News

TUC proposes N2.5m threshold for personal income tax waiver

The Trade Union Congress of Nigeria has called for an increase in the tax exemption threshold from N800,000 to N2.5m per annum to ease economic challenges faced by low-income earners.

The union stressed that this measure would increase disposable income, stimulate economic activity, and provide much-needed relief to workers and their families.

The president of the union, Festus Osifo, made the call in a statement on Tuesday.

He said, “We still have two items that we strongly believe should be reviewed in the tax bills that will immensely benefit Nigerians.

“The threshold for tax exemptions should be increased from the current N800,000 per annum, as proposed in the bill, to N2,500,000 per annum. This will provide relief to struggling Nigerians within that income bracket, easing the excruciating economic challenges they face by increasing their disposable income.”

On the proposed transfer of royalty collection to the Nigeria Revenue Service, the TUC president warned of potential revenue losses and inefficiencies due to the lack of technical expertise in oil and gas operations within the NRS

He said, “The proposed bill assigning royalty collection to the Nigeria Revenue Service appears beneficial on the surface but would most likely result in significant revenue losses for the government. Royalty determination and reconciliation require specialised technical expertise in oil and gas operations, which NUPRC possesses but NRS lacks, potentially leading to inaccurate assessments and enforcement issues.

“Additionally, this shift would create regulatory burdens, increase compliance costs for industry players, and reduce investor confidence due to overlapping functions and inefficiencies between NUPRC and NRS.”

Osifo reiterated that allowing the VAT rate to remain at 7.5 percent was the best for the country.

“Allowing the Value Added Tax rate to remain at 7.5% is in the best interest of the nation, as increasing it would place an additional financial burden on Nigerians, many of whom are already struggling with economic challenges.

“At a time when inflation, unemployment, and the cost of living are rising, imposing higher taxes would further strain households and businesses, potentially slowing economic growth and reducing consumer purchasing power,” Osifo said.

Osifo noted that the union welcomed the inclusion of a derivation component in VAT distribution among the three tiers of government, describing it as a step toward reducing dependence on oil revenues and encouraging sub-national productivity.

He said, “On a general perspective, we welcome the inclusion of a derivation component in the Value Added Tax distribution amongst the three tiers of government. When passed into law and properly implemented, it will encourage productivity at the sub-national level, thereby moving us gradually from a total rent-seeking economy to a derivation-based system that will stimulate economic activities.”

The TUC president said the continued existence of the Tertiary Education Trust Fund and the National Agency for Science and Engineering Infrastructure would bring about progress to the nation’s education as well as engender economic development in the country.

He said, “It is also good to note that both TETFUND and NASENI will remain a going concern, as these institutions have greatly impacted the country through their respective mandates. Both have respectively been instrumental in improving our tertiary education and the adoption of homegrown technologies to enhance national productivity and self-reliance. Their continued existence is vital for sustaining progress in education, technology, and economic development across the country.”

However, the union president urged the Federal Government to adopt equitable tax policies that prioritise the welfare of citizens.

He said, “ While we deeply appreciate the Federal Government’s efforts to listen and adjust to our advocacy, we still advocate that the above concerns be considered and adopted in the Tax Reform Bill, they will be highly beneficial to the Government and Nigerian populace.

“The Trade Union Congress of Nigeria has a shared responsibility to promote policies that improve the lives of Nigerians amongst whom are workers. We believe that proactive measures, when implemented, are for the maximum good of the citizens and are evidence of great and sincere leadership. As the conversations around the Tax Reform Bill continue, it is our expectation that the focus would be equitable economic growth and improved living conditions for all Nigerians.”

News

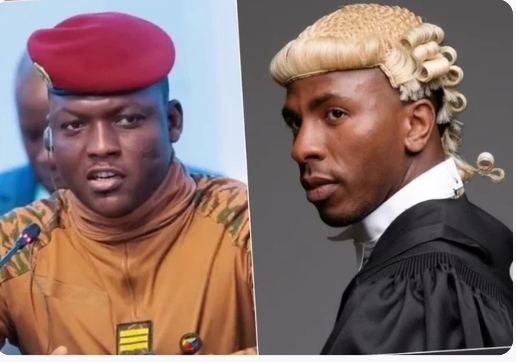

Burkina Faso outlaws colonial-era judicial wigs to embrace cultural identity

In a historic attempt to decolonise the country’s judiciary, President Ibrahim Traoré of Burkina Faso has formally banned judges from wearing wigs from the British and French colonial eras.

President Traoré emphasised in his announcement the importance of eschewing colonial-era traditions and implementing customs that respect Burkina Faso’s cultural identity.

The action is in line with his larger plan to fortify national identity and declare the nation’s autonomy from outside influences. The colonial wigs, which have traditionally stood for outside authority in African legal systems, are gradually being abandoned.

News

Covenant, ABU Emerge Top In Nigeria as 2025 world university ranking released

Covenant University (CU) has again been listed as Nigeria’s overall best university in Times Higher Education (THE) 2025 Rankings.

