News

FG To Begin 2024 Tax Reforms In January, Exempting SMEs and Farmers from Withholding Tax

The Federal Government of Nigeria has officially commenced the implementation of the 2024 Withholding Tax Regulations, a move that marks a significant step toward modernizing the country’s tax system. Approved by President Bola Tinubu in July 2024 and published in the Official Gazette in October, the new regulations became effective on January 1, 2025.

Formally known as the “Deduction of Tax at Source (Withholding) Regulations, 2024,” the updated tax regime aims to streamline compliance, reduce administrative burdens, and address inefficiencies in the system, especially for Small and Medium Enterprises (SMEs), manufacturers, producers, and farmers—sectors critical to Nigeria’s economic stability and growth.

In a statement posted on his official X (formerly Twitter) account on New Year’s Day, Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, confirmed the new regulations’ effective date. He highlighted some of the key features of the reforms, such as exempting SMEs from withholding tax compliance. This measure is expected to alleviate financial and administrative pressures on these businesses, fostering growth and innovation in the sector.

The new regulations also include reduced withholding tax rates for businesses with low-profit margins to improve cash flow and reduce operational costs. Manufacturers, producers, and farmers are fully exempted from withholding tax obligations, a move intended to support these vital sectors and ensure their sustainability.

Additionally, the reforms aim to simplify the process of crediting taxes deducted at source, making it easier for businesses to claim and utilize these deductions efficiently. The regulations also address long-standing issues, including ambiguities around the timing of deductions and unclear definitions of key terms, which had previously hindered tax compliance.

These changes are also part of the government’s broader effort to combat tax evasion, enhance transparency, and minimize opportunities for tax avoidance.

Earlier, the Federal Government had unveiled a broader set of tax reforms to reduce the tax burden on the manufacturing sector and small businesses. These reforms, part of the “Deduction of Tax at Source (Withholding) Regulations, 2024,” also seek to simplify the deduction of taxes at the source for taxable entities under multiple tax acts, including the Capital Gains Tax Act, Companies Income Tax Act, Petroleum Profits Tax Act, and the Personal Income Tax Act.

In addition to these reforms, Oyedele recently announced that high-income earners could face an increased monthly PAYE tax burden under new proposed tax laws. These changes aim to address fiscal inequities that have resulted in “fiscal drag” due to inflation, pushing lower-income earners into higher tax brackets.

For instance, individuals earning N400,000 a month currently pay the same top marginal tax rate as those earning N20 million. Under the new tax framework, this discrepancy would be addressed, with high-income earners contributing more while providing relief to low- and middle-income earners.

Oyedele clarified that individuals earning N1.7 million or less per month would see reduced PAYE tax obligations under the proposed system, with more than 90% of workers in the public and private sectors benefiting from lower taxes. Meanwhile, top earners would face a slight increase in taxes, with rates reaching up to 25% for those earning over N50 million annually.

These reforms are designed to simplify the tax system, reduce the tax burden for most Nigerians, and address the disparity between personal and corporate tax regimes. Oyedele emphasized that while high-income earners would pay a greater share, the majority of Nigerians would benefit from tax reductions.

News

Court Orders Fast-Tracked Trial Of 15 Workers Held In Prison For 6 Yrs Over Patience Jonathan’s Missing Jewellery

The Bayelsa State High Court has ordered a fast-tracked trial for 15 domestic workers who have spent nearly six years in detention at the Okaka Correctional Centre, Yenagoa, without conviction, over missing jewellery belonging to former First Lady Patience Jonathan.

SaharaReporters gathered that the order came after the prosecution and defence teams reached a rare consensus during Thursday’s proceedings to fast-track the case, which has suffered deliberate and serial delays allegedly masterminded by Patience Jonathan’s private legal team.

“The court proceeded well today, and both parties have agreed to finish the case as soon as possible, with an accelerated hearing. So victory is coming,” a source close to the defence told SaharaReporters.

