News

Oil Trade Sector Flags Key Concerns Over Tax Reform Restrictions

…as manufacturers association call for fair implementation

By Gloria Ikibah

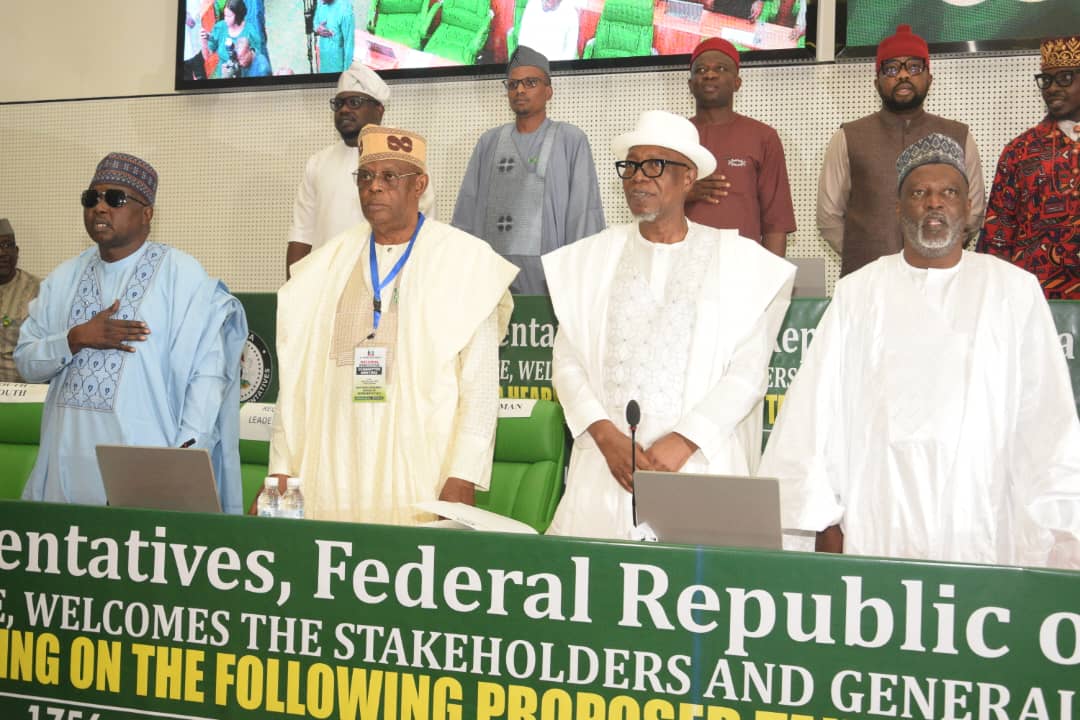

The Oil Producing Trade Sector (OPTS) has raised concerns over four key tax reform restrictions: limited access to tax incentives, increased effective tax rates, exclusion of recently announced incentives, and contract stabilization issues.

Speaking at the resumed 3-day public hearing on the Tax Reform Bills in Abuja, OPTS representative Oluwole Oladimeji highlighted specific concerns regarding Sections 57 and 85 of the proposed law. He emphasized the need for clarity on the minimum effective tax rate and investment utilization under the new framework.

“How do you work with Section 57? It introduces a minimum effective tax rate, but clarity is needed on how it will be computed,” Oladimeji stated.

He also pointed to the need for further explanation on three-year tariff limits and the application of tax credits in investment calculations.

“If I move on to another section of concern, on the three-year tariff limits, section 85, subsection 4, it talks about the three-year tariff limit on recouped tax credits. And this, if implemented, will reduce the benefits of the non-associated tax, as well as the due potential consequential fiscal derivatives.

“The third element on that list has to do with clarity that is needed with respect to section 85, subsection 1b, that says that the tax credit will not be applicable after the 10th year, i.e., before the 11th year. Our request regarding this is, one, that if we are going to have an even minimum effective tax rate at all, all taxes should be included in the basis for determining this. Secondly, that all tax credits will be utilized before the issue of any minimum tax, effective tax rate, will even arise at all.

“And then, with respect to the 11th year, that the current provision in section 85, subsection 1b should be extended by putting provision except carried forward from the 10th, so that if we are going to utilize tax credits in the 10th year, it will not be lost at all when we have only tax allowance that is also applicable. Then, another thing we would like to talk about is related to section 85, subsection 2, which provides that the incentives, tax incentives, will only be applicable to companies under the PIM. This will be the use of section 78, which covers section 78 through 88, and here we have the map incentives in there.

