News

First Bank Shareholders In Dilemma As Ownership Tussle Continues, Hindering Recapitalisation

Shareholders of First Bank of Nigeria (FBN) Holdings, Nigeria’s oldest financial institution, are growing increasingly anxious as recent crises and scandals have caused the company’s share price to plummet by over 50% in five months, POLITICS NIGERIA reports.

FBN Holdings, which traded at ₦43.95 per share on March 19, has seen its share price fall to ₦20.35 as of Wednesday, according to data from the Nigerian Securities Exchange (NGX).

This dramatic decline is largely attributed to a series of controversies that have embroiled the company’s management and operations in recent months.

Asides the controversies surrounding the ownership of its controlling stake, a litany of court cases pending determination and a fraud case that led to the dismissal of over a hundred staff have raised concerns for investors holding the bank’s shares, sources confided in this newspaper.

Recapitalisation Stalled

These developments have cast a cloud of uncertainty on the bank’s recapitalisation plans as many of its competitors have completed a fresh capital raise in line with the standard set by the Central Bank of Nigeria (CBN).

Recall that the Apex bank, under a new threshold released in March, stated that commercial banks with international authorization must have at least 500 billion naira, leaving banks with two years to meet the new standard.

FBN Holdings, although announced plans to raise some N300 billion through issuance of shares via a public offering in April, the Annual General Meeting (AGM) which is meant to approve it, is yet to take place.

A Lagos Federal High Court halted an AGM initially scheduled for August 22. The meeting is now postponed till September 3, according to a notice published on the NGX.

Investors are worried that these ongoing issues could lead to a further decline in the bank’s fortunes.

“These are the kind of issues that led to the fall of Skye Bank. If care is not taken, many local and foreign investors will pull out,” said an investor who has held shares in the company since 1995. He added, “The troubles are piling up day by day and it seems there is no end in sight. It is even difficult to hold an ordinary Annual General Meeting, not to mention raising capital.”

Ownership Dispute

The ongoing dispute over the ownership of FBN Holdings’ controlling stake has been a major cause of concern for investors. In December 2021, billionaire Femi Otedola became the company’s single largest shareholder.

However, he was soon displaced by Barbican Capital Limited, a company owned by Oba Otudeko, which now claims to hold a 15.01% stake in the company.

Barbican Capital has filed a lawsuit against FBN Holdings, challenging the reduction of its shareholding from 13.61% in December 2023 to 8.67%. The company submitted evidence from the Central Securities Clearing System (CSCS) to support its claim, showing that it actually owns 5.39 billion shares, representing 15.01% of the lender’s total shares.

This ownership dispute, along with the legal battles surrounding it, has further destabilised investor confidence.

‘Illegal’ 2023 AGM

Despite a court order prohibiting FBN Holdings in 2023, the bank proceeded with the meeting and this has resulted in multiple lawsuits filed by aggrieved shareholders.

One of the plaintiffs, Kujenya Olayiwola Yusuf, prayed the court to nullify all decisions made during the August 223 AGM, including the registration of the new share capital.

In another case related to the controversial AGM, a minority shareholder Yetunde Olowoyeye, argued that all the resolutions passed during the AGM are null and void, having been forged in the fires of judicial contempt.

The outcome of these cases, some shareholders say, will impact on the future of the company as a reversal of the decisions made at the AGM could set the bank on a path of collapse.

40 billion Fraud

While there is so much going on in the FBN Holding board room, the banking hall is also not spared of scandals. The bank sacked at least 120 employees after discovering a ₦40bn fraud, Tech Cabal reported in August.

Tijani Muiz Adeyinka, a manager on the operations team who reportedly diverted ₦40 billion over two years, has been on the run for weeks after his heist was discovered in May. The employees dismissed were accused of laxity in carrying out their duties and were told they should have spotted the fraud earlier.

The Tech Cabal report added; “Several employees were questioned by the Nigerian Police Force (NPF) and detained at the Lion’s Building for at least six hours, one person with direct knowledge of the incident said. Those employees needed to post bail before they were released. Restrictions have been placed on all their personal accounts except their First Bank accounts. “

Meanwhile, Lagos-based banking and finance consultant, Hakeem Morakinyo, told POLITICS NIGERIA that FBN Holdings is in a precarious position as these crises continue to unfold.

“The coming weeks will be critical in determining whether the bank can resolve its internal conflicts and restore investor confidence or if it will follow the same path as other failed institutions,” he said.

