News

Drama as Band A customers request downward review of high tariff

By Francesca Hangeior

Many electricity consumers in the Federal Capital Territory (FCT) on Band A, have appealed to the Federal Government to lower the high tariff amid the economic hardship.

Reports have it that Band A customers are those who enjoy at least 20 hours of electricity daily and are expected to pay N209.5/kilowatts per hour (KWh).

The consumers who live at Lugbe, Area 10, Apo resettlement area, and environs spoke with NAN in Abuja on Sunday.

They said that Band A was okay because they enjoy constant power supply but added that the tariff was too high and so could not cope with the present situation.

Mrs Amen Odigie, a civil servant residing in Lugbe, said that she found herself paying so much to enjoy power supply, which was okay.

Odigie said that what she paid for electricity in the two-bedroom flat she occupied was more than N30,000 in a month.

“This is really telling on me, as what I earn as salary cannot go anywhere with the present economic hardship in the country.

”I want to appeal to the government to review the high electricity tariff as this Band A is taking most of my income, ” she said.

Mr Ugochukwu Okafor, also residing in Lugbe, said that the electricity tariff for Band A customers was too high.

Okafor, a Vulcaniser, said that his income in a month could not pay for the Band A tariff.

According to him, he wants the Federal Government to do something about the Band A tariff, as it is too high, in view of the present hardship in the country.

Mrs Anita Adaje, a fashion designer residing in Apo resettlement, said that she used electricity a lot to run her business, and with this Band A tariff, she was not making any profit.

”When you bill customers so high, they will refuse to pay, and this is really affecting my business.

”My appeal is that government should look into this high tariff and do something about it,” she said.

Mr Festus Ogunbor, a printer in Area 10, said that he recharged more than N30,000 daily to run his printing machines.

Ogunbor said that the high cost of electricity was affecting his business as he could no longer do much work.

”How much do I make that I have to be paying so much for electricity? Please, I want the government to look into this high tariff as it is seriously affecting businesses and cost of living,” he said.

Mr Chidi Okeke, also a printer in Area 10, said that he had been finding it difficult to power his printing machines because of high electricity tariff.

Okeke said that the government should look for a way of reducing the high cost of electricity to boost businesses as well as encourage more Nigerians to go into business.

News

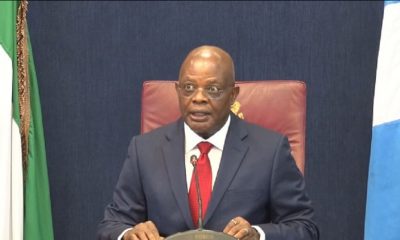

Presidency slams El-Rufai over plot to woo Buhari

The Presidency and the ruling All Progressives Congress have dismissed the prospect of any opposition coalition unseating President Bola Tinubu in 2027, describing recent moves by former Vice President Atiku Abubakar and ex-Kaduna State Governor, Nasir El-Rufai, as futile and politically opportunistic.

Their reactions followed the high-profile visit by Atiku and El-Rufai—accompanied by former governors Aminu Tambuwal (Sokoto), Gabriel Suswam (Benue), Jibrilla Bindow (Adamawa), and Achike Udenwa (Imo)—to former President Muhammadu Buhari at his Kaduna residence last week.

Although Atiku maintained the visit was merely a post-Sallah courtesy call, political observers and members of the ruling party believe it was part of broader opposition coalition talks aimed at weakening Tinubu’s political base.

“There is a plan for the major political parties to come together and form a strong opposition. But it is not part of our visit,” Atiku told reporters.

In recent weeks, concerns have risen within the APC over speculated coalition efforts and the potential exit of the Congress for Progressive Change bloc from the party, following defections to the Social Democratic Party.

But the APC’s National Secretary, Senator Ajibola Bashiru, waved off the speculations in a phone interview with The PUNCH, questioning the credibility of the so-called CPC defection narrative.

“It is not true. Which CPC bloc did you people say is leaving? Was El-Rufai or Atiku a CPC member? Is our Vice National Chairman (North-West), Garba Datti Mohammed, and even former Governor Al-Makura not in the CPC? Have you heard any of them saying he is leaving?” Bashiru queried. “I don’t know why the media keeps giving these sorts of people unnecessary attention.”

