News

29 states spend N2 trillion on travels, others – Report

A total of 29 state governors spent N1.994 trillion on recurrent expenditures, including refreshments, sitting allowances, travelling, and utilities in the first nine months of 2024, findings have shown.

It was also gathered that the states obtained a N533.29bn loan, while it spent N658.93bn to service its debts owed to local, foreign, and multilateral creditors, reports The PUNCH.

However, these states fell short in their revenue-generating targets, collecting a total sum of N1.92tn as internally generated revenue but fell short of the revenue target of N2.868tn, recording a deficit of N948.28bn.

The recurrent data utilised in this report did not include personnel costs.

An analysis of the fiscal performance of each state, utilizing data from the Q1 to Q3 budget performance reports obtained from each state’s website, revealed a pressing need for stringent measures to prioritise fiscal discipline, especially amidst growing calls to reduce the costs of governance.

This comes despite a 40 per cent increase in the state’s statutory allocations from the Federation Account.

For the first three quarters of the year, our correspondent examined budget implementation data from twenty-nine states; data for six states was not available.

Borno, Gombe, Kaduna, Kano, Kwara, Sokoto, and Ogun states were the ones without the latest data from January to September 2024.

Since the commencement of the current administration, state governments have enjoyed improved monthly allocation mainly due to the elimination of fuel subsidies and the unification of the foreign exchange market.

The Nigeria Extractive Industries Transparency Initiative recently noted that the Federation Accounts Allocation Committee disbursed N3.473tn to the three tiers of government in the second quarter of 2024.

This reflects an increase of N46.77bn (1.42 per cent) compared to the first quarter of 2024.

The federal government received N1.102tn, representing 33.35 per cent of the total allocation, while 36 states received N1.337tn (40.47 per cent), and the 774 local government councils shared N864.98bn (26.18 per cent).

A comparison with the previous quarter shows that the Federal Government’s allocation decreased by N41.44bn (3.76 per cent), while state governments saw an increase of N58.13bn (4.29 per cent), and local government councils experienced a rise of N30.82bn (3.57 per cent).

But this improved funding hasn’t translated to an improved standard of living for its citizens.

A breakdown showed that the 29-state government spent N1.994tn on its recurrent expenditure, which included refreshments for guests, sitting allowances to government officials, local and foreign travel expenses, and utility bills.

The general utilities include electricity, internet, telephone charges, water rates, and sewerage charges, among others.

Lagos, Plateau, and Delta States spent the highest on their operating expenses, incurring a cost of N375.19bn, N144.87bn, and N121.54bn, respectively. This was followed by Ondo and Bauchi spending N107.34bn and N99.31bn.

Niger State, under the leadership of Governor Mohammed Umar Bago, was the highest borrower within the review period, obtaining loans worth N79.09bn. Katsina followed with a loan of N72.89bn. Oyo State also got a loan of N62.48bn.

In terms of revenue, Lagos State collected the highest of N912.17bn, followed by Rivers State with a collection of N269.18bn. Third on the list was Delta (N97.02bn).

A state-by-state analysis revealed that Abia State, led by Governor Alex Otti, spent N17.91bn on operating expenses and generated N22.15bn in revenue, falling short of the N32.14bn revenue target. Additionally, the state borrowed N3.901bn and allocated N10.91bn for debt servicing.

Adamawa State spent N41.45bn on recurrent expenditure, while it earned N9.16bn income out of its revenue of N22.24bn. This state borrowed N10bn and paid N22.68bn to service its debts.

Akwa-Ibom State recurrent spending reached N85.45bn in nine months, N43.98bn more than its generated revenue of N41.47bn in nine months. The state paid N34.47bn as debt service but didn’t borrow.

Anambra State generated more revenue (N28.296bn) than its recurrent spending of N12.70bn. It spent N4.56bn on debt service and didn’t record any borrowing.

The Bauchi government spent N99.31bn on its operating expenses. This state only got N15.92bn out of its budgeted target of N37.03bn but borrowed N33.64bn and paid N27.54bn as debt service.

Bayelsa state got N57.85bn IGR more than its revenue target of N23.87bn. It spent N75.23bn on its operating costs and spent N30.54bn on its debt service.

Governor Hyacinth Alia of Benue state approved the spending of N29.45bn for operating expenses while it collected N8.71bn as revenue out of an N23.91bn target. This state didn’t borrow but spent N5.48bn to service previous loans collected.