“So the way the thing is now, it will be only available to companies that are converted to PIM. And to cure this, we propose that there should be a remapping of the current section 78 to chapter 8, that includes incentives, so that one would not think that it is particularly restricted to companies under the particular tax regime. Because if this is not done, it will be introducing a limitation that is not in the executive order signed by the President in 2024.

“Another area of concern is section 92, subsection 3, which as currently drafted, says that the company shall be excluded from other incentives if it has utilized associated gas incentives. Now, gas incentives have typically determined a project, not a company. And the exclusion clause currently existing is overly broad and can give us other incentives.

“Another element of concern under this restriction on utilization of tax incentives has to do with section 104, which today knocks off investment tax credits enjoyable, allowable under section 4 of the deep offshore and inland leasing production sharing contract. What section 104 talks about today is only investment tax allowance.

“It has removed the investment tax credit that is currently a trade dispute. So our request is that there should be a retention of the current provision of section 4 of the deep offshore act that we are proposing. I will give you a second indicator to look at now, which has to do with increase in effective tax rates”.

In section 146, Oladimeji observed a sharp increase in the heat rate, rising from 7.5% to a progressive 15% in 2013. Additionally, sections such as 21, 27, 69, 94, and 97, along with sections 1–4, introduce penalties when P80 is due—whether on an expense or an asset that is not charged. This results in the affected expense or asset being non-deductible for tax purposes.

He furthermore noted that, the current wording of the law lacks clarity on how P80 will be treated, raising concerns that businesses might face penalties simply because of unclear payment terms. “The issue of P80 penalties has already been addressed in the Nigerian Tax Acquisition Regulations, particularly in Sections 64 and 121, which outline penalty conditions for unpaid P80.

“It is important to note that Nigeria already has a well-established legal framework for determining capital allowances and utilizing SAFE under existing laws, such as the Petroleum Profits Tax Act, the Petroleum Industry Act, the Deep Offshore and Inland Basin Production Sharing Contract Act, and CITA. The aim of the Tax Committee should be to simplify these laws, not introduce unnecessary complications.

“The oil and gas industry operates in collaboration with multiple government agencies, including the ATD, CDMA, FRS, and CBA, as well as partnerships with the NNPC. These collaborations involve project reviews, performance assessments, and audits. Therefore, tax reforms must prioritize simplification and efficiency, ensuring that regulatory burdens do not make doing business more difficult. Overloading companies with excessive tax obligations will ultimately increase costs and hinder economic growth”, he added.

The President of the Manufacturers Association of Nigeria (MAN), Otunba Francis Meshioye commended the federal government for adopting a structured and consultative approach to tax reforms. He noted that this method would facilitate early revenue generation and drive inclusive economic growth.

Meshioye expressed confidence that the proposed reforms under the Constitutional Reconciliation Bill would effectively tackle the long-standing issue of multiple and excessive taxation.

However he highlighted the growing concern over arbitrary levies imposed by regulatory bodies at various levels of government, as well as the unlawful collection of taxes and fees by non-state actors, which continue to create an unpredictable business environment.

“We look forward to the implementation of these reforms to address the persistent challenges of high taxation and restrictive policies. It is our hope that this will usher in a new era where the National Assembly refrains from approving arbitrary levies on businesses to finance government agencies,” he stated.

He cited a recent instance where businesses were required to contribute a percentage of their market capitalization to sustain certain financial indices. He warned against such measures, emphasizing that they place undue strain on businesses.

Meshioye welcomed the planned reduction of the Corporate Income Tax (CIT) rate from 30% to 27.5% in 2025 and 25% in 2026, aligning with global trends toward lower income tax rates. He described this move as a positive step that would ease financial pressure on manufacturers, attract investment, and reinforce the government’s commitment to reducing the cost of doing business in Nigeria.

Addressing concerns related to tax rates in free trade zones, he stressed the importance of maintaining clarity and ensuring that tax policies align with existing laws. He argued that rather than undermining the incentives for businesses operating within the zones, a fair tax structure would create a level playing field between companies within and outside these zones, particularly in relation to sales into the customs territory.

