment by Deposit Money Banks (DMBs) and other Financial Institutions (FIs) for their utilization of Unstructured Supplementary Service Data (USSD) services provided by MNOs from September 2019 till date.”

> “Regardless of the numerous ministerial and joint regulator-led interventions on this issue, commencing with the intervention of the immediate past Honorable Minister of Communications and Digital Economy (HMoCDE) in 2021, the consequent approval for disconnection of the banks issued by the Commission further to the HMoCDE’s directive in 2022, and the recent joint resolutions issued by the Commission and the CBN in August 2023 on the terms for defraying the debts owed, the DMBs and FIs have brazenly and persistently refused to meet their obligations to the MNOs through the malicious non-payment or, in many instances, the payment of a minuscule portion of their monthly invoices which has led to the accumulation of a massive debt of ⁓N200 Billion.”

> As a former Executive Director, Technical Services at the Nigeria Inter-Bank Settlement System PLC (NIBSS), “we believe the EVC appreciates the facilitative role of telecommunications in the provision of financial services to Nigerians and how the USSD service has transformed digital banking and advanced financial inclusion in Nigeria, thereby, positively impacting the balance sheet of the DMBs and FIs.”

> “We maintain that it is beyond the pale for the banking industry to hold the telecommunications industry to ransom by its impenitent freeloading activities.

We, therefore, respectfully urge the EVC to take decisive action to put an end to this deplorable practice moreso as the provision of such USSD services to DMBs and FIs come at considerable cost to MNOs. “

> USSD services require substantial investment in enabling platforms such as Applications Programming Interface (APIs) and USSD Gateways for service delivery, cost of establishing signaling channels (a limited and critical network resource essential for the hitch-free service delivery) and the opportunity cost of utilizing these signaling channels and network services for USSD services instead of other prepaid network services such as Call/SMS set-up and delivery which cannot run in parallel with a USSD session.

Opinion

5G,IoT and AI to boost global GDP by 2030

By Sonny Aragba-Akpore

With Mobile technologies and services now generating around 5.8% of global Gross Domestic Product (GDP) a contribution that amounts to about $6.5 trillion of economic value, there are strong projections that by 2030, this figure will rise to almost $11 trillion, or 8.4% of GDP.

Global System of Mobile Communications Association (GSMA) says much of this will be driven by countries around the world increasingly benefiting from the improvements in productivity and efficiency brought about by the increased take-up of mobile services and digital technologies, including 5G, Internet of Things (IoT) and Artificial Intelligence (AI).

The GSMA recently introduced the 5G Connectivity Index to provide insights into 5G performance in 39 markets in order to encourage informed decision-making.

In terms of Economic Impact,

the GSMA emphasizes the economic benefits of mobile technologies and services, including 5G, projecting that they will contribute significantly to GDP growth by 2030.

“The GSMA provides specific reports and analyses on 5G in different regions, such as Sub-Saharan Africa, Asia ,Middle East among others highlighting the progress and challenges of 5G deployment in specific areas.”

In Sub Saharan Africa for instance with particular attention on Nigeria,South Africa,Egypt,Kenya and Botswana among others some measure of progress in deployment has been recorded.

The rollout of 5G has brought immense benefits across multiple industry sectors, particularly those involving internet of things (IoT) and artificial intelligence (AI) applications in which the real-time transfer of data is crucial.

More broadly, the adoption of 5G is expected to accompany increased data use across the globe, with forecasts anticipating mobile data traffic of over 300 exabytes per month by 2030, more than twice the volume consumed in 2024 according to Statista.

And with a third of global population expected to be covered by this fifth generation (5G) networks ,a technology that has defined new ways of communication by 2025 ,GSMA

says the technology has surpassed growth projections of all times.

“5G subscriptions increased by 163 million during the third quarter 2024 to total 2.1 billion. 5G subscriptions reached close to 2.3 billion by the end of 2024 accounting for more than 25 percent of all global mobile subscriptions.

“4G subscriptions continue to decline as subscribers migrate to 5G” according to GSMA.

