News

Nigeria to repay $500m health loan in 25 years – World Bank

The Federal Government will begin repaying a $500m concessional loan secured from the International Development Association from 2029 to 2054.

This is according to a financing agreement signed between Nigeria and the World Bank’s lending arm, which was obtained by Sunday PUNCH.

The loan, which falls under the Nigeria Primary Healthcare Provision Strengthening (also referred to as HOPE-PHC) Programme, is aimed at improving the country’s primary healthcare services, particularly maternal and child health, emergency medical care, and pandemic preparedness.

The funds will be managed by the Federal Ministry of Health and Social Welfare, alongside key agencies such as the National Primary Healthcare Development Agency, the National Health Insurance Authority, and the Nigeria Centre for Disease Control and Prevention.

State governments will also be involved in implementation through their respective Ministries of Health, Primary Healthcare Development Boards, and other agencies.

Details of the repayment structure show that the loan will be serviced twice a year, with instalments due every April 15 and October 15.

Between 2029 and 2049, Nigeria will repay the principal at a rate of 1.65 per cent annually, after which the rate will increase to 3.40 per cent from 2049 until 2054.

The loan also attracts a commitment charge of 0.5 per cent on unwithdrawn funds and a service charge of 0.75 per cent on withdrawn balances.

However, the total repayment cost may fluctuate due to currency conversion adjustments. The funds will be disbursed based on specific healthcare performance indicators, ensuring that money is released only upon achieving measurable results.

These indicators include increasing access to primary healthcare services, expanding emergency obstetric and neonatal care, improving the supply of essential medicines, and strengthening Nigeria’s pandemic response framework.

A significant portion of the funds will also be used to enhance digital health infrastructure, improve climate resilience in the health sector, and ensure greater enrolment of vulnerable populations in health insurance schemes.

Despite the concessional terms, concerns have been raised over Nigeria’s growing external debt and rising debt servicing obligations. Given the continued depreciation of the naira, the real cost of repayment in local currency could rise significantly over the loan’s 25-year repayment duration.

The loan was approved on September 26, 2024, with an expected operational period starting in fiscal year 2025. The closing date is set for June 30, 2029, indicating that the programme will run for about four years, if the closing date is not extended.

However, the country will spend about 25 years repaying the loan from the proposed closing of 2029 to 2054.

The PUNCH earlier reported that the World Bank may approve a total of $1.13bn in loans for Nigeria before the end of March 2025 as part of ongoing efforts to support the country’s economic resilience, health security, and education reforms.

Among the projects set for negotiation is the Accelerating Nutrition Results in Nigeria 2.0 programme, valued at $80m, which is expected to be approved by March 31, 2025.

This initiative is aimed at improving nutrition outcomes, particularly among vulnerable groups, by enhancing access to essential dietary support and reducing malnutrition rates.

Another project in the negotiation phase is the Community Action for Resilience and Economic Stimulus Programme, which has a commitment value of $500m and is expected to be approved by March 24, 2025.

The project is designed to provide economic stimulus for community-driven initiatives to strengthen economic resilience and growth.

The HOPE for Quality Basic Education for All programme, with a proposed funding of $552.2m, is also at the negotiation stage and is expected to secure approval by March 31, 2025.

This initiative seeks to improve the quality of basic education by addressing infrastructure deficits, enhancing teacher training, and increasing educational accessibility across the country.

The potential approval of these loans comes at a time when Nigeria continues to grapple with economic challenges, including foreign exchange liquidity constraints, fiscal deficits, and mounting debt servicing obligations.

Nigeria expended a total of $5.47bn on external debt servicing between January 2024 and February 2025, according to data from the Central Bank of Nigeria.

The figures, published on the apex bank’s website, indicate the growing burden of debt obligations on the country’s external reserves and fiscal stability.

News

Parents of 9 kidnapped kids beg Bauchi gov for assistance

Parents of the nine kidnapped children in Miya village in Ganjuwa Local Government Area of Bauchi State have appealed to Governor Bala Mohammed to intervene and assist them in rescuing their wards.

The parents made the plea while speaking with journalists at the NUJ Press Centre in Bauchi on Wednesday.

The spokesman of the parents, Musa Kwana, who is the traditional ruler of the community stated that unless the governor and his wife Aisha Bala Mohammed intervene, they may not see their children again.

Kwana gave the names of the children abducted as Sangi Turaki, Cikawa Turaki, Danjuma Turaki, Yangawa Dogo Talangu, Bebi Bawa, Jumolo Dangaladima, Kangaya Kori, Jummai Adamu and Alti Shehu, all of Miya village in Ganjuwa LGA of Bauchi State.

The spokesman said, “Now that we have tried everything humanly possible for several years since the incident happened in 2014 and could not get a positive result, we want the governor and his wife to step in and wipe our tears. We want to see our children.”