The 15 accused persons, most of whom were part of Mrs Jonathan’s domestic staff, were arrested in 2019 and have remained in detention without bail, with the case dragging on endlessly for years amid reports of consistent manipulation of court processes.

A previous report by SaharaReporters exposed a pattern of intentional court delays reportedly orchestrated by Mrs Jonathan’s private prosecutors, Ige Asemudara and Samuel Chinedu Maduba, both of whom have been consistently representing the former First Lady since 2019.

“The prosecutors are Ige Asemudara and Samuel Chinedu Maduba,” one of the sources confirmed.

“One of them comes from Lagos while the second travels in from Port Harcourt. They’ve been handling this case from day one, presenting witnesses who come to tell lies. One witness took almost two years,” a source earlier told SaharaReporters.

Sources alleged that Mrs Jonathan gave direct instructions to delay the proceedings.

“The aim is to frustrate the process and keep these innocent people in prison as long as possible. It’s an abuse of the legal system,” a source close to the courtroom told SaharaReporters.

The delay tactics reportedly included health excuses, unreachable witnesses, and repeated adjournments based on flimsy reasons. “Sometimes, Ige Asemudara would claim he is sick or his witness has work. Other times, he just asks for long adjournments,” said another insider.

Shockingly, the judiciary itself was not spared from complicity allegations. A source revealed that the presiding judge initially delayed hearing the bail applications, claiming she wanted to listen to some of the prosecution’s evidence first to determine the nature of the charges.

“When the case started in 2019, they all applied for bail,” the source said. “But the judge told their lawyers to wait so she could hear some evidence. After that, she shockingly denied bail, saying the offences were capital and therefore not bailable.”

Meanwhile, the Bayelsa State High Court has denied any involvement in the delays, recently restating its commitment to speedy justice and dismissing reports of suspects’ trials being delayed.

The court, in a reaction to reports that alleged that the trial of 15 domestic workers facing trial for burglary and theft of jewellery, was being delayed, said the claim was false.

It claimed that, according to available records, the matter had suffered delays due to multiple defence lawyers who must cross-examine witnesses, which had slowed down proceedings. It added that the case had also suffered several adjournments at the instance of counsel.

The delays have left the defence team and families of the detainees stunned, particularly since the prosecution reportedly failed to produce any convincing evidence to support the capital charges.

The affected persons are Williams Alami, Vincent Olabiyi, Ebuka Cosmos, John Dashe, Tamunokuro Abaku, Sahabi Lima, Emmanuel Aginwa, Erema Deborah, Precious Kingsley, Tamunosiki Achese, Salomi Wareboka, Sunday Reginald, Boma Oba, Vivian Golden and Emeka Benson.

They have remained behind bars without justice, caught in the web of power, influence, and a compromised legal process.

With the court finally conceding to an accelerated hearing, hope has once again sparked for the victims of this legal nightmare.

News

Catholic Church gives Anambra APC guber candidate rigid conditions for support

Barely 10 days after he emerged as the All Progressives Congress (APC) gubernatorial standard bearer for the November 8 gubernatorial poll in Anambra State, Prince Nicholas Chukwujekwu Ukachukwu has been given rigid conditions to receive the support of the Catholic Church in the state.

Sources told The Guardian that the basic conditions set before the APC governorship candidate include the selection of a deputy from the Catholic fold, and also that 60 per cent of his cabinet must be Catholics.

This is just as the APC governorship hopeful has been inundated by lobbyists for the position of running mate, even as he engaged with concerned APC stakeholders in the state in a bid to find common ground with various women groups agitating for gender parity.

The Guardian learned that the race for Ukachukwu’s running mate had been narrowed down between two former female Senators, Dr. Uche Lilian Ekwunife and Dr. Margery Okadigbo, who hail from the Central and North Senatorial Districts of the state, respectively.

Although both female politicians are Catholics, the factor of zoning is said to be impacting their chances, because while the more politically active Ekwunife hails from the populous Anambra Central District, Mrs. Okadigbo is from Anambra North, which has just served out eight years of governorship through Willie Obiano.

