News

Reps Direct NPF, Banks, Fintech To ensure Victims Of One Chance Get Justice In FCT

News

Nigeria’s inflation jumps to 24.23% in March 2025

Nigeria’s headline inflation rate rose to 24.23% in March 2025, according to the official government data source, the Nigeria Bureau of Statistics (NBS).

The rise in the country’s inflation rate, from 23.18% back in February 2025 to 24.23% in March 2025, reflected a major increase in the rising commodity and energy costs in the last few weeks.

According to the March 2025 Consumer Price Index (CPI) Report which measures the inflation rate released by the government agency on Tuesday, the country’s food inflation rate was 21.79% year-on-year in March 2025.

The food inflation rate, however, showed a decrease compared to the food inflation rate of 23.51% recorded in February 2025.

Economists had predicted that the country’s inflation rate which decreased minimally in February would rise when the Dangote Refinery and the state-run NNPCL got entangled in a petrol price war that culminated in the temporary termination of a naira-for crude agreement between the two oil companies and the subsequent increase in the pump price of petrol.

Some observers had also said the minimal reduction in the prices of food commodities experienced earlier in February was not sustainable, attributing the temporary decline in the prices of food to the importation intervention of the Federal Government.

Food and commodity inflation have skyrocketed as Nigerians battle what can pass for the worst cost of living crisis since the country’s independence over six decades ago, a development that economic wizards have attributed to President Bola Tinubu’s twin policies of petrol subsidy removal and unification of the forex rates.

News

Plateau 51: Mutfwang mourns, says “we failed you”, begs affected community

Governor Caleb Mutfwang of Plateau State has apologised to the people of Bassa Local Government Area (LGA) for the failure of government and security agencies to protect lives and properties.

Fifty-one persons were gunned down early Monday in the Zikke community of the LGA, with houses razed and many displaced about two weeks after a similar attack led to the killing of scores of persons in Bokkos Local Government Area.

Less than two days after the most recent assault, Governor Mutfwang apologised for the government’s inability to protect the people.

Fifty-one persons were gunned down early Monday in the Zikke community of the LGA, with houses razed and many displaced about two weeks after a similar attack led to the killing of scores of persons in Bokkos Local Government Area.

Less than two days after the most recent assault, Governor Mutfwang apologised for the government’s inability to protect the people.

The governor said this on Tuesday at the palace of the Paramount Ruler in Miango.

“I will tell you the truth: I have been crying since yesterday because I had trusted God that all the arrangements were put in place, that this will not happen again. We have made investments in security,” he said.

But like all human arrangements, sometimes they fail. I want to admit that on Sunday night into Monday morning, we failed you. Please, forgive me.”

He urged the people not to relent in their efforts to secure their communities and ensure that they complement security agencies’ efforts by providing vital information for intelligence gathering and expose the antics of the criminals.

Governor Mutfwang, in the company of security chiefs and members of the state executive council, was in Zikke community to commiserate with the people on the death of over fifty persons killed in Monday’s attacks.

The Paramount Ruler of Irigwe land, Ronku Aka, who is the Brangwe of Irigwe, urged the government to come to the aid of the communities with the provision of social amenities in the area.

The governor and the entourage also went to see some of the families who lost their loved ones in the attack. The victims have been buried just as members of the community demanded action to stem the rising wave of insecurity in the state.

Plateau State has been a hotbed of attacks, but the renewed spate of attacks adds a fresh layer of twist to the decades-long crisis rocking the North-Central state.

After the most recent assaults, President Bola Tinubu ordered security agencies to fish out the masterminds, describing the attacks as condemnable.

While experts have linked the lingering Plateau crisis to farmers-herders tussle for resources, Governor Muftwang said it was sponsored and genocidal.

According to him, over 64 communities in the state have been taken over by gunmen.