As of the first quarter of 2024, there were nearly two billion 5G connections worldwide, with 185 million new additions. This is expected to grow to 7.7 billion by 2028.”

Statistics show that 5G is the fastest-growing mobile broadband technology, reaching 1.5 billion connections by the end of 2023.

It only took four years to reach this number, compared to 10 years for 3G and more than five years for 4G.

“5G is more than a new generation of technologies; it denotes a new era in which connectivity will become increasingly fluid and flexible.5G Networks will adapt to applications and performance will be tailored precisely to the needs of the user” GSMA submits.

By covering one-third of the world’s population , impact on the mobile industry and its customers will be profound according to GSMA.

To deepen the spread of 5G ,GSMA is working closely with the mobile operators pioneering 5G, “by engaging with governments, vertical industries including automotive, financial services, healthcare providers, transport operators, utilities and other industry sectors to develop business cases for 5G.”

And In order to accelerate the growth and spread, many operators are said to be deploying

AI technology as part of an integral part of telecoms operators’ strategic and operational plans.

“Operators are making important advancements in the deployment of AI technology, which is serving as a transformative force shaping the telecoms industry. By deploying autonomous AI-based systems, operators can enhance operational efficiency, customer satisfaction and security, while also creating new revenue opportunities”.

China, South Korea, the United Kingdom, Germany, and the United States are the leading countries with robust 5G coverage in the world.

Since the first commercial launches of the fifth generation of mobile networks in late 2018, these five countries have emerged as leaders because multiple companies in these countries have deployed networks and are selling compatible devices. Countries including Switzerland and Finland are up and comers in 5G development, though they have limited deployment.

In China there are three Companies leading in deployment.

The world’s largest 5G network was launched by the three largest Chinese network operators Oct 31, 2019, according to the state-run news agency Xinhua. These are China Mobile, China Unicom, and China Telecom which all activated their networks in less than five months after they were issued 5G licenses.

Each of the network operators offered their 5G services at $18 per month in 50 Chinese cities at the beginning of the launch.

GSMA expects 36% of China’s mobile users to be using 5G by 2025. That’s about 600 million subscribers, who would also make up 40% of the entire global 5G market by this year.

This is all despite efforts made by the United States government to hamper the progress of Chinese vendors, though those efforts may affect how Chinese companies may expand into the global market.

In South Korea,SK Telecom and Korea Telecom run as the main competitors for the South Korean 5G market.

SK Telecom acquired spectrum in the 3.5 GHz and 28 GHz frequencies to prepare for deploying 5G.

In April of 2019, the Enterprise claimed to be the first mobile carrier in the world to launch 5G services to work on 5G smartphones. SK Telecom asserted an edge over rival Verizon, as the former launched 5G services available at the same time as Samsung Galaxy S10 5G smartphone launched in South Korea. Verizon launched mobile 5G services in the U.S. before a 5G enabled smartphone was available to U.S. consumers.

SK Telecom also conducted tests with a 5G Standalone (SA) Core (a core not reliant on the 4G network) for their 5G network in cooperation with Samsung Electronics.

The world’s largest 5G network was launched by the three largest Chinese network operators Oct 31, 2019, according to the state-run news agency Xinhua. These are China Mobile, China Unicom, and China Telecom which all activated their networks in less than five months after they were issued 5G licenses. Each of the network operators offered their 5G services at $18 per month in 50 Chinese cities at the beginning of the launch.

“What we are seeing is a concerted effort by the Chinese — the operators, vendors, and government regulators — to deploy 5G as quickly as possible,” Chris Nicoll, principal analyst at ACG Research, pointed this out in a November 1, 2019 SDxCentral article.

With all of these players working together, the three network operators had collectively deployed nearly 86,000 5G base stations peaked over 130,000 by the end of 2019. The latter number breaks down into China Unicom and China telecom, with each planning to install 40,000 base stations, and the market leader China Mobile to install 50,000.This was the projection by 2019 but they have since overshot this by the beginning of 2024.