News

Police arrest woman for allegedly trying to sell stolen 3-year-old boy in Abuja

The Federal Capital Territory (FCT) Police Command has arrested a woman for allegedly attempting to sell a 3-year-old boy she claimed to be her son for N1.5 million.

Police sources told security analyst, Zagazola Makama that the suspect, identified as Hana Yusuf of Kpaduma II Village, approached a resident, Isaac Tom, on March 18, 2025, requesting his help in finding a buyer for the child.

Tom, disturbed by the request, reported the matter to the Asokoro Police Division.

Acting swiftly, police operatives set up a sting operation, with ASP Promise Gandi posing as a potential buyer.

The suspect was lured to a meeting point, where she was arrested, and the child was safely rescued.

Preliminary investigations confirmed that the child, Yusuf Ibrahim, is the son of Mr. and Mrs. Mariam Ibrahim of Kpaduma II, Guzape.

The police have since reunited the boy with his parents while further investigations continue.

The suspect remains in custody and is undergoing interrogation.

Authorities say she will be charged in court upon completion of the investigation.

News

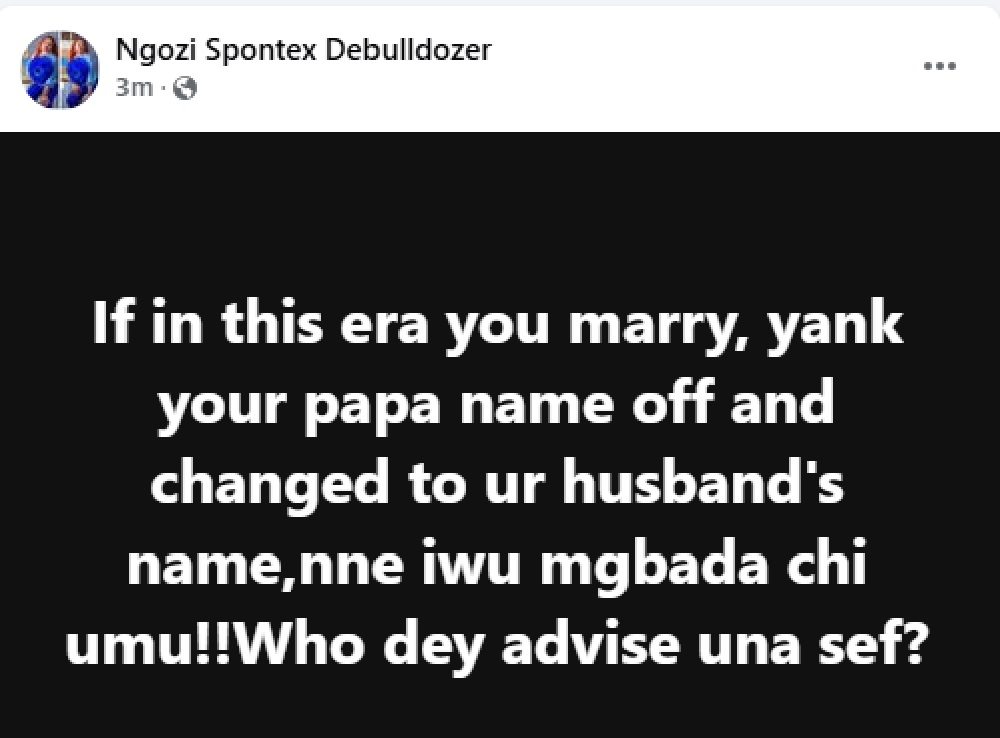

Who is advising you? – Nigerian lady criticizes women who discard their father’s name after marriage

A Nigerian lady, Ngozi, has criticized women who remove their father’s names after marriage.

“If in this era you marry, yank your papa name off and changed to ur husband’s name, nne iwu mgbada chi umu!!Who dey advise una sef?,” she wrote in a Facebook post on Thursday.

-

News3 hours ago

News3 hours agoBUSTED! CAC confirms Kogi group demanding Natasha’s recall is FAKE

-

News22 hours ago

News22 hours agoJUST-IN: Police Nab Niger Delta Congress President After Calls for Protest Against Emergency Rule

-

News22 hours ago

News22 hours agoHold Tight To One Wife – Emir Advises Muslim Men

-

News22 hours ago

News22 hours agoPastor Adeboye Cries Out Against Using His Fake AI-Generated Content to Scam People (PHOTO)

-

News22 hours ago

News22 hours agoLanding cost of petrol jumps to N885 per litre

-

News16 hours ago

News16 hours agoMinister kicks against shooting of NIS officer, vows tough action against Chinese firm

-

News16 hours ago

News16 hours agoPresident Tinubu To Mark 73rd Birthday With Special Prayer At Abuja Mosque -Spokesman

-

News16 hours ago

News16 hours agoBenue AG orders immediate treatment of 10 year old boy bitten by a snake + Photos