Also reacting, President Tinubu’s Special Adviser on Policy Communication, Daniel Bwala, criticised the coalition talks, dismissing them as a desperate power grab by political misfits with no shared ideology.

“This coalition is an association to grab power,” Bwala said. “That’s why you will hear Peter Obi say they are only there to grab power. Tomorrow, he will say he is considering joining. As for my senior brother, El-Rufai, I like what he is doing. He is using them to play ping pong.”

Bwala added that internal resistance within the Peoples Democratic Party had already disrupted El-Rufai’s attempts to lure the opposition into the SDP.

“When El-Rufai came, he thought he would move all of them to SDP. But His Excellency (Sule Lamido) screamed, ‘Hold it there!’ He reminded them that it was the PDP that made El-Rufai minister twice and gave him political relevance. Now, he wants to drag them out? We’re not going anywhere,” Bwala recounted.

The Presidency insists that despite the rising political noise, President Tinubu remained focused on governance and would not be distracted by alliances it described as unstable and self-serving.

Credit: PUNCH

News

Court dismisses suit seeking Oyo monarch’s removal

An Oyo State High Court sitting in Ibadan has dismissed a suit contesting the nomination and installation of the Olugbon of Orile Igbon, Oba Francis Alao.

In his ruling on Monday, Justice K.A. Adedokun nullified the case for lack of jurisdiction.

Four members of the Akingbola family who instituted the suit contested the selection, appointment, and approval of Oba Alao as the Olugbon.

Justice Adedokun held that the court lacked the jurisdiction to entertain the matter, saying that the claimants had no locus standi to file the suit.

He ruled that the case was defective as it failed to include Surulere Local Government, the authority legally empowered to initiate the selection process and approve the traditional ruler’s appointment.

Oba Alao, whose installation as Olugbon was ratified by the Oyo State government and traditional institutions, is the current vice chairman of the Oyo State Council of Obas and Chiefs.

News

EFCC arraigns Chinese for giving false information in Lagos

The Economic and Financial Crimes Commission (EFCC) has arraigned a Chinese, Liu Beixiang, over alleged false information to an officer of the agency.

Liu was arraigned yesterday before Justice Ayokule Faji of the Federal High Court sitting in Ikoyi, Lagos.

The charge reads: “That you, Liu Beixiang (a.k.a Lao Liu), sometime in December 2024 in Lagos, within the jurisdiction of this honourable court, did give information, which you knew to be false, to an officer of the Federal Government of Nigeria in the discharge of his duties and thereby committed an offence contrary to Section 16 (1) of the Economic and Financial Crimes Commission (Establishment) Act, 2004.”

The defendant, however, pleaded not guilty to the offence when the charge was read to him. In view of his plea, the prosecution counsel, Babatunde Sonoiki, asked the court for a trial date and also prayed that the defendant be remanded in a correctional facility.

But in his response, the defence counsel, F.A. Dalmeda, informed the court of an application submitted to the EFCC seeking a plea bargain.

“We filed an application for a plea bargain, and we also filed a motion for bail, which the EFCC responded to this morning.

“We need a date for us to report on the plea bargain.

Consequently, Justice Faji adjourned the matter till June 23, 2025, for a report on the plea bargain and remanded the defendant in a correctional centre.

-

News19 hours ago

News19 hours agoJust in: Namibia Moves to Deport Over 500 Americans in Bold Visa Policy Shift

-

News19 hours ago

News19 hours agoRivers women rally in support of state of emergency

-

News14 hours ago

News14 hours agoYou must refund N300m, Rivers State tells NBA

-

Politics18 hours ago

Politics18 hours agoBwala accuses Senator Ndume of plans to defect from APC

-

Foreign15 hours ago

Foreign15 hours agoUS orders 30-day registration for all foreign nationals or face jail, deportation

-

News19 hours ago

News19 hours agoSoldiers rescue 16 kidnapped passengers in Plateau

-

News2 hours ago

News2 hours agoPeter Obi speaks as Benue govt. blocks humanitarian visit

-

News19 hours ago

News19 hours agoGunmen invade Plateau community in fresh attack, Kill 40 People