Similarly, Cross Rivers spent N55.73bn on recurring expenses, collected N32.42bn IGR, borrowed N20.67bn from its creditors and spent N19.99bn on debt service.

Delta State recurrent expenditure reached N121.54bn in nine months while it earned N97.02bn as revenue out of the N110.3bn target. The oil-rich state serviced its debt with N55.9bn and didn’t obtain any loan.

Also, Ebonyi State spent N37.73bn on its recurrent expenses but earned N15.67bn as revenue. The state borrowed N15.65bn and spent N8.46bn on debt service.

Edo State spent N75.78bn on recurrent expenditure but generated N52.68bn revenue. The state borrowed N12.84bn and spent N27.5bn on its debt service commitments.

Similarly, Ekiti State recurrent spending was N74.73bn, generated N23.16bn revenue, borrowed N11.75bn and spent N12.93bn to service its debts.

Enugu State spent N10.88bn on its operating expenses but got N39.98bn in revenue. This state borrowed N1.39bn and spent N6.93bn on its debt service.

Imo State under Governor Hope Uzodinma, spent N42.75bn on its operating expenses but got N15.24bn as revenue. This state spent N15.94bn to service its debts but didn’t obtain any loan.

While Jigawa incurred N35.69bn as operating expenses, it collected N18.41bn as revenue out of its target of N50.65bn borrowed N744.75m, and N2.17bn on debt service.

Further analysis showed that Katsina State spent N40.73bn on its recurrent expenditure while it generated revenue of N29.95bn. This state increased its loan by N72.89bn and paid N12.78bn as debt service.

Kebbi State recurrent spending was N22.42bn while it generated N7.86bn revenue. It also obtained an N24.59bn loan and paid debt service of N3.42bn.

Kogi State spent N84.48bn on its operating expenses but earned N19.86bn in revenue. The confluence state also obtained N51.68bn as loans and repaid N18.12bn debt.

Lagos State spending on recurrent expenses was N375.19bn, while it earned N912.15bn revenue. The state paid N84.53bn as debt service but didn’t obtain any loan.

Within the same period, Nasarawa spent N42.63bn on its operating expenses but got N22.78bn as revenue, Niger state recurrent expenses reached N41.28bn while it earned N29.22bn.

Ondo State spent N107.34bn on recurring expenses but only earned N24.43bn, Osun State spent N48.87bn but earned N28.86bn as revenue while Oyo State spent N51.24 on its recurrent expenditure, N45.79bn was collected as revenue.

Plateau spent N144.86bn on its recurring expenses but only earned N18.03bn; Rivers State’s spending on its operating costs was N72.69bn, but it earned N269.17bn.

Taraba State spending on recurrent expenditure reached N58.39bn, surpassing its revenue generation of N7.84bn, resulting in a deficit of N50.55bn. This state borrowed N52.63bn and paid N21.19bn.

Yobe State spent N51.29bn on its recurrent costs but earned N8.14bn as revenue. Also, Zamfara spent N36.34bn on its recurrent expenditure but earned N18.46bn.

Commenting in an interview, A professor of Economics at Babcock University, Segun Ajibola, stated that the enduring problem of high governance expenses had persisted at the state level, with inadequate oversight and accountability resulting in minimal economic benefits for grassroots citizens.

Ajibola, a former president of the Chartered Institute of Bankers, lamented that state assemblies had also abandoned their oversight duties, leaving the state governors to operate with no iota of transparency and accountability.

The Fiscal Responsibility Commission last week expressed concerns over Nigeria’s current fiscal federalism structure, cautioning that the system may be unsustainable in its present form. ( Culled from PUNCH)

News

PDP headache: Saraki’s Cttee signals there’s genuine intention to reconcile and resolve knotty issues -Hon Teejay Yusuf