Credit: POLITICS NIGERIA

News

Court Orders Fast-Tracked Trial Of 15 Workers Held In Prison For 6 Yrs Over Patience Jonathan’s Missing Jewellery

The Bayelsa State High Court has ordered a fast-tracked trial for 15 domestic workers who have spent nearly six years in detention at the Okaka Correctional Centre, Yenagoa, without conviction, over missing jewellery belonging to former First Lady Patience Jonathan.

SaharaReporters gathered that the order came after the prosecution and defence teams reached a rare consensus during Thursday’s proceedings to fast-track the case, which has suffered deliberate and serial delays allegedly masterminded by Patience Jonathan’s private legal team.

“The court proceeded well today, and both parties have agreed to finish the case as soon as possible, with an accelerated hearing. So victory is coming,” a source close to the defence told SaharaReporters.

The 15 accused persons, most of whom were part of Mrs Jonathan’s domestic staff, were arrested in 2019 and have remained in detention without bail, with the case dragging on endlessly for years amid reports of consistent manipulation of court processes.

A previous report by SaharaReporters exposed a pattern of intentional court delays reportedly orchestrated by Mrs Jonathan’s private prosecutors, Ige Asemudara and Samuel Chinedu Maduba, both of whom have been consistently representing the former First Lady since 2019.

“The prosecutors are Ige Asemudara and Samuel Chinedu Maduba,” one of the sources confirmed.

“One of them comes from Lagos while the second travels in from Port Harcourt. They’ve been handling this case from day one, presenting witnesses who come to tell lies. One witness took almost two years,” a source earlier told SaharaReporters.

Sources alleged that Mrs Jonathan gave direct instructions to delay the proceedings.

“The aim is to frustrate the process and keep these innocent people in prison as long as possible. It’s an abuse of the legal system,” a source close to the courtroom told SaharaReporters.

The delay tactics reportedly included health excuses, unreachable witnesses, and repeated adjournments based on flimsy reasons. “Sometimes, Ige Asemudara would claim he is sick or his witness has work. Other times, he just asks for long adjournments,” said another insider.

Shockingly, the judiciary itself was not spared from complicity allegations. A source revealed that the presiding judge initially delayed hearing the bail applications, claiming she wanted to listen to some of the prosecution’s evidence first to determine the nature of the charges.

“When the case started in 2019, they all applied for bail,” the source said. “But the judge told their lawyers to wait so she could hear some evidence. After that, she shockingly denied bail, saying the offences were capital and therefore not bailable.”

Meanwhile, the Bayelsa State High Court has denied any involvement in the delays, recently restating its commitment to speedy justice and dismissing reports of suspects’ trials being delayed.

The court, in a reaction to reports that alleged that the trial of 15 domestic workers facing trial for burglary and theft of jewellery, was being delayed, said the claim was false.

It claimed that, according to available records, the matter had suffered delays due to multiple defence lawyers who must cross-examine witnesses, which had slowed down proceedings. It added that the case had also suffered several adjournments at the instance of counsel.

The delays have left the defence team and families of the detainees stunned, particularly since the prosecution reportedly failed to produce any convincing evidence to support the capital charges.

The affected persons are Williams Alami, Vincent Olabiyi, Ebuka Cosmos, John Dashe, Tamunokuro Abaku, Sahabi Lima, Emmanuel Aginwa, Erema Deborah, Precious Kingsley, Tamunosiki Achese, Salomi Wareboka, Sunday Reginald, Boma Oba, Vivian Golden and Emeka Benson.

They have remained behind bars without justice, caught in the web of power, influence, and a compromised legal process.

With the court finally conceding to an accelerated hearing, hope has once again sparked for the victims of this legal nightmare.

News

Catholic Church gives Anambra APC guber candidate rigid conditions for support

Barely 10 days after he emerged as the All Progressives Congress (APC) gubernatorial standard bearer for the November 8 gubernatorial poll in Anambra State, Prince Nicholas Chukwujekwu Ukachukwu has been given rigid conditions to receive the support of the Catholic Church in the state.

Sources told The Guardian that the basic conditions set before the APC governorship candidate include the selection of a deputy from the Catholic fold, and also that 60 per cent of his cabinet must be Catholics.

This is just as the APC governorship hopeful has been inundated by lobbyists for the position of running mate, even as he engaged with concerned APC stakeholders in the state in a bid to find common ground with various women groups agitating for gender parity.