Meshioye underscored the need for a balanced approach to taxation, ensuring that Nigeria’s trade policies remain competitive while protecting the country’s tax base.

He pointed to Section 16 of the Real Tax Clause as a crucial reference for maintaining fairness and economic stability.

The hearing continues on Friday when the Nigerian National Petroleum Company Limited will present their observations.

News

Weeks to 2nd anniversary, Niger deputy gov, plans to resign, move out personal effects

There are growing reports that Yakubu Garba, the Deputy Governor of Niger State, is on the brink of stepping down from his position, with sources indicating that he has already begun moving his personal belongings out of his official residence.

According to Daily Nigerian, unusual activity indicating a move by the deputy governor to resign was sparked by movements around his official residence over the weekend, suggesting preparations for his departure. Sources close to the deputy governor revealed that he has substantially moved his belongings to his private home, signaling that he could resign at any moment.

The governor and the Secretary to the State Government, SSG are not in the country, the camp of the governor has put pressure on staff in the SSG’s office not to acknowledge any letter of resignation should Garba go ahead to submit it.

As of now, he has moved most of his belongings out of the official residence. He is expected to resign soon,” a source told Daily Nigerian.

Despite these signs, it is unclear if Garba has changed his mind after a reported meeting with some traditional rulers who visited him on Sunday night in an attempt to persuade him to stay in office. Details of the discussions remain unclear, and it is unknown whether they had any impact on his decision.

Insiders suggest that the deputy governor’s decision to resign is driven by a growing rift with the state’s governor, Umaru Bago. According to sources, Garba has been repeatedly sidelined and disrespected within the administration, despite being elected on the same ticket as the governor.

The tension between Garba and Governor Bago intensified recently over the upcoming local government elections. Garba, who hails from Shiroro, had endorsed Babangida Kudodo as the preferred candidate for the APC in the area. However, the final list released by the party’s headquarters featured a different candidate, Isyaku Bawa, a move reportedly made on the governor’s orders.

Further fueling the rift, sources claim that Garba’s influence within the government has diminished, with even his monthly allowances being drastically reduced. “He has been excluded from major government decisions, and his role has been diminished despite his significant contributions to the party and his loyalty to the governor. Even his financial entitlements have been cut,” said an anonymous source.

Despite the widespread speculation, Garba has yet to publicly confirm any plans to resign. His press secretary, Ummikhultume Abdullahi, however, denied any knowledge of a resignation, adding that she had recently met with Garba at his official residence, and he had not yet fully moved out.

As the situation unfolds, many are left wondering whether Garba’s resignation will indeed take place or if ongoing discussions with influential figures in the state will convince him to stay in office.

News

Insecurity: BUDA urges govt to quickly rescue Baruten from terrorists

The Batombu Unity and Development Initiative, Abuja (BUDIA), has raised an alarm over invasion of Baruten in Kwara state by bandits and terrorists, demanding for urgent government intervention.

This was contained in a statement issued and signed by its President, Nasir Abubakar Othman and endorsed by the Board of Trustees.

The nonprofit organization dedicated to advocating for the welfare and development of the Batombu people, expresses grave concern over the worsening insecurity caused by escalating terrorism, which pose a critical threat to lives and properties in Baruten and Kaiama Local Government Areas of Kwara State.

“In recent months, communities in Baruten and Kaiama Local Government Areas, located near Kainji Lake National Park, have endured a surge in violent killings These blood birth has led to tragic loss of lives, widespread destruction of properties and a growing climate of fear and cessation of farming and economic activities.

The violence has displaced and disrupted numerous families, local businesses and agricultural activities, as well as severely destabilized and displaced the affected areas.

BOARD OF TRUSTEES

ALH. YUSUF TUNKU

Chairman

PROF. UMARU SEMO ISHIAKU Member

RT. HON. IBRAHIM ISA BIO

Member

RT. HON. ZAKARI MOHAMMED Member

RT. HON. MOHAMMED OMAR BIO

Member

IBRAHIM ALIYU KPEROGI

Member

SABIYABE YAHAYA Member

EXECUTIVES

BARR. ABUBAKAR NASIR OTHMAN

President

ABDULLAHI KABIR

Vice President

MOHAMMED JIBRIL FCA

General Secretary

ABDULLAHI HALIDU ALIYU

MADAKI’N GWANARA Treasurer

BARR. ABUBAKAR KOTO ALIYU

Legal Adviser

HAJIA AISHA AHMED OYORU President Women Wing

The towns of Chikanda, Yashikira, Kuburufu and Gure are now overwhelmed by the influx of internally displaced persons (IDPs), the majority of whom are women, children, and elderly individuals.