…says Sunday meeting best step ever

… constitution of strategy meeting well balanced

…beware of Zamfara debacle

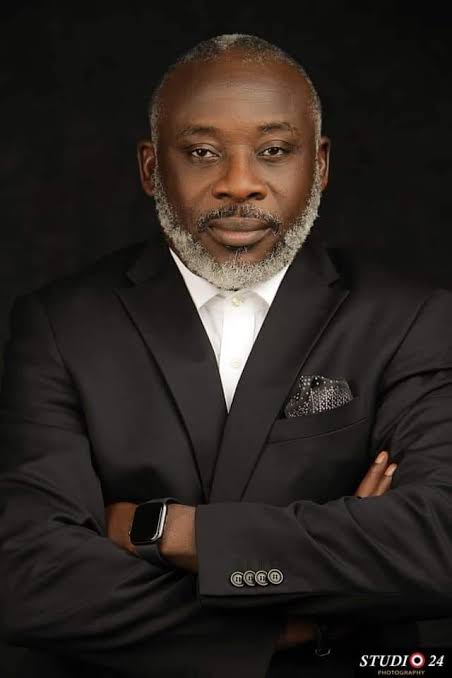

Hon Teejay Yusuf, a three-term HoR Member, an economist, real estate magnate, vibrant lawmaker in three assemblies and national executive of NANS in his student days spoke extensively on the knotty issues weighing down the major opposition party in Nigeria, the PDP and proferred the way forward to bring it back to national reckoning, hear him.

This is where we are again, they said they’re trying to smoothen everything, tap from experience and make sure that they have a very good NEC meeting come the 27th of May. What should the PDP be nervous about with the upcoming NEC?

I think a lot. However the meeting of yesterday(Sunday )to me, for a long time look like one of the best step ever taken to resolve this matter.

If they are going to have a NEC meeting without resolving the matters, if not what they want Saraki to do now, it would have been disastrous.

First of all, there was the Supreme Court ruling on secretaryship, the governors met in Ibadan and said they recognize the deputy secretary. However the court recognize Anyanwu, apart from that, Anyanwu has a High Court ruling that cannot be removed; so if you had gone ahead to have a NEC meeting without resolving this matter, by implication whatever you do there, somebody will just wake up one day, go to court and quash it.

It’s a very complicated situation you know that ruling of the Supreme Court has also been known to say that all this internal party affair, all this disputes around positions are internal party affairs. But I do know that the controversy was whether it was the NWC or the NEC that said that rather than the Governor’s Forum because they felt that that decision should have come from either the NEC or the NWC not the Governor’s Forum.

The NWC has no such power. He was elected at the Convention, there’s a process of removal. So why going into that kind of crisis when you have convention coming that you can remove secretary legally, you can rezone so that’s the path they’re taking now.

We must understand, a friend of mine we were talking this morning, the current governors must understand something that a court ruling is not a buffet, you cherry pick, it’s alakat, you take what is served. You might not like it.

If I’m in their shoe all I will do just allow Anyanwu then we prepare, do this kind of meeting we are doing now, do our NEC meeting, prepare for Convention, Convention is in August, he’s out. So why are you putting booby traps?

The Zamfara experience on how APC lost the whole state is still fresh, we applauded it then, we love what happened and we are walking to that kind of trap.

So I see what happened on Sunday, I don’t know the detail but when I saw the committee, Saraki, I think there is a balance of all interests in that committee and so I assume for the first time there is a genuine intention to reconcile and if they can get that done we’ll fly.

I don’t even know if journalists had the time to ask such a question as to whether they were walking back on that earlier decision of theirs to say that they were recognizing a deputy secretary?

If they don’t it is a recipe for disaster.

Is it automatically taken for granted that with the resolution that they have now reached through this reconciliation committee, that is also a part of what…?

Definitely, I assume that it will be give and take. First of all you have a divided National Working Committee. Have you heard the legal adviser talking on this matter? Most time you hear the publicity secretary talking, interpreting legal issues, by implication there a lot of divisions, so Saraki’s first responsibility to bring them together.

You guys your tenures will be ending very soon, it’s even good for you to work together and exit with some honour. So I don’t have details of what happened but the pictures and the things the committee I saw, the setup, to me it is what they should have done from day one to get this thing sorted out.

We are in our position and we are consciously laying bobby trap for ourselves. Look at the FCT local government election that is coming up, a lot of the chairmen who were in PDP have crossed to APC because who sign, okay let’s assume you have such power to say deputy secretary should act and you now sign the candidature of these people and somebody just wake up and go to court and quash it; why taking such risk?

So I do not know why we invest so much energy on ego. If you don’t like Wike, he has his own shortcoming and what have you, you can’t dispute the fact that between 2015 – 2019 he gave PDP a voice and he wasn’t the one that was going to run for president then. It was those who left us and came back that took that privilege.

So who among the governors is doing such thing right now? Who is taking responsibility? Look at the Natasha issue, who is talking from the PDP top echelon? Who is saying anything?

If you are not even supporting, are we making effort to say oh, this lady, this take it or leave it today, she’s one of the most popular brand of PDP Natasha, so what have we done in that light?