The International Telecommunication Union (ITU), says 5G coverage reached 40% of the world’s population in 2023 with an uneven coverage and distribution with developed countries having more coverage than low-income countries:

In Europe ,68% of the population is covered and

Americas had 59% of the population covered while

Asia-Pacific has 42% of the population covered as at 2023.

Arab States have 12% of the population covered.

Commonwealth Independent of States (CIS) had 8% of the population covered.

ITU figures show Africa,s coverage rose to 10 % of the population by 2023 .

The ITU also notes that 90% of the world’s population is covered by 4G, but 55% of people without access to 4G live in low-income countries because In low-income countries, 3G is often the only technology available to connect to the Internet.

The ITU develops and adopts international regulations and global standards to enable the harmonization and implementation of broadband mobile networks.

In Africa, around a dozen nations have launched services including Botswana, Kenya, Mauritius, Madagascar, Nigeria, Seychelles, South Africa, Tanzania, Togo, Zimbabwe, and Zambia but Africa is a patchwork of 54 countries.

And penetration is predicted to be slow.

By 2027, Ericsson predicts that 80 percent of phone users in Europe will have 5G service.

At the same time, 5G subscriptions in Africa, home to 1.4 billion people, May stagnate at a little over 10 percent. Why will so few people in Africa get access to 5G services?

China, South Korea, the United Kingdom, Germany, and the United States remain the leading countries with robust 5G coverage in the world.

While many countries are already providing robust services,Africa remains on the outskirts of 5G services.

The countries in Africa that have launched 5G networks, include South Africa with its roll out

In March 2022, when the Independent Communications Authority of South Africa (ICASA) sold spectrum across several bands.

In Nigeria,MTN rolled out commercial 5G services in Lagos in 2022, with other roll out in Abuja, Port Harcourt, Ibadan, Kano, Owerri, and Maiduguri among others.

MTN Congo announced that it was the first country in Central Africa to deploy 5G.

In Botswana Orange deployed 5G technology to provide new services in the Gaborone and Francistown regions.

Other countries in Africa that have launched 5G Fixed Wireless Access (FWA) services include: Angola, Kenya, Zambia, and Zimbabwe.

Analysts say “5G’s potential is growing due to its ability to deliver fiber-like speeds. However, there are still challenges in the region, such as:

Urban areas are reaching their maximum capacity whereas a large portion of the population lives in rural areas.

This explains why 5G adoption in the sub-Saharan region is currently below six percent “

Analysts report that 5G deployment in Africa faces many challenges, including Spectrum assignment,regulatory issues,infrastructure,security,financial resources among others.

“Spectrum is a limited resource that is already in use by other services, such as TV broadcasters and satellite operators. Governments need to open up frequencies and grant 5G licenses at reasonable prices. “

Infrastructure is another major challenge.

“5G networks require a large initial investment, including expensive devices, antennas, and Radio Access Network (RAN) hardware. The infrastructure needs to be fiberized to support 5G services.

Regulatory conditions also serve as challenges to deployment.

For instance “regulatory authorities may not have started the process for licensing and granting frequencies in the right portion “

“Most of the equipment and devices required for 5G deployment need to be imported.”

There are also security challenges that make

5G technology vulnerable to cyber security threats, such as tracking calls and exposing user locations.

Opinion

Right of Reply: THE PUNCH AND BUSYBODY BUSINESS

The recent declaration of a State of Emergency in Rivers State has triggered diverse commentaries from a wide range of Nigerians.

Almost everyone hailed the presidential proclamation because of the visible threat to law and order in the state at the time the action was taken. Of course, there were a few naysayers who read political meanings into an otherwise sincere and prompt intervention.

One such negative interpretation is the position taken by the Editorial Board of The Punch newspaper. In one of its editorials published on the matter, the national daily claimed that the entire crisis was caused by what it described as “the needless meddlesomeness in the governance of the state by its former governor and Tinubu’s Federal Capital Territory Minister, Nyesom Wike….” It is unfortunate that this narrative and others like it have become commonplace in the media space.

