News

Macron’s call for elections in France adds to fears of financial woes

Investors made clear on Tuesday the depth of their concerns over President Emmanuel Macron’s gamble to call for new elections in France, driving up the nation’s borrowing costs, pushing down stock prices and prompting the Moody’s ratings agency to warn it may downgrade French sovereign debt as risks of political instability rise.

Mr. Macron’s dissolution of the lower house of Parliament on Sunday after his party was battered by Marine Le Pen’s far-right party in European Parliament elections has ignited concerns that the government could grind to a stalemate. The turmoil has focused attention on France’s fragile finances, and the prospect of legislative gridlock that could undermine the government’s ability to address it.

“This decision will not ease the economic challenges facing the country,” Philippe Ledent, senior economist at ING Bank, wrote in a note to clients. Public finances and the performance of the French economy will be “at the heart of the electoral campaign,” he added.

As the head of France’s conservative party on Tuesday called for an alliance with the far right to beat back Mr. Macron ahead of two rounds of national voting that will start on June 30, investors punished French stocks, sending the Paris Bourse down 1.33 percent, after a sharp fall on Monday.

The yield on France’s 10-year government bonds rose sharply for a second day amid investor unease over France’s ability to manage its finances. Bond yields are indicative of the government’s borrowing costs, and elevated levels would make it harder to stimulate the economy and manage the country’s debt.

France is suddenly facing uncharted territory. The prospect that Ms. Le Pen’s party, the National Rally, could triumph in the hastily called legislative elections — which could weaken Mr. Macron’s grip on power and possibly force him to govern with a prime minister from his political opposition — risks piling economic havoc atop the political toll.

“Fiscal and domestic economic policies are set by the government, which needs a majority for its legislation in Parliament,” said Holger Schmieding, chief economist at Berenberg Bank in London. “For a fiscally challenged France, new parliamentary elections add a level of uncertainty.”

The turmoil comes with the French economy in a rough patch, as the wars in Ukraine and Gaza, economic slowdowns in Germany and China and record-high interest rates take a bigger-than-expected toll on growth. Mr. Macron’s government recently warned that growth would be weaker than expected this year, and his finance minister, Bruno Le Maire, was charged with finding more than 20 billion euros in savings quickly as the nation’s finances deteriorate.

After the government spent lavishly during the pandemic to support the economy and shield consumers from high energy prices, French debt has climbed to 3 trillion euros, or 110.6 percent of gross domestic product. The government deficit for 2023 stands at €154 billion, accounting for 5.5 percent of gross domestic product, one of the worst performances in the eurozone.

France is now at risk of breaching European Union budget rules that restrict government borrowing and is likely to be sanctioned next week by the European Commission, the E.U. executive branch. On Tuesday, Mr. Le Maire warned that France could be thrown into a “debt crisis” if Ms. Le Pen’s party gained power.

Paris had been increasingly concerned about French debt being downgraded by international rating agencies, which increases borrowing costs. On May 31, Standard & Poor’s downgraded France’s debt rating, rattling the government, whose economic credibility has been one of its main political assets.

Then on Tuesday, Moody’s warned that Mr. Macron’s maneuver could deepen France’s financial woes by creating “a polarized political environment.” By dissolving the National Assembly, Mr. Macron had increased the risks that France will not be able to bring its budget back in line, raising the prospect of a further downgrade.

“There is a high risk of greater political instability in the future,” the agency said, adding that Parliament could be thrown into political gridlock for at least a year because the winner of the upcoming elections was unlikely to have an absolute majority. That could mean that almost any legislation Mr. Macron puts forward would be blocked, including measures to cut government spending needed to avoid breaching the European Union’s fiscal rules.

The danger is that France’s high debt balloons even further, which could lead to a faster-than-expected rise in interest payments, Moody’s added.

Ms. Le Pen and her firebrand protégé, Jordan Bardella, have backed higher public spending to address issues that have driven waves of voters to the National Rally party, especially a loss of purchasing power brought by high inflation and energy costs, and demand for job creation in areas that have been devastated by industrial losses to globalization.

Mr. Macron has sought to play the role of a European leader during Russia’s invasion of Ukraine, but the National Rally has assiduously been courting voters, especially in rural areas.

Ms. Le Pen’s party won by large margins this weekend in places that have lost jobs to deindustrialization. The National Rally has grabbed bigger audiences for its pledges to bolster purchasing power, create employment through “intelligent” protectionism and shield France from European policies that expanded globalization.

Mr. Macron has been trying to counter the rise of National Rally, which has seized on the economic slowdown, immigration issues and regulatory requirements imposed by the European Union to attract disenchanted voters.

Now in the middle of his second term, Mr. Macron has sought to show that he was moving France back to business, burnishing its image especially with foreign investors. He has overhauled France’s rigid labor code to make it easier for companies to hire and fire and is streamlining France’s generous unemployment system.

He is also overseeing an enormous subsidized industrialization program that has attracted hundreds of billions of euros in commitments from multinational companies. These include the creation of four big battery plants for electric cars in northern France and a beefed-up pharmaceutical industry with new investments from Pfizer and Novo Nordisk, which will expand production of its popular Ozempic and Wegovy weight-loss drugs.

Last month, Mr. Macron hosted hundreds of global chief executives at the Palace of Versailles for an annual business conference that drew large new pledges, including a €4 billion investment by Microsoft for a new data center in eastern France.