So the governors must understand that they are a product of constitutionality, the truth of the matter is that if you do not have a constitution and been obeyed, 10 people will come out that they are governors in the state. But because there is a pronouncement of court and people obey it, so just drop your ego let’s work.

BoT unfortunately, I’m so disappointed because it ought to be the conscience of the party, we shouldn’t have, what the governors are doing now should have been done by BoT.

But they went into the crisis with partisan motive, they had an opinion of what should happen, what should not happen; a lot of them look at somebody in the party as the hope of their generation, so if it’s not the candidate of the party they will not be relevant again.

I’m looking at the papers this morning and I was hearing that the PDP is set to install a new BoT today, I don’t know, did you get that memo as a member of the PDP.

No I’m not a member of the BoT.

Okay well it’s right there on the front page of the Punch. I mean that should not be something that is done in secret, it should be something that members are aware of.

And it should not be something you should be doing now.

Honourable the one question that’s on my mind right now is I mean you just talked about this whole idea of another reconciliation headed by a Former President of the Senate Bukola Saraki. The question on my mind right now is with this mediation efforts that is being tinkered with, some may already see it as being already biased serving particular interests; so with the fact that prior reconciliation attempts failed what if members doubt the sincerity of this new initiative?

There’s nothing cast in stone, you cannot have a 100% opinion about any matter. Human beings naturally have a diverse opinion on any issue.

However I assume that the list I saw is a composition of different segments and cleavages agitating for, I mean control of the party and Saraki to me is a very seasoned politician who understands the power of negotiation. I think that committee will if they genuinely want to do it, they can do a good work.

So I can’t sit here and say because other reconciliation failed, what about the ones they succeeded in. They’ve gone around and did some reconciliation before, it is this particular item that linger this long and this is the first time the governors are coming out with a committee to see how they bridge those gaps. So I want to give them the benefit of doubt.

The last time we spoke about this honourable, remember you dated the issues back more than 10 years and consequently one can imagine that there have been quite a number of other issues that have come up over the last 10 years and not just one. You said then that it was a cumulation of the issues over the years; do you see this committee being able to tackle those issues, those historical internal discrepancies or rather disagreements within the party?

The committee might not go into those details but the committee will attempt to reconcile the actors now so as to have a smooth convention. What will determine if we will heal those wounds will be when we begin to zone positions.

I listened to somebody in another platform a few days ago who was misrepresennting facts and was talking about the PDP will zone to South East, it is some people that, I said no. I mean I don’t want to mention name, it is not like that in PDP dynamics.

I was in the committee meetings I was at the NEC meeting where the decisions were taken.

The major mistake we made, we didn’t zone party presidential ticket to the South, for the first time we didn’t zone. We don’t zone to geopolitical zone, we zone chairman, secretary to either North or South, different geopolitical zone within those enclaves will now jostle for it. If you zone entry to North, North West, North East and North Central will jostle for it.

Ayu emerged as chairman of PDP not because it was zoned to North Central, it was zoned to the North but the North Central were able to come together and make sure other aspirants from the zone step down for Ayu.

Going to the larger Northern caucus then everybody realized that North Central coming as a bloc will defeat them, Shekari, Makarfi was running, Shema was also running a lot of them. So Ayu became more formidable because about seven states in North Central were coming for him.

So for anybody to say that we should have zones to South East that’s why, we did not zone, we left it open.

So if we are able to have a successful NEC meeting, a successful Convention and those who are saddled with this responsibility will now realize that let’s retrace our step because in 2014 people complain that Jonathan should not run because it should go to the North.

2019 we rescind our decision and zone to the North so nobody from the South contested. We should do the same thing now, zone to the South so that nobody from North will contest.

You’ve already expressed optimism that this reconciliation committee could work; how confident are you that it could stop members from defecting?

First of all, the confidence is that it might not stop but it will reduce it and don’t be surprised about people moving to the ruling party. Around 2007, 2009, 2011 PDP has almost 30 states in this country, so it is in the nature of our politicians in Nigeria to always gravitate towards who is in power.

If tomorrow PDP is in power, some people will gravitate back to PDP but some of us will stay, so some people stayed with ACN and what have you, today the APC is in power, so I don’t begrudge them. Put more ingredients in the soup and make it sweeter.

News

SAD! Popular Broadcast Journalist Bukola Agbakaizu Slumps, Dies Before Afternoon Shift

The Ogun State media industry was plunged into mourning on Monday following the sudden death of veteran broadcast journalist, Mrs. Bukola Agbakaizu, a longtime staff member of Ogun State Television (OGTV).