In the 2025 rankings, the Ahmadu Bello University, Zaria came second, displacing the University of Ibadan which occupied the position for the 2024 ccrankings.

The Times Higher Education World Rankings is a comprehensive global ranking of universities published annually.

The 2025 rankings THE said it ranked more than 2,000 institutions from 115 countries and territories.

Globally, Oxford holds on to the top spot for the ninth consecutive year, bolstered by significant improvements in industry engagement and teaching. MIT rises to second place, overtaking Stanford, which drops to sixth.

The ratings were done based on 18 carefully calibrated performance indicators that measure an institution’s performance across five areas: teaching, research environment, research quality, industry, and international outlook.

University of Oxford

Massachusetts Institute of Technology

Harvard University

Princeton University

University of Cambridge

Stanford University

California Institute of Technology

University of California, Berkeley

Imperial College London

Yale University

Top ranked Nigerian universities

1. Covenant University

2. Ahmadu Bello University

3. Landmark University

4. University of Ibadan

5. University of Lagos

6. Bayero University

7. Federal University of Technology Akure

8. Federal University of Technology, Minna

9. University of Benin

10. University of Ilorin

11. University of Nigeria Nsukka

12. Ekiti State University

13. Federal University of Agriculture, Abeokuta

14. Federal University of Technology, Owerri

15. Federal University Oye-Ekiti

16. Ladoke Akintola University of Technology

17. Lagos State University

18. Nnamdi Azikiwe University

19. Obafemi Awolowo University

20. University of Port Harcourt

21. Usmanu Danfodiyo University, Sokoto

22. Abia State University

23. Akwa Ibom State University

24. Alex Ekwueme Federal University, Ndufu-Alike

25. Ambrose Alli University

26. Baze University

27. Bells University of Technology

28. Benson Idahosa University

29. Bowen University

30. Delta State University, Abraka

31. Evangel University, Akaeze

32. Federal University of Petroleum Resources, Effurun

33. Godfrey Okoye University

34. Lagos State University of Education

35. Lagos State University of Science and Technology

36. Nasarawa State University, Keffi

37. Niger Delta University

38. Nile University of Nigeria

39. Osun State University

40. Rivers State University

41. Thomas Adewumi University

42. University of Cross River State

43. University of Maiduguri

44. Veritas University, Abuja

News

Court dismisses SERAP’s suit against NASS budget

By Francesca Hangeior

Justice James Omotosho of the Federal High Court sitting in Abuja has dismissed a suit by the Incorporated Trustees of the Socio-Economic Rights and Accountability Project, SERAP, challenging the powers of the National Assembly to amend its budget in the 2024 Appropriation Act.

Justice Omotosho ruled, among others, that SERAP lacked the locus standi to institute the suit.

The judge upheld the argument of Dr. Sheriff Adesanya, who represented the 1st Respondent (the Senate President), that the interest of SERAP and that of the 20 concerned citizens it represented, was no greater than that of the general public.

Furthermore, Justice Omotosho agreed with Dr. Adesanya (of Abiodun Adesanya & Co) that the plaintiff’s claims were without merit.

He dismissed the case in its entirety.

SERAP, through Andrew Nwankwo of Eko Akete Chambers, had contended that the National Assembly’s unilateral increase of its budget allocation from ?197 billion to ?344 billion contravened Section 81 of the Constitution, the Code of Conduct for Public Officers, and democratic principles, particularly the separation of powers.

The organization sought a declaration that the budgetary increase was unconstitutional and requested orders compelling the National Assembly to adhere to constitutional procedures by re-presenting any amended appropriation bills to the President for approval before enactment.

Apart from arguing that the Plaintiffs had no standing to initiate the suit, Dr. Adesanya also defended the procedural validity of the National Assembly’s budgetary actions, Saying SERAP failed to show that the lawmakers’ action was procedurally irregular.

The lawyer had told the court that “It is respectfully submitted that the presumption of regularity enjoyed by the National Assembly’s Act must be rebutted by the Plaintiffs.

“Apart from speculative claims by the Plaintiffs that the altered appropriation bill was not forwarded to the President after amendment by the National Assembly, there is no evidence (assuming such alteration necessitated representation to the President) to support this assertion.”

-

News23 hours ago

News23 hours agoCourt orders immediate arrest of Access Bank’s Ag MD, others for theft, contempt

-

News24 hours ago

News24 hours agoIsraeli far-right minister thanks Trump for revoking US sanctions on settlers

-

News22 hours ago

News22 hours agoBarron Trump: Meet 18-year-old ‘possible heir’ to US President’s dynasty

-

News15 hours ago

News15 hours agoReps Reject Coastal Guard Proposal, Call for Enhanced Navy Funding

-

News21 hours ago

News21 hours agoJust in: Police nab pastor after discovering python, buried casket in church altar

-

News14 hours ago

News14 hours agoFinance Ministry Seeks Upward Review Of N25bn In 2025 Budget Allocation

-

Metro22 hours ago

Metro22 hours agoEx-convict caught with human skull in Ogun burial ground

-

News24 hours ago

News24 hours agoWHO calls for dialogue as Trump announces US withdrawal