News

Four men arraigned for defiling underage girls in Lagos

A 35-Year-Old man identified as Godwin Peter Femi has been arraigned in court for allegedly defiling a 13-year-old girl in Adeba, Ibeju Lekki Lagos.

The case was brought to light after the victim’s father, Samuel reported the incident to the police.

The complaint was initially filed at the Elemoro police division and later transferred to the gender unit of Lagos police command, Ikeja in September. According to the police report, Samuel alleged that Femi had been sexually assaulting his daughter since June 2024

The father further revealed that on June 30, his daughter withdrew N20,000 from his bank account using his ATM card without his knowledge. When confronted, the young girl confessed that she had given the money to the suspect. She explained that Femi had threatened to kill her if she revealed that he had been defiling her.

Following her confession, the police apprehended Femi, who admitted to having sexual relations with the grip but shockingly claimed that she was his ‘girlfriend’.

The suspect was arraigned in court on September 20, 2024, facing charges of defilement.

News

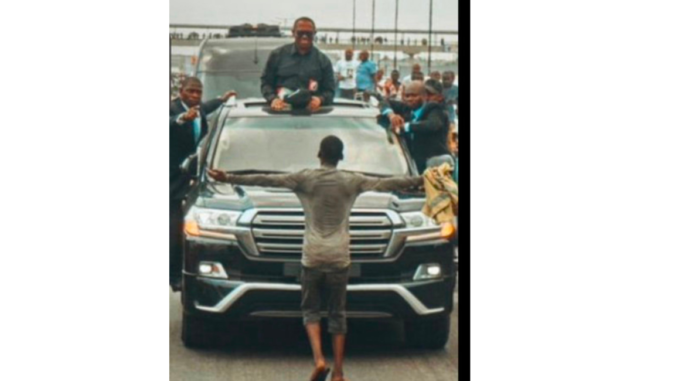

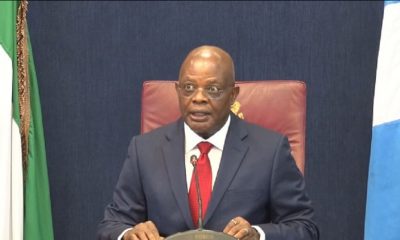

Finally , Lagos Court frees Quadri, young Nigerian who stood before Obi’s convoy in viral photo

The Apapa Magistrate Court, Court 9 sitting at Orege, Ajegunle – Sikiru Adagun Courthouse, has discharged and acquitted Alabi Quadri, the young Nigerian who became a national symbol of courage during the 2023 general elections, for standing boldly in front of the convoy of then-Labour Party presidential candidate Peter Obi.

He was discharged and acquitted of conspiracy to commit felony and armed robbery.

The court held that he has no case to answer.

Quadri was brought to court on Thursday, April 17, 2025, after spending months in Kirikiri Prison, Lagos.

The Nigerian Correctional Service produced Quadri at the Apapa Magistrate Court, located at Orege, Ajegunle—Sikiru Adagun Courthouse (Court No. 9).

Quadri’s case was initially slated for a hearing on April 28, 2025.

However, human rights lawyer and activist Inibehe Effiong had revealed that both he and the Director of Public Prosecutions (DPP) requested that the date be moved forward, and the court granted the application.

Quadri gained widespread attention after a viral video showed him, a teenage boy at the time, fearlessly standing before Peter Obi’s campaign convoy—a moment many Nigerians interpreted as a symbol of youthful defiance and hope during a tense election period.

The media reported that Effiong revealed that Alabi’s recent painful descent into the Nigerian prison system was not due to any major crime but rather a result of prolonged malice and resentment harboured by some self-acclaimed ‘area boys’ (thugs) in his neighbourhood.

According to the lawyer, these individuals felt entitled to a portion of the unexpected attention and goodwill, including financial support, that Alabi received following his moment in the spotlight during the 2023 presidential campaign.

Effiong, who recently visited the Apapa Magisterial Court in Lagos alongside Alabi’s mother and legal colleagues, stated that Alabi’s journey to Kirikiri prison was not only heartbreaking but appeared to be the outcome of a vendetta fuelled by local ‘area boys’ who felt entitled to the financial support Alabi received after his viral moment.

Effiong revealed that Alabi was abducted in January near his home while returning from work by the ‘area boys’ who had been threatening him.

They allegedly took him to Amukoko Police Station (popularly known as Pako Police Station) and accused him of being involved in street fights.

However, Alabi was then arraigned before a Magistrate Court along with four other individuals, said to be complete strangers to him, on allegations of conspiracy to commit armed robbery with cutlasses.

According to the charge sheet, the alleged victims were robbed of N579,000, comprising cash and four mobile phones.

Effiong also emphasised that despite being a minor, Alabi had been detained with adults at Kirikiri since January, pending legal advice from the Lagos State Directorate of Public Prosecutions (DPP).

News

Lawmaker Slams NBA Over Rivers Crisis, Demands Return of N300m

News

BREAKING: Unknown gunmen reportedly storm Senator Natasha’s family residence

Senator Natasha Akpoti-Uduaghan’s family residence in Kogi was reportedy invaded by gunmen around 1 a.m. on Tuesday, April 16, leaving damaged windows but no injuries.

The incident happened at her hometown residence in Obeiba-Ihima, located in Okehi Local Government Area of Kogi State.

Sources familiar with the event said the attackers arrived around 1:00 a.m. Armed with cutlasses and guns, they damaged parts of the building, smashing windows and causing panic in the area. At least three men were involved in the attack.

Senator Natasha’s Chief Security Officer, Yakubu Ovanja, quickly informed the appropriate security agencies.

In response, officers from the Okehi Police Division rushed to the scene.

Although nobody was hurt and no suspects have been arrested yet, security officials recorded the extent of the damage and launched a preliminary investigation.

The reason behind the attack is still unknown, and as of now, Senator Akpoti-Uduaghan has not released any official statement. She represents Kogi Central in the Senate and is known as a vocal figure in Nigerian politics.

According to Zagazola Makama, police are still trying to figure out what motivated the attackers and are working to find those responsible.

-

News2 hours ago

News2 hours agoBREAKING: Unknown gunmen reportedly storm Senator Natasha’s family residence

-

News11 hours ago

News11 hours ago“How my father escaped assassination” – Bishop Oyedepo’s daughter

-

News5 hours ago

News5 hours agoSnub story on removal of Rivers Sole Administrator, it’s FAKE-Chief Registrar

-

News11 hours ago

News11 hours agoFG expresses sympathy for CBEX victims, urges a united effort to combat Ponzi schemes

-

News24 hours ago

News24 hours agoSuswan kicks as PDP governors reject merger talks

-

News17 hours ago

News17 hours agoEl-Rufai labels Tinubu’s government ‘worst in Nigeria’s history’

-

News4 hours ago

News4 hours agoSAD! Again, Alleged Herdsmen Attack Three Benue Communities

-

News17 hours ago

News17 hours agoNigeria-Niger Vow to Strengthen Ties, Tackle Border Security