How did the Editorial Board of a reputable newspaper arrive at such a conclusion? Their claim that the Sole Administrator, Admiral Ibok Ete Ibas (rtd), has been acting a script purportedly written by the Minister of the Federal Capital Territory, Nyesom Wike, is also faulty and has no iota of truth.

They also faulted the sacking of all political appointees who served in Governor Siminalayi Fubara’s administration, insinuating that their replacements were drawn from Wike’s political camp. Again, nothing can be further from the truth.

Since his appointment as the Sole Administrator of Rivers State, Admiral Ibok Ete Ibas has been running the state with the abundant human resources available in the state and has not imported anybody from outside the state. Did the Editors of The Punch really expect him to run the administration with the politicians loyal to the suspended governor?

Do they not know that the crop of political appointees who served Fubara would have found it difficult to work with the Sole Administrator?

Certainly, they know the truth, but they have chosen to stoke the fire to generate more tensions in Rivers State.

Certain interests might have commissioned this editorial to cast aspersions on the Sole Administrator and raise doubts about his capacity to run the state.

It may also have been the handiwork of Wike’s political detractors, the man whom many politicians love to hate for no other reason than envy and jealousy.

We urge the Punch newspapers to seek a better mode of intervention in the political situation and not dwell on innuendos and unsubstantiated allegations against certain political actors in order to blackmail them.

Dr Ike Odogwu

Opinion

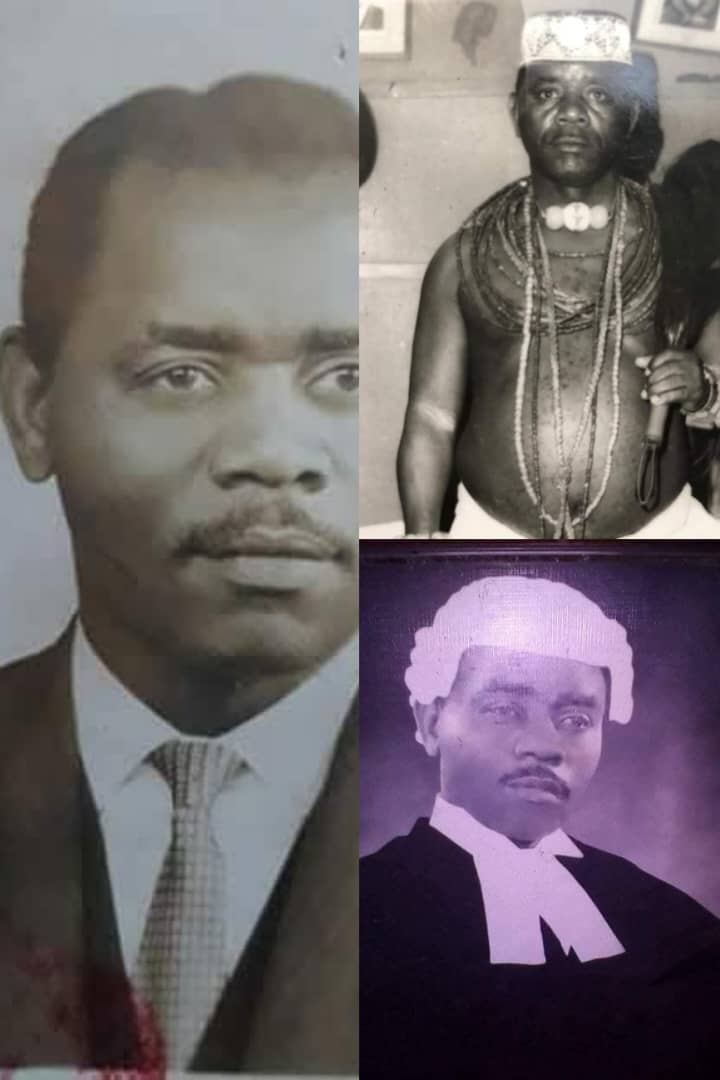

“Chief. Dr. Ekuogbe Akpodiete; A Philanthropist, Lawyer, and Statesman”

In a life of achievement, Chief Ekuogbe Akpodiete popularly called the Duke by his contemporaries in the UK was an assessment clerk, post office clerk, a court interpreter, an educationist, a business man, a political party chieftain, a Barrister and Solicitor, a Magistrate, the Otota (the Prime Minister) of Ughelli kingdom which is the highest traditional chieftaincy office that underpin the royal office of the Ovie of Ughelli Kingdom.