This critical situation calls for immediate intervention from the government and security agencies to restore order and protect vulnerable populations in these communities.

BUDIA commends the Kwara State Governor, Alhaji Abdulrahman Abdulrazaq, along with senior military officials and representatives of security agencies, for visiting Kaiama as part of their ongoing assessment efforts.

However, we strongly urge the government to extend similar assessment visits to the troubled areas of Baruten Local Government Area to address the urgent needs of affected communities and adopt a comprehensive strategy to resolve this crisis.

Similarly, we call on all residents of Baruten and Kaiama to remain law abiding and vigilant, promptly reporting any suspicious activities or unfamiliar movements of strangers to security agencies stationed within their communities and to traditional rulers.

BUDIA stands in solidarity with all sons and daughters of Baruten and Kaiama as we urgently appeal for decisive military intervention to end the violence and restore peace and stability in our communities.

News

Kano Judiciary Takes Action Against Judges, Suspend Registrars Over Misconduct

The Kano State Judicial Service Commission has taken disciplinary action against two court registrars and two Upper Shari’a Court judges over misconduct.

This was contained in a statement issued by the spokesperson for the Kano State Judiciary, Mr Baba Jibo-Ibrahim, on Monday in Kano.

He said that the decision was part of the resolutions reached at the JSC’s 80th meeting held on April 22, 2025.

He said the commission, in line with its mandate, adopted the recommendations of the investigation carried out by the Judiciary Public Complaints Committee and resolved to suspend and issue formal warnings to them.

Those suspended are Ibrahim Adamu, Principal Registrar II of the Kano High Court, and Maigida Lawan, Principal Registrar of the Sharia Court of Appeal.

Upper Sharia Court Judges Alkali Mansur Ibrahim and Nasiru Ahmad were issued warnings.

Jibo-Ibrahim said Adamu, a Principal Registrar II of the Kano High Court of Justice, was suspended without pay for six months.

The statement added, “His promotion is deferred after a finding that confirmed he verbally assaulted and attempted to use physical force against his superior officer, amounting to gross misconduct in violation of the provisions of the Kano State Civil Service Rules 2004 and the JSC Regulations.

“This is the second time Adamu has appeared before an investigative committee for violence-related actions at work, and he has been issued a series of queries.”

The commission found Adamu’s actions to be grossly unbecoming of his office and imposed the appropriate disciplinary sanctions.

The statement said Lawan, a Principal Registrar of the Kano State Sharia Court of Appeal, was suspended without pay for six months, immediately, after being found guilty of demanding and accepting improper gratification under false pretences.

“The commission adopted the recommendation of the JPCC, and Lawan was demoted by one grade level (from GL-13 down to GL-12),” the statement read.

He said that the commission issued a warning to Malam Mansur Ibrahim, an Upper Shari’a Court judge, after evidence confirmed he used insulting and abusive language towards a litigant.

The JSC also issued a formal warning to Nasiru Ahmad, an Upper Shari’a Court judge, for ordering the detention of a judgment debtor in a manner that suggested personal interest and compromised judicial impartiality.

-

News8 hours ago

News8 hours agoJust in: Senator Natasha tenders satirical ‘apology’ to Akpabio

-

News24 hours ago

News24 hours agoGunmen abduct two senior LG workers, three others

-

News5 hours ago

News5 hours agoUNUSUAL! Without invitation, Police declared me wanted — Daughter of ABC Transport owner

-

News17 hours ago

News17 hours agoBenue LG chairman gives Fulanis 48hrs to leave all farmlands

-

News23 hours ago

News23 hours agoFrancophone Ambassadors, Nigeria Unite To Fight Against Climate Change

-

News3 hours ago

News3 hours agoInsecurity: BUDA urges govt to quickly rescue Baruten from terrorists

-

News1 hour ago

News1 hour agoWeeks to 2nd anniversary, Niger deputy gov, plans to resign, move out personal effects

-

News17 hours ago

News17 hours agoFive suspected kidnappers eliminated by police in Delta