News

Court reserves verdict in Ganduje, seven others alleged financial infractions case

The Kano State High Court on Tuesday reserved ruling in the high-profile case involving the National Chairman of the All Progressives Congress (APC), Dr. Abdullahi Umar Ganduje, and seven others, who are facing an eight-count charge bordering on bribery, misappropriation, and diversion of public funds.

The case, instituted by the Kano State Government, lists Ganduje, his wife Hafsat Umar, Abubakar Bawuro, Umar Abdullahi Umar, Jibrilla Muhammad, Lamash Properties Limited, Safari Textiles Limited, and Lasage General Enterprises Limited as defendants.

When the case came up for hearing, the legal teams for all defendants presented various preliminary objections challenging the jurisdiction of the court and filed applications for extension of time.

Leading the defence for Ganduje, his wife, and Umar, Offiong Offiong (SAN) told the court: “We filed our preliminary objection dated November 18, 2024, supported by a 28-paragraph affidavit and a written address. We also filed a reply on point of law dated April 4, 2025. We urge the court to grant our application.”

On the other hand, the prosecution led by Adeola Adedipe, SAN, maintained that the defence applications lacked merit.

“The state’s reply to the preliminary objection is dated October 22, 2024. It is backed by a seven-paragraph counter affidavit and a written address with supporting documents,” Adedipe said.

“We urge the court to dismiss the applications in their entirety.”

Counsel to the 3rd and 7th defendants, Adekunle Taiye-Falola, filed a similar preliminary objection dated October 18, 2024.

In response to the complainant’s counter affidavit, we submitted a further and better affidavit dated December 12, 2024, along with a reply on point of law. We respectfully urge the court to grant the application,” he said.

Sunusi Musa, SAN, representing the 5th defendant, filed his own objection with similar supporting documents.

“We are seeking not just a grant of our application, but also substantial costs against the complainant,” Musa added.

Ashafa Yusuf, counsel to the 6th respondent, noted: “Our notice of preliminary objection was dated September 9, 2024. We filed a further and better affidavit on February 17, 2025, and a reply on point of law. We request the court to grant our reliefs.

For the 8th defendant, counsel Faruk Asekome also filed a preliminary objection and followed up with a further affidavit and legal reply dated February 13, 2025.

“We have complied fully with the procedural requirements, and we ask the court to grant the application,” he said.

Presiding over the case, Justice Amina Adamu-Aliyu granted the applications for an extension of time. She, however, reserved ruling on the preliminary objections.

“Ruling on the notices of preliminary objection is hereby reserved. A new date will be communicated to all parties in due course,” Justice Adamu-Aliyu stated.

The court’s eventual decision on jurisdiction is expected to determine whether the trial will proceed or be dismissed at this stage.

-

News9 hours ago

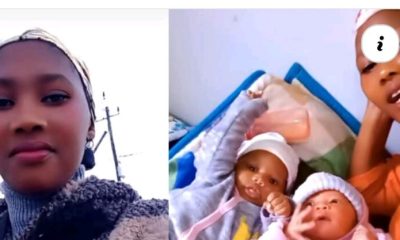

News9 hours agoSHOCKING! One month after giving birth, woman discovers another baby in her womb

-

News9 hours ago

News9 hours agoTears, anguish as Plateau Community buries 51 killed by bandits

-

News15 hours ago

News15 hours agoPeter Obi speaks as Benue govt. blocks humanitarian visit

-

News9 hours ago

News9 hours agoAngry investors raid CBEX office, loot assets in Ibadan after digital Platform crash

-

News7 hours ago

News7 hours agoCBEX: 60 fraudulent Ponzi scheme operators to avoid in Nigeria

-

News16 hours ago

News16 hours agoFUOYE VC suspended over sexual harassment allegations

-

Politics9 hours ago

Politics9 hours agoIgbo Youths Set To Mobilize 5 Million Man-March In Support Of Tinubu, Kalu

-

News9 hours ago

News9 hours ago‘Not something I’d wish on anyone’ — Melinda Gates opens up on divorce