The Guardian learned that the race for Ukachukwu’s running mate had been narrowed down between two former female Senators, Dr. Uche Lilian Ekwunife and Dr. Margery Okadigbo, who hail from the Central and North Senatorial Districts of the state, respectively.

Although both female politicians are Catholics, the factor of zoning is said to be impacting their chances, because while the more politically active Ekwunife hails from the populous Anambra Central District, Mrs. Okadigbo is from Anambra North, which has just served out eight years of governorship through Willie Obiano.

Also, the fact of her maiden community, Igboukwu in Aguata Local Council, and influence as the current Director General of South East Governors’ Forum is ticking in Ekwunife’s favour, as her candidacy is expected to help slice the votes in Old Aguata Union from where the incumbent Governor Chukwuma Soludo hails. (The Guardian)

News

NJC investigates 18 Imo judges over suspected age falsification

The National Judicial Council has launched a probe into 18 judges in the Imo State judiciary over allegations of age falsification, in a development raising fresh concerns about integrity and transparency within Nigeria’s judicial system.

The NJC, in a statement on Thursday by its Deputy Director of Information, Kemi Ogedengbe, confirmed that the allegations were being treated with utmost seriousness and were currently under review.

“Allegations of this nature require detailed investigation before any action can be taken,” Ogedengbe stated.

“The NJC is investigating the allegations and may take a decision by the end of the month. For now, we cannot act without completing our inquiries. The council will convene and make decisions on the matter.”

The investigation follows a petition submitted by a civil society group, Civil Society Engagement Platform, which described the matter as an “unprecedented breach of judicial integrity.”

The group alleged that the judges deliberately manipulated their birth records to either prolong their tenure or gain appointments within the judiciary.

In a letter addressed to the NJC Chairman and Chief Justice of Nigeria, Justice Kudirat Kekere-Ekun, the platform cited discrepancies in the judges’ official documents, including Law School registration forms, Department of State Services reports, and Nominal Rolls.

The petition, signed by CSEP’s Director of Investigation, Comrade Ndubuisi Onyemaechi, included what it described as compelling documentary evidence marked as Exhibits 001 to 018.

Among those named in the petition is Justice I. O. Agugua, who reportedly has two different birth dates—May 10, 1959, and May 10, 1960—and is also facing separate allegations of misconduct.

Justice C. A. Ononeze-Madu is alleged to have birth records stating both July 7, 1963, and July 7, 1965, while Justice M. E. Nwagbaoso is accused of presenting conflicting dates of birth—August 20, 1952, and August 20, 1962.

The remaining 15 judges also reportedly have varying inconsistencies in their personal data, a revelation that has intensified public scrutiny of the judiciary’s accountability mechanisms.

The NJC, which is constitutionally empowered to discipline judicial officers, is expected to reconvene soon to deliberate on the findings of its inquiry and take appropriate disciplinary actions where necessary.

The unfolding development comes amid mounting calls for institutional reforms to restore public trust in the judiciary and reinforce ethical standards across all arms of government.

-

News23 hours ago

News23 hours agoBREAKING: Unknown gunmen reportedly storm Senator Natasha’s family residence

-

News17 hours ago

News17 hours agoAbuja light rail project must be commissioned on May 29-Wike vows

-

News23 hours ago

News23 hours agoLawmaker Slams NBA Over Rivers Crisis, Demands Return of N300m

-

News8 hours ago

News8 hours agoTinubu Remains Engaged In Governance From Europe, Will Return After Easter – Presidency

-

News21 hours ago

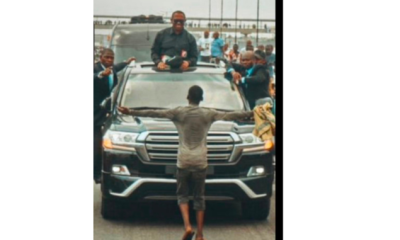

News21 hours agoFinally , Lagos Court frees Quadri, young Nigerian who stood before Obi’s convoy in viral photo

-

News18 hours ago

News18 hours agoJust in: Alleged Herdsmen Armed With AK-47 Rifles Take Over Communities In Benue State

-

News18 hours ago

News18 hours agoSEYI Tinubu Speaks On Alleged Abduction, Brutalization Of NANS President Atiku Abubakar Isah

-

Foreign8 hours ago

Foreign8 hours agoTrump To Close US Embassies In South Sudan, France, Others