Agbakaizu, aged 52, reportedly collapsed while preparing for her afternoon shift at the OGTV studios in Abeokuta. Despite immediate efforts to revive her, she was pronounced dead upon arrival at the Federal Medical Centre, Abeokuta.

Her passing was officially confirmed on Tuesday night in a statement issued by the Secretary of the Nigeria Union of Journalists (NUJ), Ogun State Council, Mr. Bunmi Adigun.

“Bukola Agbakaizu, a dedicated staff member of OGTV, tragically slumped while preparing for her shift. She was rushed to the hospital but could not be saved,” Adigun stated.

He described her as a passionate and highly respected journalist who had previously served as Vice Chairman of the OGTV Chapel and was a valued member of the Wale Olanrewaju-led executive of the NUJ Ogun State Council.

“She was a vibrant and committed media professional. Her death leaves a painful void in our community,” Adigun added.

Agbakaizu also served as an ex-officio member of the NUJ Ogun State Council. She is survived by her two children, her elderly mother, colleagues, and a wide circle of friends in the journalism community.

The Nigeria Association of Women Journalists (NAWOJ), Ogun State Chapter, also expressed profound sorrow over her untimely demise, noting her contributions to the advancement of women in journalism.

News

Just in: NNPC Cuts Petrol Price Amid Competitive Moves with Dangote Refinery

By Kayode Sanni-Arewa

The Nigerian National Petroleum Company (NNPC) Limited has announced a reduction in the pump price of Premium Motor Spirit (PMS), popularly known as petrol, at its retail outlets in the Federal Capital Territory (FCT), Abuja.

According to a report by The Cable, the petrol price at the NNPC station in Wuse Zone 3, Abuja, was cut from ₦935 per litre to ₦910, signaling a slight relief for consumers in the nation’s capital.

However, the new pricing has not yet extended to Lagos, where petrol prices at NNPC retail outlets remain unchanged. This discrepancy has sparked renewed concerns over regional price variations in Nigeria’s downstream oil market.

The latest adjustment comes in the wake of an intensifying price contest between NNPC and the privately-owned Dangote Refinery. Just days earlier, on May 12, the Dangote Refinery lowered its ex-depot petrol price to ₦825 per litre, a strategic move aimed at capturing a larger share of the domestic fuel market.

The price reduction appears to be an outcome of recent high-level discussions between NNPC’s Group Chief Executive Officer (GCEO), Bayo Ojulari, and Dangote Refinery’s founder, Aliko Dangote. The meeting, held on May 9, reportedly sought to realign the relationship between the two entities and promote collaboration rather than rivalry.

Speaking after the meeting, Dangote stated, “There is no competition between us; we are not here to compete with NNPC Ltd. NNPC is part and parcel of our business, and we are also part of NNPC. This is an era of cooperation between the two organisations.”

Ojulari echoed this position during a press briefing on May 12, attributing the petrol price reduction to the recent procurement of fuel at lower international prices. He explained that the earlier surge in pump prices was due to existing stock purchased by marketers at higher rates.

“This downward price adjustment reflects our effort to respond to changing supply conditions and deliver better value to Nigerians,” Ojulari said, while also noting that more adjustments may occur as the market stabilizes.

Industry observers view the ongoing price adjustments as an early indicator of growing competition in Nigeria’s petroleum sector, especially with the Dangote Refinery ramping up its operations. Analysts believe that sustained collaboration between both players could enhance supply efficiency and potentially ease the burden of fuel costs for consumers nationwide.

-

News23 hours ago

News23 hours agoJust in: Another major headache as 3 PDP senators defect to APC

-

News4 hours ago

News4 hours agoJust in: NNPC Cuts Petrol Price Amid Competitive Moves with Dangote Refinery

-

News23 hours ago

News23 hours agoCourt Jails Two Six Months for Naira Abuse in Lagos

-

News23 hours ago

News23 hours ago$1.43m scam: Ajudua on the run as Supreme Court orders his return to prison

-

Economy8 hours ago

Economy8 hours agoCBN launches new platform, targets $1bn monthly diaspora remittances

-

News7 hours ago

News7 hours agoKano varsity shuts female hostel over immorality

-

News8 hours ago

News8 hours ago19-Year-Old Candidate Commits Suicide over Low UTME Score

-

News21 hours ago

News21 hours ago10 WAEC students still missing as Rivers women demand Sole Administrator’s intervention