Also, the fact of her maiden community, Igboukwu in Aguata Local Council, and influence as the current Director General of South East Governors’ Forum is ticking in Ekwunife’s favour, as her candidacy is expected to help slice the votes in Old Aguata Union from where the incumbent Governor Chukwuma Soludo hails. (The Guardian)

News

NJC investigates 18 Imo judges over suspected age falsification

The National Judicial Council has launched a probe into 18 judges in the Imo State judiciary over allegations of age falsification, in a development raising fresh concerns about integrity and transparency within Nigeria’s judicial system.

The NJC, in a statement on Thursday by its Deputy Director of Information, Kemi Ogedengbe, confirmed that the allegations were being treated with utmost seriousness and were currently under review.

“Allegations of this nature require detailed investigation before any action can be taken,” Ogedengbe stated.

“The NJC is investigating the allegations and may take a decision by the end of the month. For now, we cannot act without completing our inquiries. The council will convene and make decisions on the matter.”

The investigation follows a petition submitted by a civil society group, Civil Society Engagement Platform, which described the matter as an “unprecedented breach of judicial integrity.”

The group alleged that the judges deliberately manipulated their birth records to either prolong their tenure or gain appointments within the judiciary.

In a letter addressed to the NJC Chairman and Chief Justice of Nigeria, Justice Kudirat Kekere-Ekun, the platform cited discrepancies in the judges’ official documents, including Law School registration forms, Department of State Services reports, and Nominal Rolls.

The petition, signed by CSEP’s Director of Investigation, Comrade Ndubuisi Onyemaechi, included what it described as compelling documentary evidence marked as Exhibits 001 to 018.

Among those named in the petition is Justice I. O. Agugua, who reportedly has two different birth dates—May 10, 1959, and May 10, 1960—and is also facing separate allegations of misconduct.

Justice C. A. Ononeze-Madu is alleged to have birth records stating both July 7, 1963, and July 7, 1965, while Justice M. E. Nwagbaoso is accused of presenting conflicting dates of birth—August 20, 1952, and August 20, 1962.

The remaining 15 judges also reportedly have varying inconsistencies in their personal data, a revelation that has intensified public scrutiny of the judiciary’s accountability mechanisms.

The NJC, which is constitutionally empowered to discipline judicial officers, is expected to reconvene soon to deliberate on the findings of its inquiry and take appropriate disciplinary actions where necessary.

The unfolding development comes amid mounting calls for institutional reforms to restore public trust in the judiciary and reinforce ethical standards across all arms of government.

-

News22 hours ago

News22 hours agoBREAKING: Unknown gunmen reportedly storm Senator Natasha’s family residence

-

News24 hours ago

News24 hours agoSAD! Again, Alleged Herdsmen Attack Three Benue Communities

-

News16 hours ago

News16 hours agoAbuja light rail project must be commissioned on May 29-Wike vows

-

News21 hours ago

News21 hours agoLawmaker Slams NBA Over Rivers Crisis, Demands Return of N300m

-

Politics24 hours ago

Politics24 hours agoPDP govs are jokers, can’t stop coalition train, Atiku boasts

-

News17 hours ago

News17 hours agoJust in: Alleged Herdsmen Armed With AK-47 Rifles Take Over Communities In Benue State

-

News7 hours ago

News7 hours agoTinubu Remains Engaged In Governance From Europe, Will Return After Easter – Presidency

-

News20 hours ago

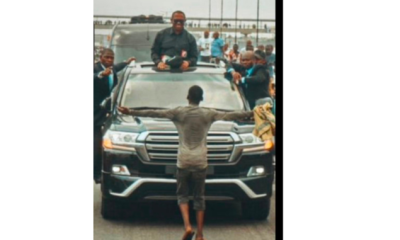

News20 hours agoFinally , Lagos Court frees Quadri, young Nigerian who stood before Obi’s convoy in viral photo