Even so, France’s economic slowdown has been noticeable, particularly to voters who have swung to Ms. Le Pen’s party. Many feel inequality has widened, rather than narrowed, as Mr. Macron pledged, in the seven years since he took office.

News

Mbah mourns ,says Christian Chukwu was a ‘football icon’

By Kayode Sanni-Arewa

Enugu Governor Peter Mbah has expressed deep grief over the passing away of former Super Eagles skipper and coach, Christian Chukwu, describing him as a football icon, titan, and phenomenon.

Reacting to the development on Saturday Mbah said: “I received with a deep sense of loss the passing away of Chairman Christian Chukwu. It is a personal loss to us as Ndi Enugu, his home state, and indeed to Nigeria as a nation and Africa as a continent.

“Christian Chukwu was a national icon, a football titan, field marshal, and phenomenon. His exploits as a footballer united the country across ethnic divides and creed.

He was patriotism personified, serving the nation and Africa unreservedly both as a player and coach of the highly successful Rangers International Football Club of Enugu and Super Eagles of Nigeria, which he captained to victory as Green Eagles at the 1980 Africa Cup of Nations, AFCON. He also coached the Harambee Stars, Kenya’s senior male national team, among others.

“Chairman, as he was fondly called, gave his all not only to the nation but to the rest of Africa. He wrote his name in gold in the annals of the history of Nigerian and African football.

Our dear legend has gone the way of all mortals, but the fond memories and the pride he gave Ndi Igbo and Nigeria as a whole will be cherished forever.

“My heart goes out to his family, Ndi Enugu, the Nigerian sports community and the entire nation over this irreplaceable loss. May the good Lord grant his soul eternal repose.”

News

Just in: Boko Haram IED Blast Kills Seven Along Maiduguri-Damboa Road

By Kayode Sanni-Arewa

No fewer than seven people lost their lives on Saturday following the detonation of an Improvised Explosive Device (IED) planted by Boko Haram terrorists in Borno State.

The deadly incident occurred along the Maiduguri-Damboa Road, a notorious route that cuts through the Sambisa Forest—an area long plagued by insurgent activities.

The victims were part of a convoy of vehicles being escorted by the military from Damboa to Maiduguri.

According to eyewitness accounts and local sources, the explosion struck as the convoy—organized to provide safe passage through the volatile region—was underway. Several other passengers sustained varying degrees of injuries and were rushed to a hospital in Maiduguri for urgent treatment.

The Maiduguri-Damboa Road serves as a vital link between the state capital and several local government areas in southern Borno, including Chibok and Gwoza.

For years, the route remained closed to civilian traffic due to persistent terrorist threats. However, under the administration of Governor Babagana Zulum, the road was reopened, with military escorts deployed to accompany travelers twice weekly after clearing the area for explosives.

Saturday’s attack raises fresh concerns about the safety of the corridor, despite consistent military presence. The blast also comes just days after Governor Zulum publicly raised alarm over renewed Boko Haram activity in the state, highlighting the persistent threat the group poses to peace and development in the region.

Authorities are yet to release an official statement on the incident, while investigations and security operations in the area continue.

News

Insecurity: Criminals Cart Away NSA Ribadu’s Office Hilux During Juma’at Prayer In Abuja

By Kayode Sanni-Arewa

The Federal Capital Territory (FCT) Police Command has initiated a search following the theft of a black Toyota Hilux vehicle belonging to the Office of the National Security Adviser (ONSA), Nuhu Ribadu, which was stolen during Friday’s Juma’at prayers in Abuja.

It was gathered that the vehicle was parked around 1:05pm opposite the Abuja Municipal Area Council (AMAC) complex in Area 10, while the official attended prayers at a nearby mosque.

Security source, Zagazola Makama, disclosed the incident via his X (formerly Twitter) handle, revealing that the ONSA official returned from the mosque only to find the vehicle missing.

According to him, a sources said the theft was immediately reported to the Garki Police Division at approximately 2:00 p.m., leading to a swift response by law enforcement.

Meanwhile, the FCT Police Command promptly activated a stop-and-search operation at various checkpoints and across all entry and exit points in the capital city.

Police authorities confirmed that investigations are ongoing and all efforts are being made to apprehend the culprits and recover the vehicle.

The Command said it had intensified efforts to track down the fleeing suspects and recover the stolen Hilux.

-

News8 hours ago

News8 hours agoInsecurity: Criminals Cart Away NSA Ribadu’s Office Hilux During Juma’at Prayer In Abuja

-

News17 hours ago

News17 hours agoSad! Explosion rocks Lagos

-

News17 hours ago

News17 hours agoWe only had lunch with Buhari not 2027 politics -El-Rufai

-

News17 hours ago

News17 hours agoParts of Abuja, Niger in total darkness -AEDC confirms

-

News16 hours ago

News16 hours agoIbas gives reasons why Sole Administrators were appointed for Rivers councils

-

News11 hours ago

News11 hours agoOERAF Rounds Up Late Chief Ekuogbe Rowland Akpodiete’s remembrance with Novelty Match

-

News15 hours ago

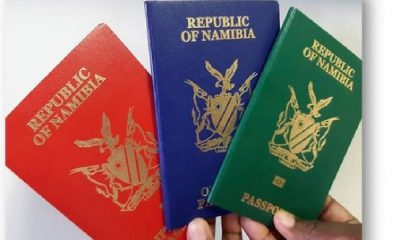

News15 hours agoFive countries with easy work visas in 2025

-

News15 hours ago

News15 hours agoUS embassy announces new requirements for visa interviews for Nigerian applicants