He was a trail blazer, a strict disciplinarian, a lover of people, and a philantropist. He saw to it that people lived in peace and happiness.

Born on the 4th of April, 1924, to parents cut from an industrious mould, Chief Ekuogbe Rowland Gregory Akpodiete took zealously to education that neither his mother Ughweriaka who was a trader, nor his father Akpodiete who was a farmer had.

He attended the Native Authority Primary School, Ughelli, and Enitona High School, Port Harcourt, for his secondary school education.

He thereafter had a brief teaching career in primary schools in Ofuoma near Ughelli, he worked as a process clerk in the then Sapele Township Department between 1950 and 1953, serving at the same time as an interpreter in the local courts.

He proceeded to the United Kingdom to seek the proverbial Golden Fleece where he worked and paid his way through, studying Law. He was admitted into the Honourable society of Gray’s Inn, England, in 1965, and shortly after, he returned home to Nigeria and attended the Nigerian Law School. He was called to the Nigerian Bar in 1966. He immediately started practice in Lagos. However, his practice in Lagos was regrettably abridged by the Nigerian Civil War, which drove him to his hometown Ughelli in 1967, where he continued to practise among his kith and kin as the first Legal Practitioner.

Chief Ekuogbe Akpodiete established himself in Ughelli. After the civil war, he served in the now defunct Mid-western State Judiciary from 1972 to 1975 as a Magistrate.

He was conferred with the chieftaincy title of Urhukperovie of Ughelli kingdom (the light of the King) by the then reigning Ovie of Ughelli, His Royal Highness Oharisi II of blessed memory in 1977.

In the quest for more knowledge, he went back to England for his Master’s degree in law (LL.M) and later a Ph.D. at the University of Warwick.

He was awarded an honourary doctorate degree (Ph.D) by Tenesse Christian University from the United States of America in 1991.

He became the Otota (the Prime Minister) of Ughelli Kingdom in 1986, an office he occupied until his demise on 9th April 1995.

Chief Ekuogbe Akpodiete was also politically involved. In the heady days of the Awolowo-led Unity Party of Nigeria, he was the party’s legal adviser in Ughelli and was on hand to assist during Chief Obafemi Awolowo’s campaign hosting in Ughelli and its environs.

In view of his love for people and entertainment, he established a popular cinema house, one of the first in Ughelli, known as REGA cinema, coined from his names, alongside an entertainment place called Unutakunu (people talk to people).

Chief Ekuogbe Akpodiete was blessed with wives and many children, grandchildren, and great grand children.

Mr. Olotu Akpodiete, PhD

Executive Director

Olotu & Ekuogbe Rowland Akpodiete foundation

-

News20 hours ago

News20 hours agoPDP governors declare support for Tinubu

-

News23 hours ago

News23 hours agoEx-finance minister rearrested in new fraud probe

-

News21 hours ago

News21 hours agoHope for Nigerians as Dangote refinery slashes petrol price again

-

News23 hours ago

News23 hours agoFubara: How can I forgive somebody who never requested for it– Wike

-

News21 hours ago

News21 hours agoRivers Emergency Rule: Abbas inaugurates 21-member panel

-

News22 hours ago

News22 hours agoPeter Obi asks president Tinubu to suspend France trip

-

News20 hours ago

News20 hours agoN1.3trn CBEX Scam: EFCC caution Nigerians against Ponzi Schemes

-

News7 hours ago

News7 hours agoFG expresses sympathy for CBEX victims, urges a united effort to combat Ponzi schemes